Telecommunications infrastructure company Lumen Technologies (NYSE:LUMN) fell short of the market’s revenue expectations in Q2 CY2025, with sales falling 5.4% year on year to $3.09 billion. Its non-GAAP loss of $0.03 per share was 88.7% above analysts’ consensus estimates.

Is now the time to buy Lumen? Find out by accessing our full research report, it’s free.

Lumen (LUMN) Q2 CY2025 Highlights:

- Revenue: $3.09 billion vs analyst estimates of $3.11 billion (5.4% year-on-year decline, 0.7% miss)

- Adjusted EPS: -$0.03 vs analyst estimates of -$0.27 (88.7% beat)

- Adjusted EBITDA: $877 million vs analyst estimates of $833.8 million (28.4% margin, 5.2% beat)

- EBITDA guidance for the full year is $3.3 billion at the midpoint, below analyst estimates of $3.33 billion

- Operating Margin: -19.5%, down from 4.1% in the same quarter last year

- Free Cash Flow was -$321 million compared to -$156 million in the same quarter last year

- Market Capitalization: $4.58 billion

“Our second quarter results underscore the momentum of our transformation strategy and the discipline of our execution,” said Kate Johnson, President and CEO of Lumen Technologies.

Company Overview

With approximately 350,000 route miles of fiber optic cable spanning North America and the Asia Pacific, Lumen Technologies (NYSE:LUMN) operates a vast fiber optic network that provides communications, cloud connectivity, security, and IT solutions to businesses and consumers.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years.

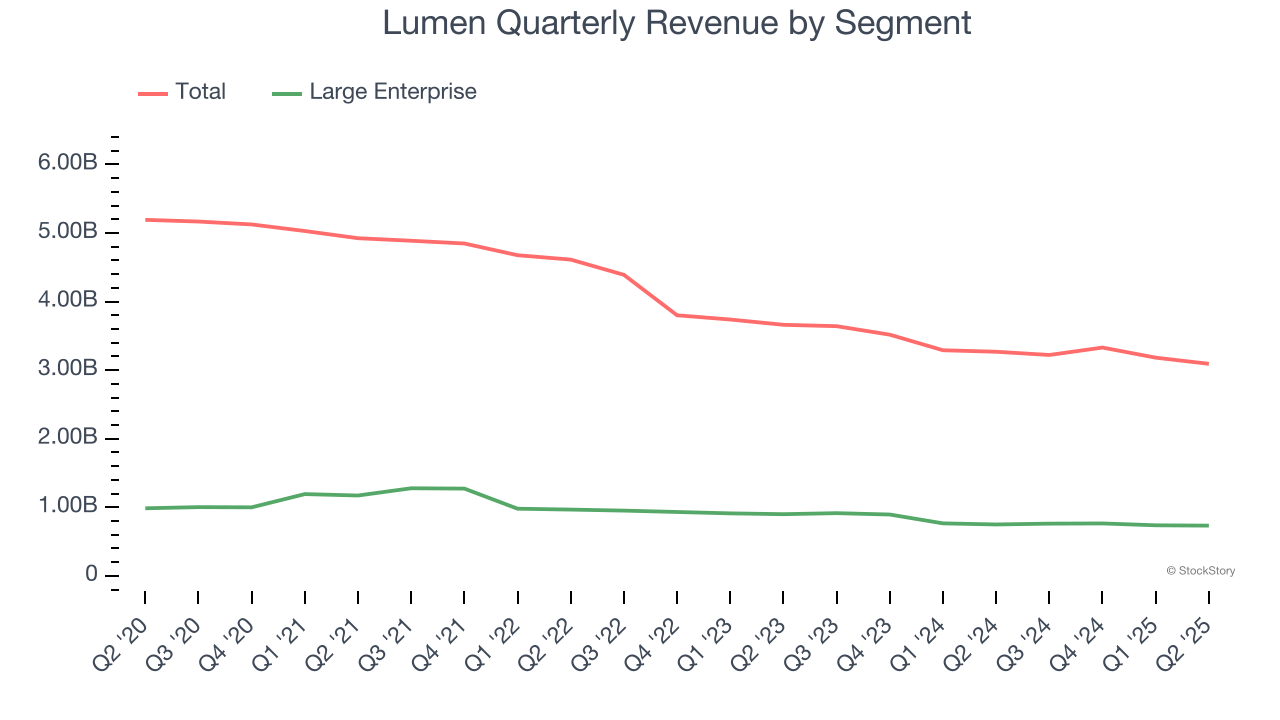

With $12.82 billion in revenue over the past 12 months, Lumen is larger than most business services companies and benefits from economies of scale, enabling it to gain more leverage on its fixed costs than smaller competitors. This also gives it the flexibility to offer lower prices. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. For Lumen to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

