Quantum computing company IonQ (NYSE:IONQ) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 81.8% year on year to $20.69 million. On top of that, next quarter’s revenue guidance ($27 million at the midpoint) was surprisingly good and 5.9% above what analysts were expecting. Its GAAP loss of $0.70 per share was significantly below analysts’ consensus estimates.

Is now the time to buy IonQ? Find out by accessing our full research report, it’s free.

IonQ (IONQ) Q2 CY2025 Highlights:

- Revenue: $20.69 million vs analyst estimates of $17.03 million (81.8% year-on-year growth, 21.5% beat)

- EPS (GAAP): -$0.70 vs analyst estimates of -$0.29 (significant miss)

- Adjusted EBITDA: -$36.52 million vs analyst estimates of -$34.12 million (-176% margin, 7% miss)

- The company dropped its revenue guidance for the full year to $91 million at the midpoint from $95 million, a 4.2% decrease

- Operating Margin: -776%, down from -430% in the same quarter last year

- Free Cash Flow was -$55.65 million compared to -$34.07 million in the same quarter last year

- Market Capitalization: $11.9 billion

Company Overview

Founded by quantum physics pioneers from the University of Maryland and Duke University in 2015, IonQ (NYSE:IONQ) develops quantum computers that process information using trapped ions to solve complex computational problems beyond the capabilities of traditional computers.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $52.37 million in revenue over the past 12 months, IonQ is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

