Metagenomi, Inc. - Common Stock (MGX)

1.6200

+0.0200 (1.25%)

NASDAQ · Last Trade: Jan 1st, 7:35 PM EST

Metagenomi reports curative-level FVIII activity for MGX-001 in primates and plans IND filing in 2026, extending cash runway into late 2027.

Via Benzinga · November 12, 2025

Via Benzinga · November 12, 2025

The regular session of the US market on Tuesday is now over, but let's get a preview of the after-hours session and explore the top gainers and losers driving the post-market movements.

Via Chartmill · November 11, 2025

Via Benzinga · November 11, 2025

Via Benzinga · December 10, 2024

Via Benzinga · September 6, 2024

Metagenomi Inc (NASDAQ:MGX) reported Q2 2025 earnings with revenue beating estimates at $8.51M and a narrower loss of -$0.54 per share. Shares dipped slightly amid investor caution over cash burn and pipeline progress.

Via Chartmill · August 12, 2025

The session on Wednesday is off to an intriguing start with several stocks showing significant price gaps. Let's examine the gap up and gap down stocks in today's session.

Via Chartmill · July 9, 2025

OpenAI CEO Sam Altman regrets underestimating Elon Musk's potential abuse of power to block OpenAI's $500B Stargate deal. Tensions also rise with Microsoft.

Via Benzinga · June 20, 2025

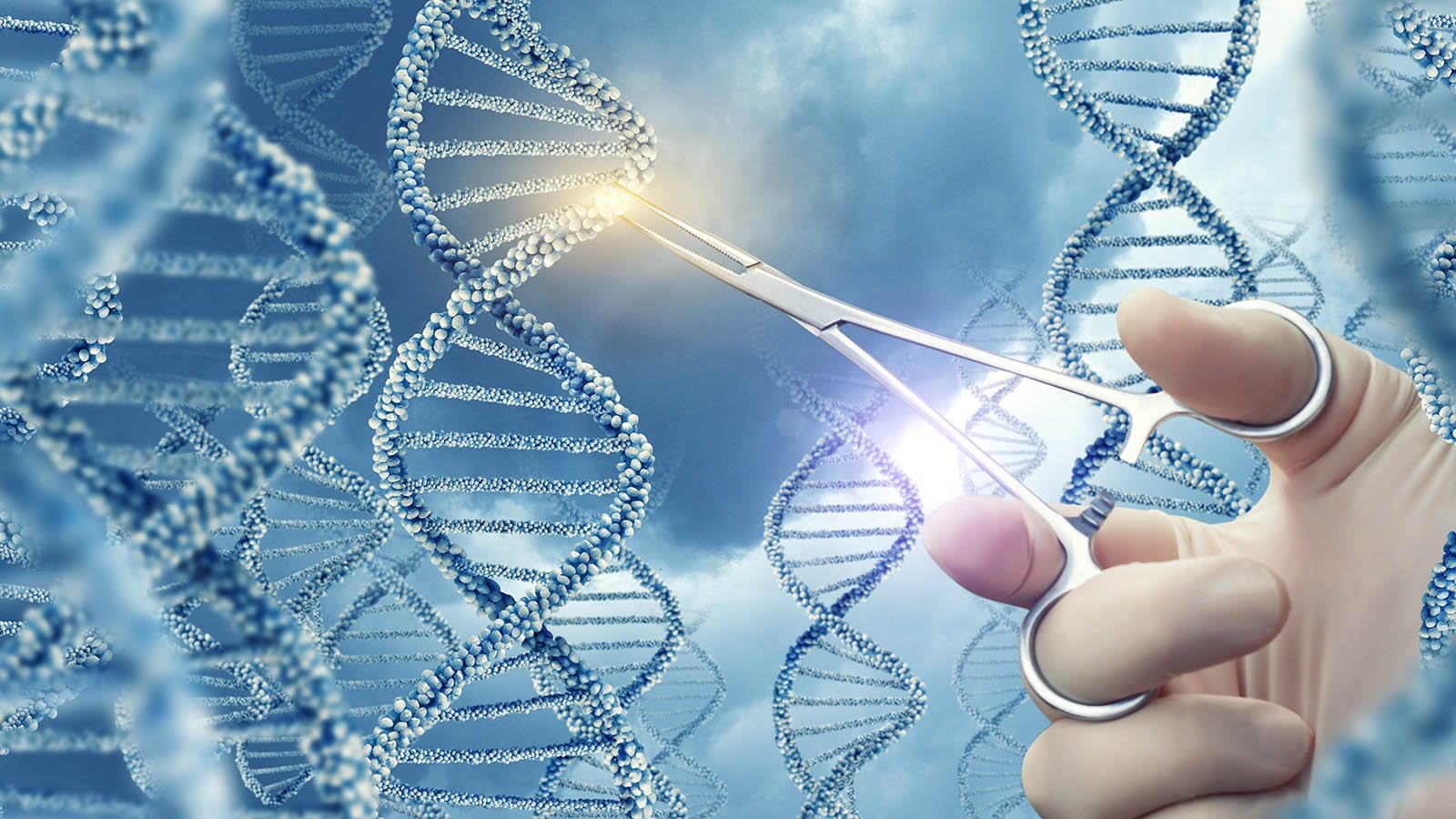

Lilly's Verve acquisition lifts sentiment in gene editing stocks, with analysts calling it a strategic and timely move in a tough funding climate.

Via Benzinga · June 18, 2025

Via Benzinga · May 15, 2025

Positive data from clinical trials, earnings readouts, M&A speculation and new research drew heavy interest from retail traders on Stocktwits for these tickers for the week ended March 14, 2025.

Via Stocktwits · March 16, 2025

There's a lot for investors to talk about.

Via The Motley Fool · January 29, 2025

Via Benzinga · January 22, 2025

Via Benzinga · January 22, 2025

Via Benzinga · December 9, 2024

Via Benzinga · August 19, 2024

MGX stock results show that Metagenomi beat analyst estimates for earnings per share and beat on revenue for the second quarter of 2024.

Via InvestorPlace · August 14, 2024

MGX stock results show that Metagenomi missed analyst estimates for earnings per share but beat on revenue for the first quarter of 2024.

Via InvestorPlace · May 14, 2024

Moderna reports Q1 loss, beating sales estimates amidst declining COVID-19 vaccine demand. Cost-saving measures drive optimism for investors. CEO Stéphane Bancel eyes strategic investments. Guidance reaffirms $4 billion sales target for 2024.

Via Benzinga · May 2, 2024

Pay close attention to gene editing stocks. By 2028, according to MarketsandMarkets, the market could be worth about $10.6 billion.

Via InvestorPlace · May 2, 2024

Via Benzinga · April 19, 2024