Latest News

In a landmark shift for the software development industry, Cognition AI has revealed that its autonomous AI software engineer, Devin, is now responsible for producing 25% of the company’s own internal pull requests. This milestone marks a transition for the technology from a viral prototype to a functional, high-capacity digital employee. By late 2025, the [...]

Via TokenRing AI · December 30, 2025

This aviation specialist isn't letting the possibility of meeting the power demands of the burgeoning AI industry fly by.

Via The Motley Fool · December 30, 2025

As we close out 2025, the personal computer is no longer just a window into the internet; it has become an active, local participant in our digital lives. Microsoft (NASDAQ: MSFT) has successfully transitioned its Copilot+ PC initiative from a controversial 2024 debut into a cornerstone of the modern computing experience. By mandating powerful, dedicated [...]

Via TokenRing AI · December 30, 2025

As 2025 draws to a close, the technology landscape looks fundamentally different than it did just twelve months ago. The catalyst for this transformation was the January 2025 launch of Nvidia’s (NASDAQ: NVDA) Blackwell architecture, a release that signaled the end of the "GPU as a component" era and the beginning of the "AI platform" [...]

Via TokenRing AI · December 30, 2025

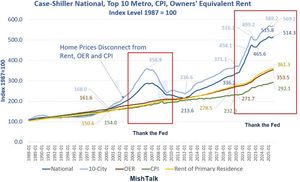

Let’s discuss affordability again.

Via Talk Markets · December 30, 2025

In a move that has fundamentally reshaped the competitive landscape of the artificial intelligence industry, Elon Musk’s xAI has officially closed a staggering $10 billion funding round, catapulting the company to a $200 billion valuation. This milestone, finalized in late 2025, places xAI on a near-equal financial footing with OpenAI, marking one of the most [...]

Via TokenRing AI · December 30, 2025

Saudi Arabia's PIF is buying the company for $55 billion, but some analysts are not convinced that the deal will succeed.

Via Barchart.com · December 30, 2025

In the rapidly evolving landscape of artificial intelligence, few milestones have been as transformative as the introduction of Google's Gemini 1.5 Pro. Originally debuted in early 2024, this model shattered the industry's "memory" ceiling by introducing a massive 1-million-token context window—later expanded to 2 million tokens. This development represented a fundamental shift in how large [...]

Via TokenRing AI · December 30, 2025

As of late December 2025, Apple Inc. (NASDAQ: AAPL) has fundamentally altered the trajectory of the consumer technology industry. What began as a cautious entry into the generative AI space at WWDC 2024 has matured into a comprehensive ecosystem known as "Apple Intelligence." By deeply embedding artificial intelligence into the core of iOS 19, iPadOS [...]

Via TokenRing AI · December 30, 2025

As of late December 2025, the "uncanny valley" that once separated AI-generated video from cinematic reality has been effectively bridged. The long-simmering "AI Video War" has reached a fever pitch, evolving from a race for mere novelty into a high-stakes industrial conflict. Today, three titans—OpenAI’s Sora 2, Google’s (NASDAQ: GOOGL) Veo 3.1, and Kuaishou’s (HKG: [...]

Via TokenRing AI · December 30, 2025

Both funds focus on dividend consistency, but their index construction leads to distinct outcomes as market leadership shifts.

Via The Motley Fool · December 30, 2025

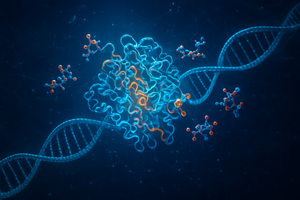

As of late 2025, the landscape of biological research has undergone a transformation comparable to the digital revolution of the late 20th century. At the center of this shift is AlphaFold 3, the latest iteration of the Nobel Prize-winning artificial intelligence system from Google DeepMind, a subsidiary of Alphabet Inc. (NASDAQ: GOOGL). While its predecessor, [...]

Via TokenRing AI · December 30, 2025

GBP/USD: is trading around 1.3470 on Tuesday, consolidating after surging to a more than three-month high near 1.3530.

Via Talk Markets · December 30, 2025

AGNC Investment has a massive 13% dividend yield, but tread carefully if you are looking for a reliable dividend stock.

Via The Motley Fool · December 30, 2025

In May 2024, OpenAI, backed heavily by Microsoft Corp. (NASDAQ: MSFT), unveiled GPT-4o—short for "omni"—a model that fundamentally altered the trajectory of artificial intelligence. By moving away from fragmented pipelines and toward a unified, end-to-end neural network, GPT-4o introduced the world to a digital assistant that could not only speak with the emotional nuance of [...]

Via TokenRing AI · December 30, 2025

In the final days of 2025, the landscape of artificial intelligence has shifted from models that merely talk to models that act. At the center of this transformation is Anthropic’s "Computer Use" capability, a breakthrough first introduced for Claude 3.5 Sonnet in late 2024. This technology, which allows an AI to interact with a computer [...]

Via TokenRing AI · December 30, 2025

Tesla's Cybertruck is struggling to gain traction among consumers due to several factors that range from higher prices to quality issues.