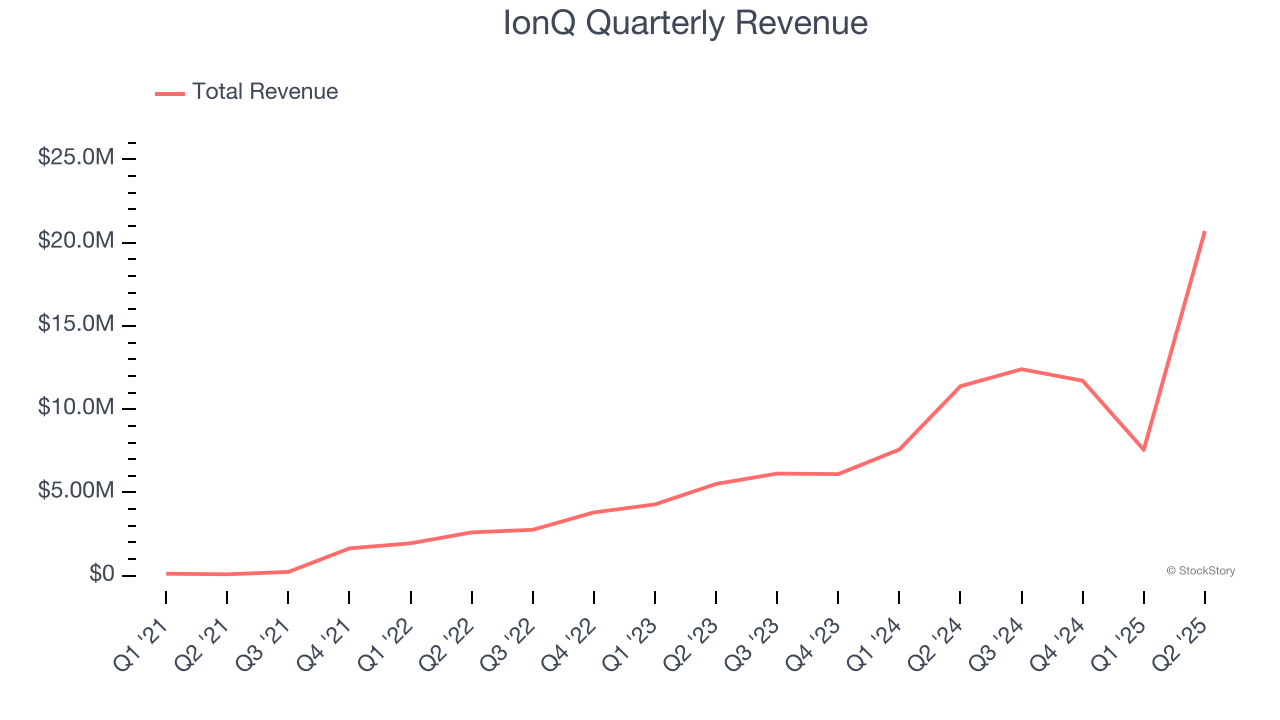

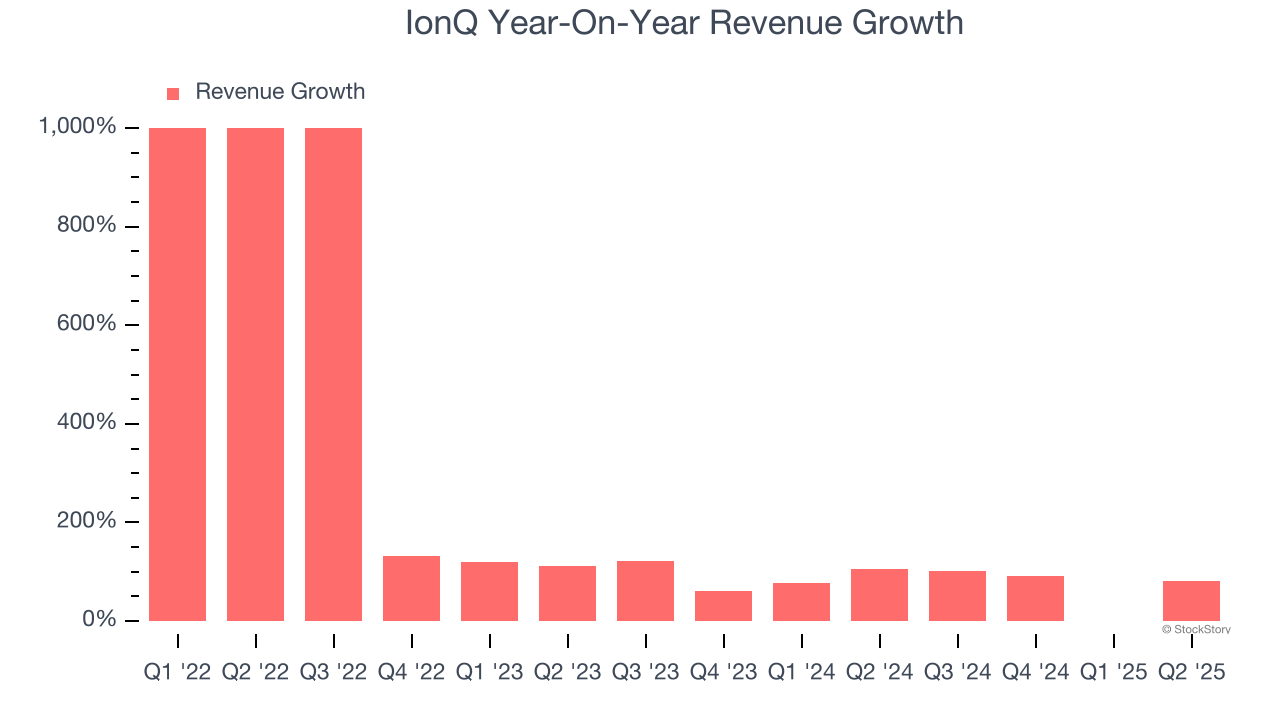

As you can see below, IonQ’s sales grew at an incredible 237% compounded annual growth rate over the last four years. This is a great starting point for our analysis because it shows IonQ’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. IonQ’s annualized revenue growth of 78.9% over the last two years is below its four-year trend, but we still think the results suggest healthy demand.

