Medical technology company iRhythm Technologies (NASDAQ:IRTC) reported Q2 CY2025 results exceeding the market’s revenue expectations, with sales up 26.1% year on year to $186.7 million. The company’s full-year revenue guidance of $725 million at the midpoint came in 4.2% above analysts’ estimates. Its non-GAAP loss of $0.32 per share was 32.5% above analysts’ consensus estimates.

Is now the time to buy iRhythm? Find out by accessing our full research report, it’s free.

iRhythm (IRTC) Q2 CY2025 Highlights:

- Revenue: $186.7 million vs analyst estimates of $174 million (26.1% year-on-year growth, 7.3% beat)

- Adjusted EPS: -$0.32 vs analyst estimates of -$0.47 (32.5% beat)

- Adjusted EBITDA: $15.7 million vs analyst estimates of $11.82 million (8.4% margin, 32.8% beat)

- The company lifted its revenue guidance for the full year to $725 million at the midpoint from $695 million, a 4.3% increase

- Operating Margin: -10%, up from -15.5% in the same quarter last year

- Market Capitalization: $4.47 billion

"The second quarter of 2025 was another record quarter for iRhythm, with growth of more than 26%, showcasing the strength of our diversified growth strategy," said Quentin Blackford, President and Chief Executive Officer of iRhythm.

Company Overview

Pioneering the shift from bulky, short-term heart monitors to sleek, wire-free patches, iRhythm Technologies (NASDAQ:IRTC) provides wearable cardiac monitoring devices and AI-powered analysis services that help physicians detect and diagnose heart rhythm disorders.

