Latest News

Superstar ETFs turn into tech and AI bets this year. VistaShares' Adam Patti explains how OMAH and ACKY reflect market dominance, not just star power.

Via Benzinga · December 30, 2025

Mark Zuckerberg has been aggressively repositioning Meta Platforms' focus and spending toward AI, particularly to achieve

Via Talk Markets · December 30, 2025

Stocks are a mixed bag as 2025 winds down, with the tech sector particularly choppy.

Via Talk Markets · December 30, 2025

Why Did CETX Shares Soar Over 27% Today?stocktwits.com

Via Stocktwits · December 30, 2025

Wall Street is bullish on AI beyond 2025, Wedbush analyst Dan Ives says investors should focus on AI ripple effect winners.

Via Benzinga · December 30, 2025

FTAI Stock Hits Record High After Launching New Power Division For Data Centersstocktwits.com

Via Stocktwits · December 30, 2025

Via Benzinga · December 30, 2025

Why Did ILLR Stock Become The Talk Of The Town Today?stocktwits.com

Via Stocktwits · December 30, 2025

With silver and gold both surging significantly higher over the past couple of weeks, a correction was inevitable.

Via Talk Markets · December 30, 2025

What’s Behind Jet.AI Stock’s Rally Today?stocktwits.com

Via Stocktwits · December 30, 2025

Via Benzinga · December 30, 2025

Via Benzinga · December 30, 2025

Curious about the S&P500 stocks that are in motion on Tuesday? Join us as we explore the top movers within the S&P500 index during today's session.

Via Chartmill · December 30, 2025

Rocket Lab stock is trading higher Tuesday, extending a 2025 rally as investors digested upbeat analyst commentary and a swelling defense backlog.

Via Benzinga · December 30, 2025

FTAI Aviation stock soared after announcing plans for a new business unit that will convert jet engines into power turbines.

Via Investor's Business Daily · December 30, 2025

Via Benzinga · December 30, 2025

Via Benzinga · December 30, 2025

Via Benzinga · December 30, 2025

Via Benzinga · December 30, 2025

Let's have a look at what is happening on the US markets in the middle of the day on Tuesday. Below you can find the top gainers and losers in today's session.

Via Chartmill · December 30, 2025

March NY world sugar #11 (SBH26 ) today is down -0.37 (-2.42%). March London ICE white sugar #5 (SWH26 ) is down -7.90 (-1.82%). Sugar prices are sharply lower today and posted 1-week lows. Today's rally in the dollar index (DXY00 ) to a 1-week hig...

Via Barchart.com · December 30, 2025

Via Benzinga · December 30, 2025

Don't miss these stocks as you add to your list of near-term buys.

Via The Motley Fool · December 30, 2025

Via MarketBeat · December 30, 2025

Mondelez expanded its CHIPS AHOY! Brookie recall to add a new date code and more UPCs after corn starch clumps raised choking concerns.

Via Benzinga · December 30, 2025

Silver shot up 7% this morning, and I watched everyone scramble to explain why. China wants delivery. Overnight futures pressure. Global demand. Inflation hedge.

Via Talk Markets · December 30, 2025

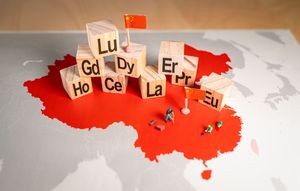

Neo Performance Materials still looks like a reasonable long-term way to play non-Chinese rare earths after a 100%+ run, but the smarter approach is now adding in small, disciplined increments rather than chasing spikes.

Via Barchart.com · December 30, 2025

Via Benzinga · December 30, 2025

Kaiser Aluminum (KALU) is trading at new 3-year highs. The stock is up nearly 70% over the past year and has strong technical momentum. KALU maintains a 100% “Buy” opinion from Barchart. Analyst and investor sentiment is bullish, with multiple “Buy”...

Via Barchart.com · December 30, 2025

China’s 2026 trade-in incentive details lifted U.S.-listed Chinese EV stocks as investors welcomed clearer demand support.

Via Stocktwits · December 30, 2025

As the final trading days of 2025 unfold, the financial markets are witnessing a phenomenon that analysts have dubbed the "Great Rebalancing." While the S&P 500 is poised to finish the year with impressive gains of nearly 19%, the final week of December has been marked by uncharacteristic turbulence

Via MarketMinute · December 30, 2025

Via Benzinga · December 30, 2025

Via Benzinga · December 30, 2025

This high-flying stock was trading for roughly two quarters just two quarters ago.

Via The Motley Fool · December 30, 2025

Oil prices are experiencing a notable upswing, driven by surging global demand and renewed optimism surrounding potential diplomatic breakthroughs.

Via Talk Markets · December 30, 2025

Via Benzinga · December 30, 2025

Via Benzinga · December 30, 2025

NIO Inc. stock (NYSE: NIO) rose on Tuesday following confirmation of extended vehicle trade-in subsidies in China.

Via Benzinga · December 30, 2025

The festive mood on Wall Street has taken a sudden, chilly turn as the final trading days of 2025 approach. The CBOE Volatility Index (VIX), often referred to as the market’s "fear gauge," saw a notable 4.4% jump to 14.20 on December 29, signaling a sharp reversal

Via MarketMinute · December 30, 2025

Dot Ai announced a three-year strategic partnership with Wiliot to commercialize asset-intelligence technology.

Via Stocktwits · December 30, 2025

March ICE NY cocoa (CCH26 ) today is down -184 (-2.95%). March ICE London cocoa #7 (CAH26 ) is down -132 (-2.94%). Cocoa prices are moving lower today, giving back some of Monday's sharp gains. Today's rally in the dollar index (DXY00 ) to a 1-week...

Via Barchart.com · December 30, 2025

According to Downdetector, user complaints surged to about 6,673, soon after 7 a.m. ET.

Via Stocktwits · December 30, 2025

As the calendar turns to 2026, the era of "wait and see" for Big Tech regulation has officially ended, replaced by a period of aggressive, court-mandated restructuring and active enforcement. While the previous two years were defined by landmark legal battles and liability rulings, 2026 is set to be the

Via MarketMinute · December 30, 2025

A potential SpaceX IPO in 2026 could be a top financial market story. A market expert shares what the IPO could mean for private companies and Tesla.

Via Benzinga · December 30, 2025

As 2025 draws to a close, the global financial landscape is bracing for what analysts are calling an "Innovation Supercycle" in the mergers and acquisitions (M&A) market. With interest rates finally stabilizing and corporate balance sheets bulging with record-breaking liquidity, the stage is set for a massive wave of

Via MarketMinute · December 30, 2025

Fears that a drop in Bitcoin (C

Via Benzinga · December 30, 2025