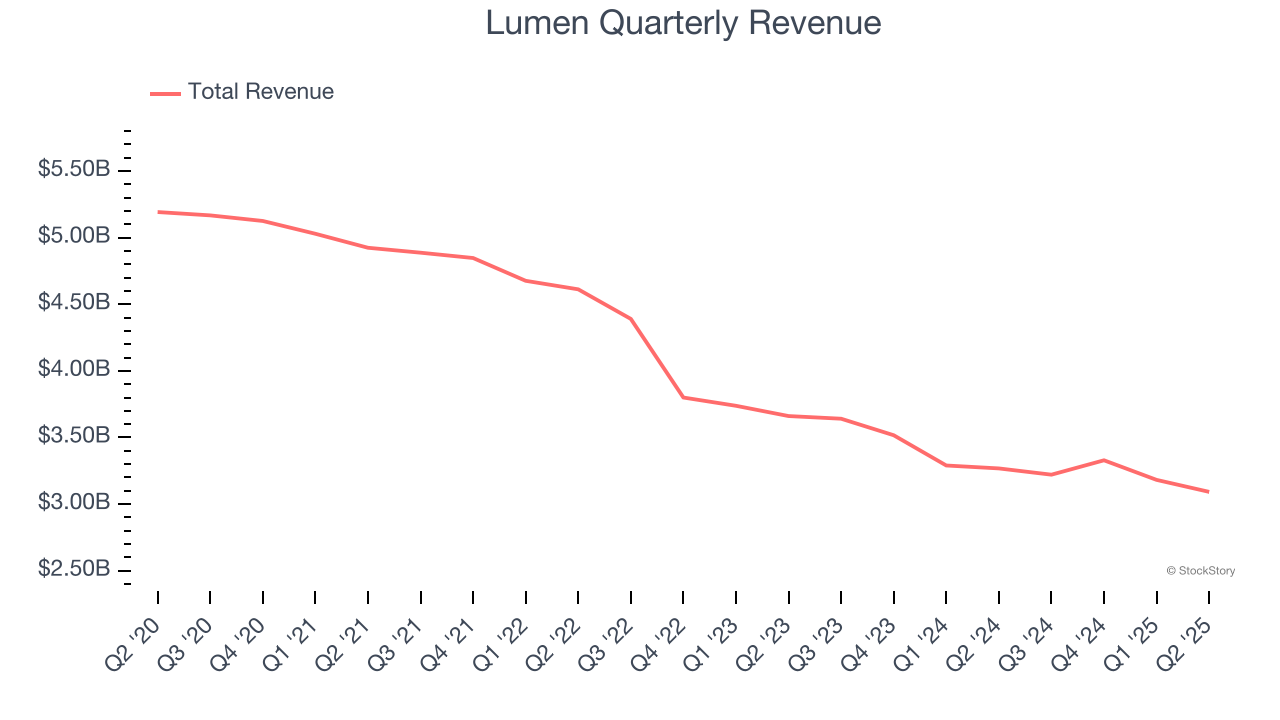

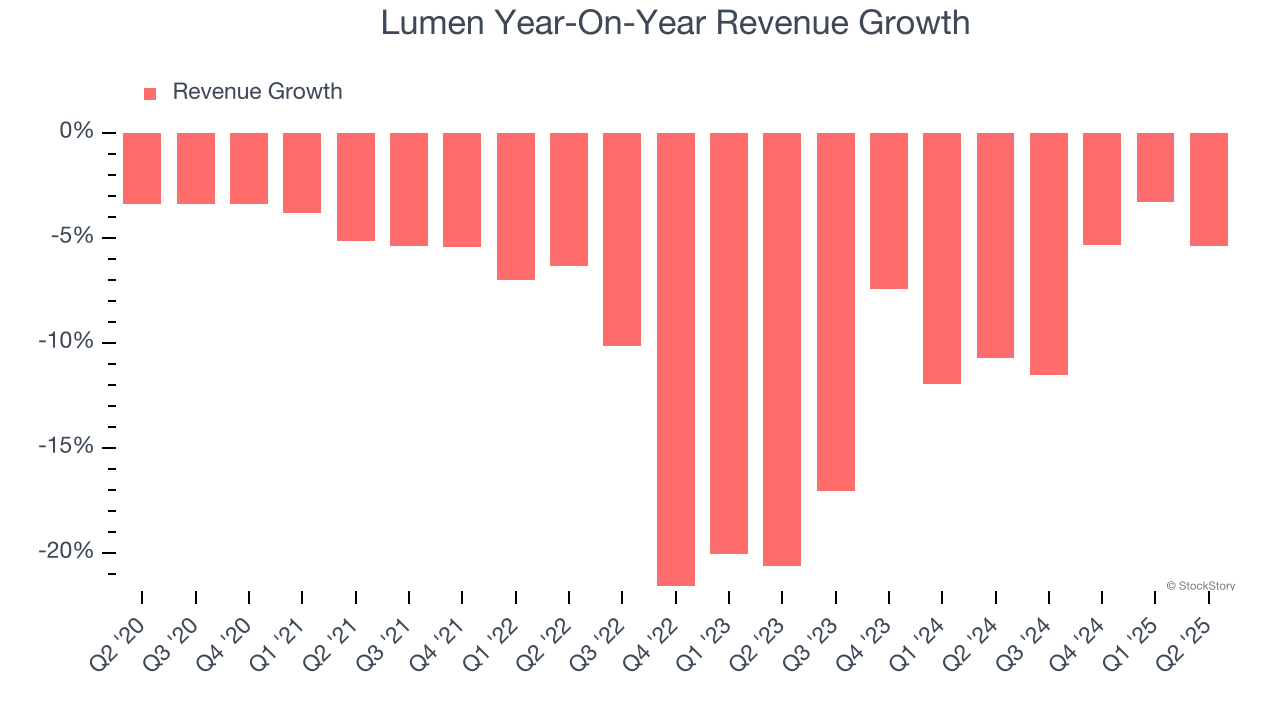

As you can see below, Lumen struggled to generate demand over the last five years. Its sales dropped by 9.5% annually, a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Lumen’s annualized revenue declines of 9.3% over the last two years align with its five-year trend, suggesting its demand has consistently shrunk.

Lumen also breaks out the revenue for its most important segment, Large Enterprise. Over the last two years, Lumen’s Large Enterprise revenue (services provided to businesses) averaged 9.7% year-on-year declines. This segment has lagged the company’s overall sales.

This quarter, Lumen missed Wall Street’s estimates and reported a rather uninspiring 5.4% year-on-year revenue decline, generating $3.09 billion of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 5.4% over the next 12 months. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

