Hilton Worldwide Holdings Inc. Common Stock (HLT)

287.25

-3.18 (-1.09%)

NYSE · Last Trade: Jan 1st, 3:35 AM EST

Detailed Quote

| Previous Close | 290.43 |

|---|---|

| Open | 289.77 |

| Bid | 286.99 |

| Ask | 288.00 |

| Day's Range | 287.15 - 290.39 |

| 52 Week Range | 196.04 - 294.92 |

| Volume | 1,254,129 |

| Market Cap | 80.05B |

| PE Ratio (TTM) | 41.63 |

| EPS (TTM) | 6.9 |

| Dividend & Yield | 0.6000 (0.21%) |

| 1 Month Average Volume | 1,574,096 |

Chart

About Hilton Worldwide Holdings Inc. Common Stock (HLT)

Hilton Inc is a global hospitality company that focuses on the management and franchising of a diverse portfolio of hotels and resorts. With a presence in various regions around the world, Hilton operates a range of brands catering to different market segments, from luxury accommodations to more budget-friendly options. The company is committed to providing exceptional customer experiences, and it emphasizes innovative service, sustainable practices, and community engagement. Hilton also offers a loyalty program that rewards frequent travelers with exclusive benefits, enhancing its appeal to both leisure and business guests. Read More

News & Press Releases

While the S&P 500 (^GSPC) includes industry leaders, not every stock in the index is a winner.

Some companies are past their prime, weighed down by poor execution, weak financials, or structural headwinds.

Via StockStory · December 29, 2025

This content is intended for informational purposes only and is not financial advice. Introduction As of December 18, 2025, Choice Hotels International (NYSE: CHH) stands at a fascinating crossroads in the global hospitality sector. Known historically as a stalwart of the midscale and economy segments, Choice has spent the last three years aggressively reinventing itself [...]

Via PredictStreet · December 18, 2025

Tattoo shop Waikiki options continue expanding as the tattoo and body art scene in Honolulu thrives with Aloha Tattoo Waikiki, Hilton Hawaiian Village, and Rainbow Bazaar establishing itself as a go-to destination for quality ink and piercings. Situated at 2005 Kālia Rd, Unit J8, inside the iconic Hilton Hawaiian Village, this location offers both residents and visitors access to award-winning artists in a clean, professional environment that reflects the island's vibrant culture.

Via AB Newswire · December 26, 2025

Piercings Waikiki services have expanded at one of Honolulu's most recognized locations, as Aloha Tattoo - Hilton Diamond Head Tower announces the addition of professional piercing to its service lineup. Visitors and locals seeking quality body art now have access to expert piercing services that complement the studio's established reputation for exceptional tattoo artistry at the Hilton Hawaiian Village.

Via AB Newswire · December 26, 2025

Via PRLog · December 23, 2025

Hilton Head Island, SC - Roberts Construction Company has been honored with four awards at the 2025 Hilton Head Area Home Builders Association (HHAHBA) LightHouse Awards, recognizing the company’s excellence in residential remodeling, design, and craftsmanship across the South Carolina Lowcountry.

Via Get News · December 22, 2025

As the calendar turns toward 2026, the American economy stands at a pivotal crossroads, transitioning from the anxiety of a looming "tax cliff" to the adrenaline of a massive fiscal expansion. For much of 2024 and early 2025, investors fretted over the expiration of the 2017 Tax Cuts and Jobs

Via MarketMinute · December 19, 2025

Although revenue growth has cooled, both Hilton and Marriott have continued to beat revenue and profit estimates in recent quarters while rolling out ambitious expansion plans.

Via Stocktwits · December 19, 2025

Recognition honors the company's leadership in leveraging artificial intelligence and automation to transform managed services

Via Press Release Distribution Service · December 18, 2025

FRISCO, Texas - December 17, 2025 - Captain Dwayne Edwards (US Marines), Founder of Veteran Mental Health Assessment (VMHA), is the recipient of the 2025 Congressional Veteran Commendation (CVC). Congressman Brandon Gill bestowed the honor on Edwards and four others at the 2025 CVC “Salute Our Veterans” luncheon, which was held at the Hilton Garden Inn in Lewisville on November 12. The CVC recognizes individuals who have honorably served their country in the Armed Forces and continue to serve their local communities. The event acknowledged veterans in the 26th Congressional District.

Via Get News · December 17, 2025

United Kingdom, December 17, 2025 -- Tulip Real Estate continues its strategic expansion across the UK hospitality sector with the acquisition of DoubleTree by Hilton Swindon, marking the company’s entry into the Wiltshire region. This addition reflects Tulip’s research-driven approach to identifying high-potential assets in commercially resilient locations, reinforcing its commitment to long-term value creation across key UK markets.

