Shell plc (SHEL)

73.48

-0.35 (-0.47%)

NYSE · Last Trade: Dec 31st, 11:21 PM EST

Detailed Quote

| Previous Close | 73.83 |

|---|---|

| Open | 73.81 |

| Bid | 73.19 |

| Ask | 74.10 |

| Day's Range | 73.18 - 73.86 |

| 52 Week Range | 58.54 - 77.47 |

| Volume | 1,638,427 |

| Market Cap | - |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 2.864 (3.90%) |

| 1 Month Average Volume | 3,529,502 |

Chart

News & Press Releases

The year 2025 has drawn to a close, leaving the global energy sector in a state of "uneasy equilibrium" after twelve months defined by a fierce tug-of-war between geopolitical friction and a bearish macroeconomic landscape. While the industry grappled with significant crude oil price declines—the largest since the 2020

Via MarketMinute · December 31, 2025

As 2025 draws to a close, the global energy landscape remains defined by a volatile cocktail of geopolitical brinkmanship and shifting trade alliances. From the "Trump effect" accelerating U.S. LNG exports to the precarious status of cross-border gas deals in South America, the market has spent much of the

Via MarketMinute · December 31, 2025

Meg O’Neill Breaks Big Oil’s Glass Ceiling — Can She Also Rescue BP?stocktwits.com

Via Stocktwits · December 18, 2025

As 2025 draws to a close, the global crude oil market is locked in a high-stakes "tug-of-war" between a looming supply surplus and a persistent geopolitical risk premium. While the broader trend for the year has been one of decline—with benchmark prices falling approximately 20% since January—the final

Via MarketMinute · December 31, 2025

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · December 31, 2025

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · December 30, 2025

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · December 29, 2025

As the final trading days of 2025 unfold, the global commodities landscape is defined by a sharp contrast between a stabilizing energy sector and a record-breaking rally in industrial metals. Brent crude oil, which spent much of the fourth quarter under pressure, has staged a modest recovery to trade just

Via MarketMinute · December 29, 2025

Brent crude oil futures climbed to $62.4 per barrel on Friday, December 26, 2025, marking a sharp reversal from mid-month lows and securing a significant weekly gain. This rally comes as a series of geopolitical flashpoints—ranging from a U.S. naval blockade in the Caribbean to drone strikes

Via MarketMinute · December 26, 2025

ADEN/RIYADH — As the world observes the Christmas holiday, the geopolitical landscape of the Arabian Peninsula is undergoing its most violent transformation in years. A sweeping military offensive launched in early December by the Southern Transitional Council (STC)—Yemen’s primary separatist movement—has effectively dismantled the Saudi-backed unity government,

Via MarketMinute · December 25, 2025

As the global energy market closes out 2025, the OPEC+ alliance has executed a high-stakes tactical maneuver designed to prevent a total price collapse in the face of a looming global supply glut. Following a modest production increase of 137,000 barrels per day (bpd) in December 2025, the cartel

Via MarketMinute · December 25, 2025

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · December 24, 2025

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · December 23, 2025

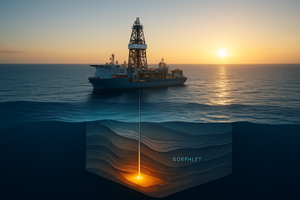

In a landmark announcement on December 22, 2025, energy giants Shell and INEOS Energy revealed a significant oil discovery at the Nashville exploration well, situated in the deepwater Norphlet play of the U.S. Gulf of Mexico—a region now increasingly referred to by industry and government officials as the

Via MarketMinute · December 22, 2025

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · December 22, 2025

Energy Transfer continues to face roadblocks with Lake Charles LNG.

Via The Motley Fool · December 21, 2025

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · December 19, 2025

As the global energy landscape undergoes a seismic shift, the Austrian energy giant OMV AG (VIE:OMV) is executing one of the most ambitious transformations in its 70-year history. By late 2025, the company has moved decisively to pivot away from its traditional oil and gas roots toward a future

Via MarketMinute · December 19, 2025

As the final weeks of 2025 unfold, the global energy market is locked in a high-stakes tug-of-war between mathematical certainty and geopolitical reality. On paper, the outlook for 2026 is nothing short of grim: a "tsunami" of crude oil is projected to flood the market, potentially driving prices to levels

Via MarketMinute · December 19, 2025

The global energy landscape faced a reckoning on December 18, 2025, as a landmark inflation report collided with a burgeoning oversupply in the crude oil markets. While the broader S&P 500 and Nasdaq rallied on news that price pressures are finally returning to the Federal Reserve’s comfort zone,

Via MarketMinute · December 18, 2025

Transaction in Own Shares

By Shell plc · Via GlobeNewswire · December 18, 2025

The financial markets breathed a collective sigh of relief on December 18, 2025, as a long-awaited inflation report finally provided clarity to an investment community that had been trading in the dark for weeks. The release of the November Consumer Price Index (CPI) data—delayed by a historic 43-day government

Via MarketMinute · December 18, 2025

The global energy landscape is undergoing a profound structural shift as 2025 draws to a close, marked by a stark divergence between crude oil and natural gas markets. While Brent crude prices have steadily eroded throughout the year, pressured by a persistent global supply glut and cooling demand in major

Via MarketMinute · December 18, 2025