Revenue Growth

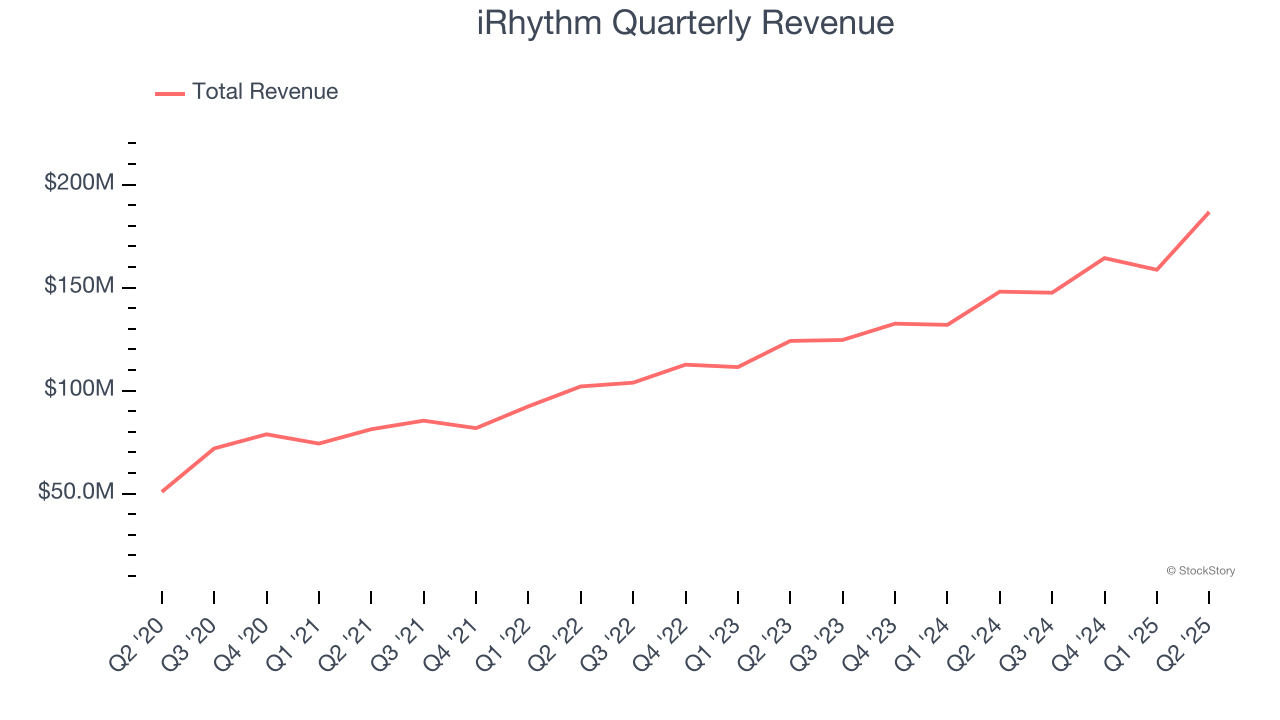

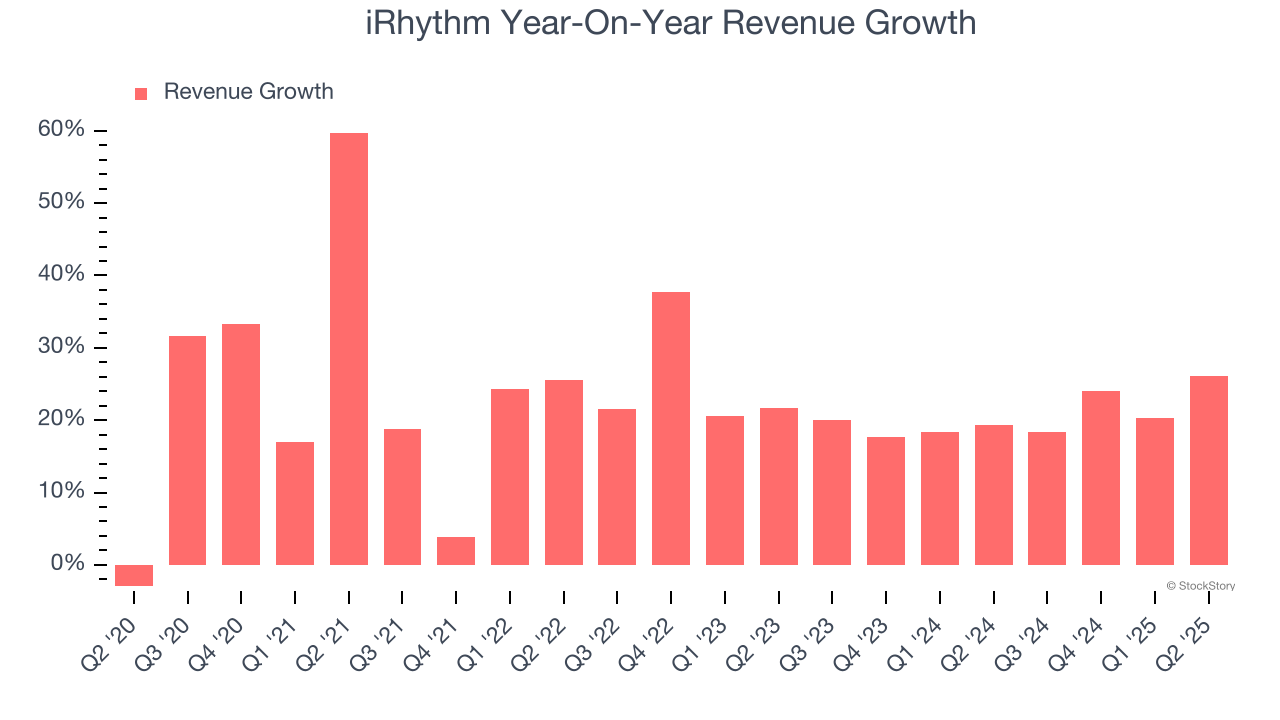

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, iRhythm grew its sales at an excellent 23.6% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. iRhythm’s annualized revenue growth of 20.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, iRhythm reported robust year-on-year revenue growth of 26.1%, and its $186.7 million of revenue topped Wall Street estimates by 7.3%.

Looking ahead, sell-side analysts expect revenue to grow 14.3% over the next 12 months, a deceleration versus the last two years. Still, this projection is noteworthy and indicates the market is baking in success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