This quarter, IonQ reported magnificent year-on-year revenue growth of 81.8%, and its $20.69 million of revenue beat Wall Street’s estimates by 21.5%. Company management is currently guiding for a 118% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 127% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will fuel better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

IonQ’s high expenses have contributed to an average operating margin of negative 704% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, IonQ’s operating margin rose over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

In Q2, IonQ generated a negative 776% operating margin.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

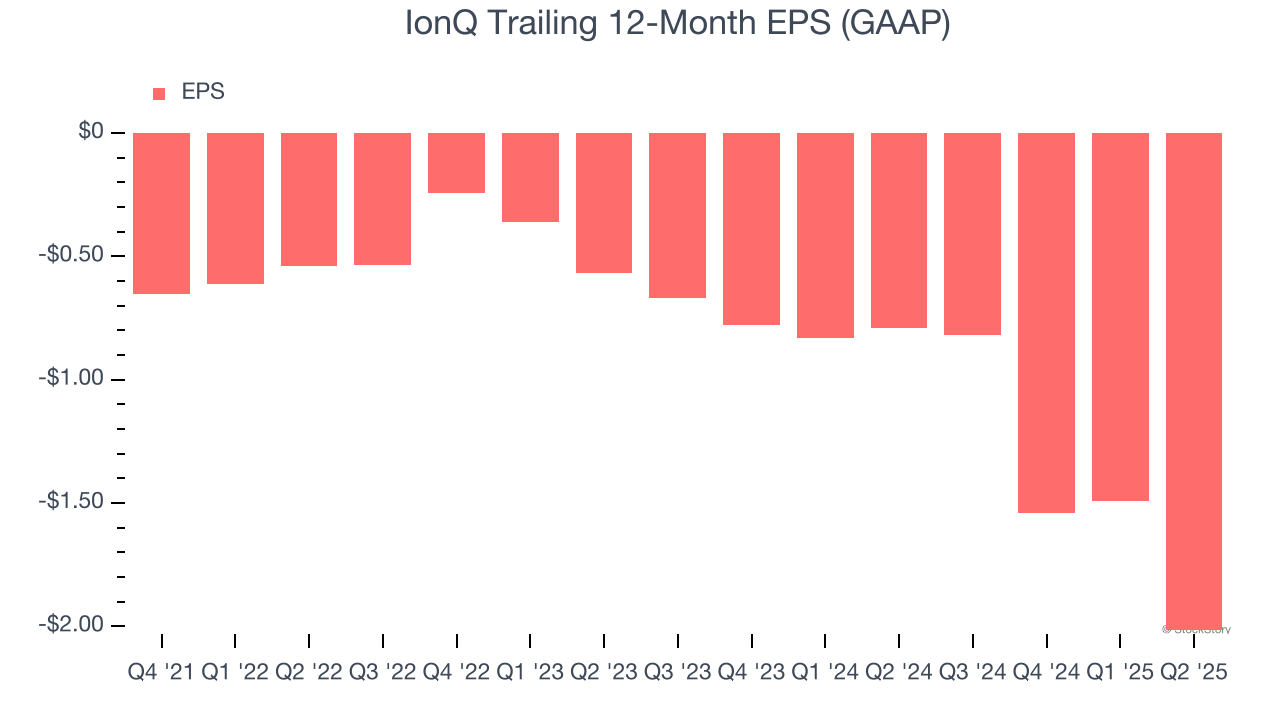

IonQ’s earnings losses deepened over the last four years as its EPS dropped 55% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For IonQ, its two-year annual EPS declines of 88.2% show it’s continued to underperform. These results were bad no matter how you slice the data, but given it was successful in other measures of financial health, we’re hopeful IonQ can generate earnings growth in the future.

In Q2, IonQ reported EPS at negative $0.70, down from negative $0.18 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects IonQ to improve its earnings losses. Analysts forecast its full-year EPS of negative $2.01 will advance to negative $1.19.

Key Takeaways from IonQ’s Q2 Results

We were impressed by how significantly IonQ blew past analysts’ revenue expectations this quarter. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. On the other hand, its EBITDA missed and full-year revenue guidance was lowered. Overall, we think this was a bit of a messy quarter with something for the bulls and something for the bears. The market seemed to be hoping for more, and the stock traded down 1.4% to $40.65 immediately following the results.

So do we think IonQ is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.