Via Barchart.com · December 30, 2025

In a final display of the "buy-the-dip" mentality that has defined the year, high-growth "rocket names" led a dramatic intraday recovery on Tuesday, signaling that investor appetite for aggressive growth remains insatiable as the market prepares for 2026. After an early morning swoon that saw major indices dip on profit-taking,

Via MarketMinute · December 30, 2025

In the final days of 2025, the landscape of artificial intelligence looks fundamentally different than it did just eighteen months ago. The catalyst for this transformation was the release of OpenAI’s o1 series—initially developed under the secretive codename "Strawberry." While previous iterations of large language models were praised for their creative flair and rapid-fire text [...]

Via TokenRing AI · December 30, 2025

As the sun sets on 2025, the S&P 500 is holding its breath. In a trading session characterized by thin holiday volume and a notable absence of institutional conviction, the benchmark index spent much of Tuesday, December 30, 2025, hovering precariously around the flatline. Trading near the 6,910

Via MarketMinute · December 30, 2025

The cost of Wegovy is about to decrease significantly in a populous overseas market.

Via The Motley Fool · December 30, 2025

Shorting out-of-the-money (OTM) put options in Apple, Inc. stock has clearly been the best play over the last month.

Via Talk Markets · December 30, 2025

As the final trading days of 2025 unfold, the Nasdaq 100 is struggling to find a clear path forward, characterized by thin holiday volume and a lack of immediate catalysts. On Tuesday, December 30, 2025, the tech-heavy index hovered near the 25,520 mark, reflecting a marginal decline as investors

Via MarketMinute · December 30, 2025

As 2025 draws to a close, the data center industry has reached a definitive tipping point: the era of the fan-cooled server is over for high-performance computing. The catalyst for this seismic shift has been the arrival of NVIDIA’s (NASDAQ: NVDA) Blackwell and the newly announced Rubin GPU architectures, which have pushed thermal design power [...]

Via TokenRing AI · December 30, 2025

As 2025 draws to a close, the gold market is witnessing a monumental shift that has fundamentally altered the balance sheets of the world’s largest miners. After a period of relative stagnation and sell-offs earlier in the decade, bullion prices have staged a historic recovery, surging to an all-time

Via MarketMinute · December 30, 2025

As of late 2025, the landscape of American industrial policy has undergone a seismic shift, catalyzed by the full implementation of the "Building Chips in America" Act. Signed into law in late 2024, this legislation was designed as a critical "patch" for the original CHIPS and Science Act, addressing the bureaucratic bottlenecks that threatened to [...]

Via TokenRing AI · December 30, 2025

As the curtain closes on 2025, the financial landscape presents a tale of two markets. While the S&P 500 (NYSEARCA: SPY) hovers near the historic 7,000-point milestone, fueled by a 19% year-to-date rally and a resilient "soft landing" for the U.S. economy, a stark divergence has emerged

Via MarketMinute · December 30, 2025

The JD.com position previously accounted for 9.4% of XY Capital Ltd’s AUM as of the prior quarter.

Via The Motley Fool · December 30, 2025

As 2025 draws to a close, the semiconductor industry is standing at the precipice of its most significant architectural shift in a decade. The transition to High Bandwidth Memory 4 (HBM4) has moved from theoretical roadmaps to the factory floors of the world’s largest chipmakers. This week, industry leaders confirmed that the first qualification samples [...]

Via TokenRing AI · December 30, 2025

The Dow Jones Industrial Average (DJIA) is facing a critical juncture as the 2025 trading year draws to a close. After a volatile month marked by a record-breaking "Santa Claus Rally" followed by a sharp three-session pullback, the blue-chip index is currently testing key technical support levels that could determine

Via MarketMinute · December 30, 2025

After DeFi experimentation ripened, institutional integration will now carry it into 2026 and beyond.

Via Talk Markets · December 30, 2025

As 2025 draws to a close, the global financial landscape is being reshaped by a rare convergence of seismic geopolitical shifts and a fundamental recalibration of U.S. monetary policy. The final week of December has seen investor sentiment swing between euphoria and caution as the prospect of a definitive

Via MarketMinute · December 30, 2025

As 2025 draws to a close, the global semiconductor landscape has undergone a seismic shift, driven not by a new proprietary breakthrough, but by the rapid ascent of an open-source architecture. RISC-V, the open-standard instruction set architecture (ISA), has officially transitioned from an academic curiosity to a central pillar of geopolitical strategy. In a year [...]

Via TokenRing AI · December 30, 2025

As the final trading days of 2025 wind down, Rhythm Pharmaceuticals (Nasdaq: RYTM) finds itself at a critical crossroads. After a meteoric rise that saw the stock gain over 100% through the first three quarters of the year, the rare-disease specialist has encountered a late-year slump, retreating from its 52-week

Via MarketMinute · December 30, 2025

As of December 30, 2025, the narrative of the global AI race has shifted from a battle over transistor counts to a desperate scramble for "back-end" real estate. For the past decade, the semiconductor industry focused on the front-end—the complex lithography required to etch circuits onto silicon wafers. However, in the closing days of 2025, [...]