Via Press Release Distribution Service · December 16, 2025

New York, NY – December 17, 2025 – The Dow Jones Industrial Average (DJIA) has concluded December 2025 with a notable ascent, marking a period of robust performance that has seen the index reach new all-time record highs. This upward momentum, however, unfolds against a complex and often contradictory economic landscape, characterized

Via MarketMinute · December 17, 2025

Goldman said it expects sustained momentum in Macau gross gaming revenue into 2026 for Las Vegas Sands. It also upgraded two hotels, citing demand for World Cup games.

Via Investor's Business Daily · December 15, 2025

As 2025 draws to a close, global investment banking giant Goldman Sachs (NYSE: GS) has delivered an urgent and comprehensive outlook for the stock market in 2026, signaling a significant shift in investment landscape. Their latest projections paint a picture of an accelerating U.S. economy, a broadening of market

Via MarketMinute · December 15, 2025

Experience a Different Kind of Holiday Season with Winter Bike Rentals on Hilton Head Island

Hilton Head Island, SC - December 12, 2025 - While much of the country bundles up for winter, Hilton Head Island offers a warm and relaxing escape perfect for holiday travelers. With mild weather, quiet beaches, and miles of scenic trails, the island becomes a haven for those looking to enjoy the season outdoors. Pedals Bike Rentals is encouraging locals and visitors to embrace a new kind of holiday tradition—exploring Hilton Head on two wheels.

Via AB Newswire · December 12, 2025

As global markets navigate the complex currents of economic policy and technological innovation, an often-underestimated force—geopolitical instability—remains a potent catalyst for market shifts. While the precise nature of future events is inherently unpredictable, the potential for geopolitical developments to trigger significant short-term volatility and influence long-term market trajectories

Via MarketMinute · December 11, 2025

Hilton Head Island, SC - Rose Hearing Healthcare Centers proudly announces the launch of its newly redesigned website, created to offer patients a more convenient, informative, and user-friendly way to explore hearing care services. The new platform reflects the company’s dedication to exceptional patient support and provides a seamless digital experience for individuals seeking reliable hearing healthcare in Hilton Head Island and Bluffton.

Via Get News · December 10, 2025

NetworkNewsBreaks – SEGG Media Corporation (NASDAQ: SEGG, LTRYW) Congratulates Lando Norris on First Formula 1 World Championship

SEGG Media (NASDAQ: SEGG, LTRYW) congratulated Lando Norris on winning his first Formula 1 World Championship at the FORMULA 1 ETIHAD AIRWAYS ABU DHABI GRAND PRIX 2025. The milestone elevates Quadrant, the creator-led motorsport, gaming, and apparel brand co-founded by Norris and now part of Veloce Media Group, in which SEGG Media holds a strategic investment and a future call option for a majority stake. Quadrant’s rapid expansion, supported by partnerships with global brands such as LEGO, Hilton, NordVPN, VISA, Revolut, RailsR, T-Mobile, McLaren, Microsoft, Thrustmaster, and E.ON, is expected to gain further momentum following Norris’ victory. Marc Bircham, chairman of SEGG Media, said the championship underscores the strength of the Company’s strategy at the intersection of sports, content, gaming, and culture.

Via Investor Brand Network · December 9, 2025

Today, Hilton and Explora Journeys – the privately owned and ultra elegant ocean travel brand of the MSC Group – announce an exclusive collaboration. As part of this exciting new travel offering, Hilton debuts Hilton Honors Adventures, an extension of Hilton’s award-winning guest loyalty program focused on immersive, adventure-driven travel.

By Hilton · Via Business Wire · December 8, 2025

The performance of consumer discretionary businesses is closely linked to economic cycles. This volatility leads to big swings in stock prices that have worked in their favor recently -

over the past six months, the industry has returned 18.1% and beat the S&P 500 by 4 percentage points.

Via StockStory · December 7, 2025

GoTech IT Solutions has been named a finalist in the 2025 MSP Titans of the Industry Awards, a prestigious recognition celebrating excellence and leadership in the Managed Service Provider Industry.

Via Press Release Distribution Service · December 6, 2025

It's almost time to replace the ISS. Which space stocks should you be watching?

Via The Motley Fool · December 6, 2025

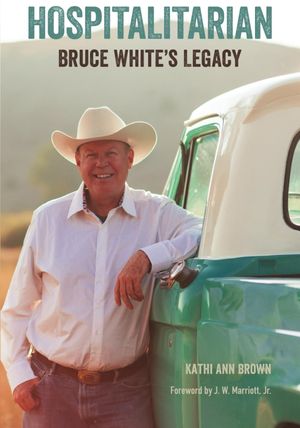

Kathi Ann Brown, the founder and president of Milestones Historical Consultants, is here to present her latest release, “Hospitalitarian: Bruce White’s Legacy.” This book chronicles the life and career of Bruce White, the founder of White Lodging and one of the most respected leaders in the American hospitality industry, which offers a rare inside look at the philosophy, values, and leadership that built a hospitality empire.

Via Get News · December 5, 2025