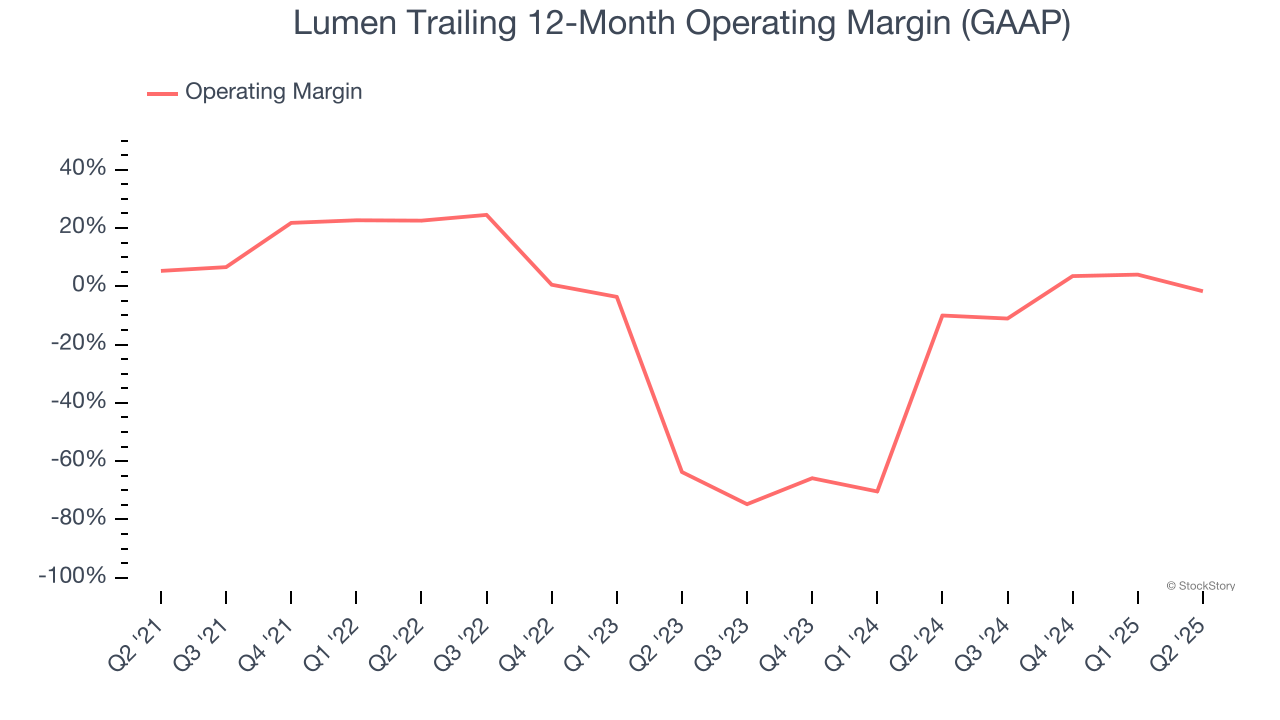

Lumen’s high expenses have contributed to an average operating margin of negative 7.6% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Lumen’s operating margin decreased by 7 percentage points over the last five years. Lumen’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Lumen generated a negative 19.5% operating margin. The company's consistent lack of profits raise a flag.

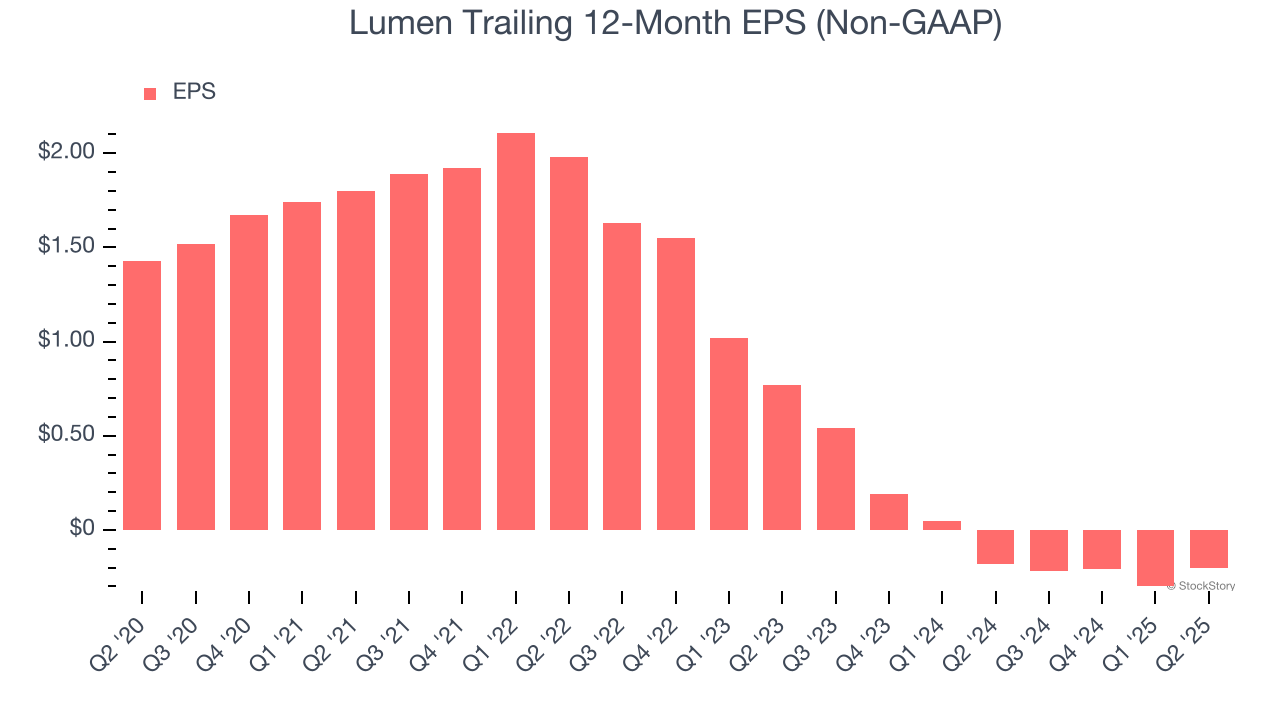

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Lumen, its EPS declined by 16.4% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

We can take a deeper look into Lumen’s earnings to better understand the drivers of its performance. As we mentioned earlier, Lumen’s operating margin declined by 7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Lumen, its two-year annual EPS declines of 50.3% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q2, Lumen reported adjusted EPS at negative $0.03, up from negative $0.13 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Lumen to perform poorly. Analysts forecast its full-year EPS of negative $0.20 will tumble to negative $1.22.

Key Takeaways from Lumen’s Q2 Results

Revenue missed, and full-year EBITDA guidance came in below expectations. This was a weaker quarter, and shares traded down 4.8% to $4.26 immediately following the results.

Big picture, is Lumen a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.