Via TokenRing AI · December 30, 2025

As the final trading days of 2025 come to a close, the financial world is looking back at a year defined by the "Quantum Summer," a period of explosive growth and speculative fervor that saw D-Wave Quantum Inc. (NYSE: QBTS) transform from a speculative penny stock into a high-stakes battleground

Via MarketMinute · December 30, 2025

March NY world sugar #11 (SBH26 ) on Tuesday closed down -0.42 (-2.75%). March London ICE white sugar #5 (SWH26 ) closed down -8.60 (-1.98%). Sugar prices slid to 1-week lows on Tuesday and settled sharply lower. Tuesday's rally in the dollar index...

Via Barchart.com · December 30, 2025

As of late 2025, the artificial intelligence industry has reached a pivotal inflection point: the era of "Silicon Sovereignty." For years, the world’s largest cloud providers were beholden to a single gatekeeper for the compute power necessary to fuel the generative AI revolution. Today, that dynamic has fundamentally shifted. Microsoft, Amazon, and Google have successfully [...]

Via TokenRing AI · December 30, 2025

Advanced Micro Devices has a big year planned for 2026 with the release of the MI450.

Via The Motley Fool · December 30, 2025

The final trading days of 2025 have proven turbulent for Warby Parker Inc. (NYSE: WRBY), as the eyewear disruptor saw its stock price slide sharply following a surprise pre-announcement of disappointing holiday sales. Despite a mid-December surge driven by a high-profile technology partnership, the company’s shares are now lagging

Via MarketMinute · December 30, 2025

March ICE NY cocoa (CCH26 ) on Tuesday closed down -179 (-2.87%). March ICE London cocoa #7 (CAH26 ) closed down -126 (-2.80%). Cocoa prices retreated on Tuesday, giving back some of Monday's sharp gains. Tuesday's rally in the dollar index (DXY00...

Via Barchart.com · December 30, 2025

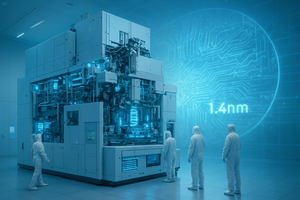

As of late December 2025, the semiconductor industry has reached a pivotal turning point with Intel Corporation (NASDAQ: INTC) officially operationalizing the world’s first commercial-grade High-Numerical Aperture (High-NA) Extreme Ultraviolet (EUV) lithography systems. At the heart of this technological leap is Intel’s Fab 52 in Chandler, Arizona, where the deployment of ASML (NASDAQ: ASML) Twinscan [...]

Via TokenRing AI · December 30, 2025

As the final curtains draw on a historic 2025, Wall Street has entered a period of "thin holiday trading," a phenomenon where depleted market participation transforms the world’s largest financial exchanges into a "liquidity vacuum." With institutional desks at major firms like Goldman Sachs (NYSE: GS) and BlackRock (NYSE:

Via MarketMinute · December 30, 2025

March arabica coffee (KCH26 ) on Tuesday closed down -1.95 (-0.55%). March ICE robusta coffee (RMH26 ) closed up +62 (+1.57%). Coffee prices on Tuesday climbed to 2-week highs, but fell back from their best levels and settled mixed with arabica coff...

Via Barchart.com · December 30, 2025

As we close out 2025 and head into 2026, the personal computer is undergoing its most radical transformation since the introduction of the graphical user interface. The "AI PC" has moved from a marketing buzzword to the definitive standard for modern computing, driven by a fierce arms race between silicon giants to pack unprecedented neural [...]

Via TokenRing AI · December 30, 2025

As the final trading days of 2025 unfold, the financial markets are witnessing a familiar spectacle: the resilience of NVIDIA (NASDAQ: NVDA). On Tuesday, December 30, 2025, the semiconductor giant staged a remarkable intraday turnaround, rebounding from early session lows to lead a broader rally across the technology sector. The

Via MarketMinute · December 30, 2025

Shares of non-lethal weapons company Byrna (NASDAQ:BYRN)

jumped 7.1% in the afternoon session after investors reacted to technical indicators suggesting the stock was oversold and due for a rebound, a view supported by positive analyst sentiment. The move followed a period where the stock had declined 11.2% over the previous four weeks. This drop pushed a technical indicator known as the Relative Strength Index (RSI) to a reading of 29.16. An RSI below 30 is often interpreted by traders as a sign that a stock is oversold, meaning the selling pressure might have been exhausted and a price reversal could be near.

Via StockStory · December 30, 2025

Shares of digital engagement platform ON24 (NYSE:ONTF) jumped 36.9% in the afternoon session after the company agreed to be acquired by Cvent in an all-cash transaction.

Via StockStory · December 30, 2025

Shares of computer processor maker Intel (NASDAQ:INTC)

jumped 3% in the afternoon session after the company confirmed that rival chipmaker Nvidia completed a previously announced $5 billion investment.

Via StockStory · December 30, 2025

Shares of online dating app Bumble (NASDAQ:BMBL)

jumped 4.9% in the afternoon session after a significant short interest in the company's stock fueled a 'short squeeze'.

Via StockStory · December 30, 2025