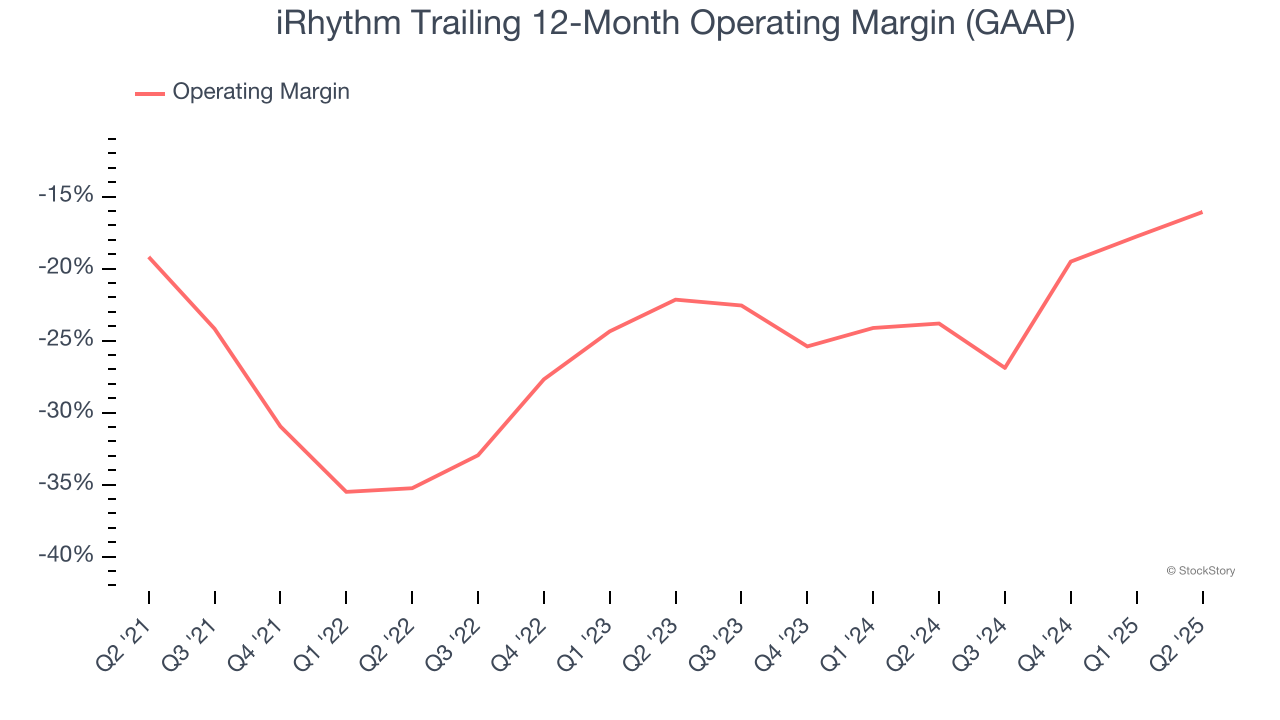

iRhythm’s high expenses have contributed to an average operating margin of negative 22.5% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, iRhythm’s operating margin rose by 3.1 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 6.1 percentage points on a two-year basis.

This quarter, iRhythm generated a negative 10% operating margin.

Earnings Per Share

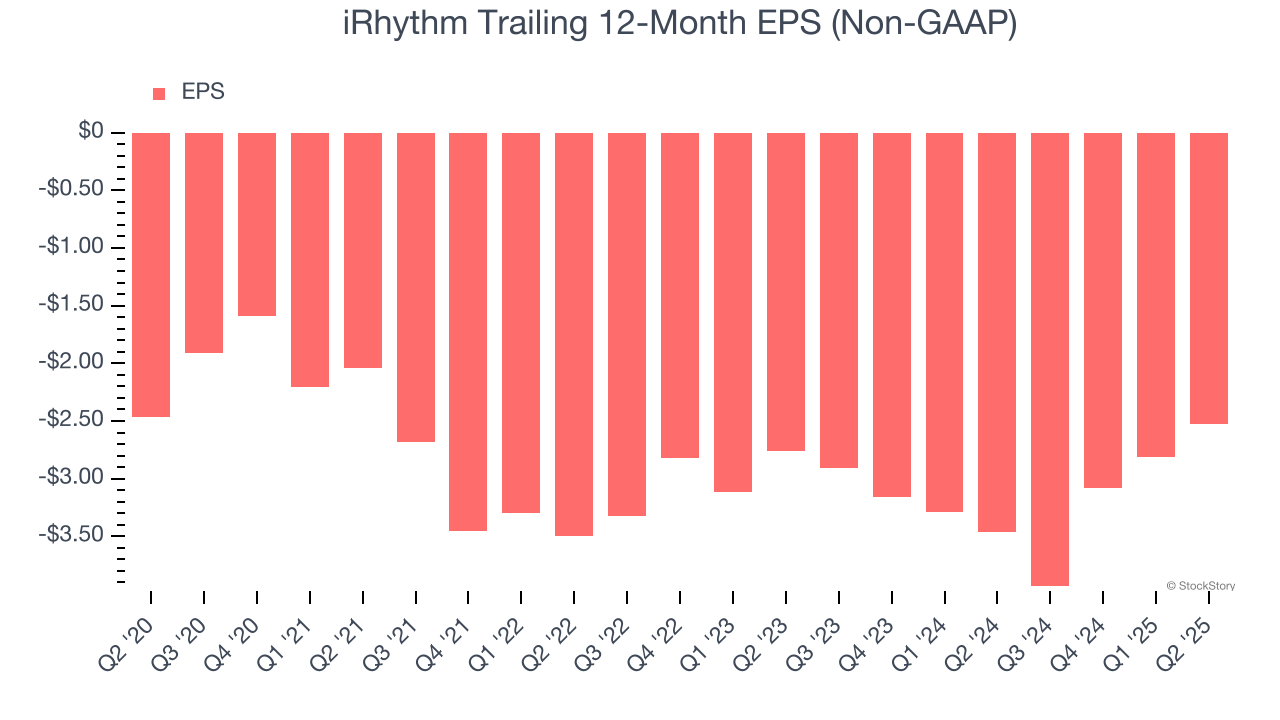

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

iRhythm’s full-year EPS was flat over the last five years. This performance was underwhelming across the board.

In Q2, iRhythm reported adjusted EPS at negative $0.32, up from negative $0.60 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects iRhythm to improve its earnings losses. Analysts forecast its full-year EPS of negative $2.53 will advance to negative $0.80.

Key Takeaways from iRhythm’s Q2 Results

We were impressed by how significantly iRhythm blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 8.4% to $152 immediately following the results.

Sure, iRhythm had a solid quarter, but if we look at the bigger picture, is this stock a buy? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.