Blockchain infrastructure company Coinbase (NASDAQ:COIN) missed Wall Street’s revenue expectations in Q2 CY2025 as sales rose 3.3% year on year to $1.5 billion. Its non-GAAP profit of $0.12 per share was 91.9% below analysts’ consensus estimates.

Is now the time to buy Coinbase? Find out by accessing our full research report, it’s free.

Coinbase (COIN) Q2 CY2025 Highlights:

- Revenue: $1.5 billion vs analyst estimates of $1.56 billion (3.3% year-on-year growth, 4.3% miss)

- Adjusted EPS: $0.12 vs analyst expectations of $1.49 (91.9% miss)

- Adjusted EBITDA: $512.1 million vs analyst estimates of $588.7 million (34.2% margin, 13% miss)

- Q3 subscription & services revenue guide: $705 million vs analyst estimates of $742 million (5.0% miss)

- Operating Margin: -1.6%, down from 23.7% in the same quarter last year

- Free Cash Flow was $328.5 million, up from -$182.7 million in the previous quarter

- Market Capitalization: $96.15 billion

Company Overview

Widely regarded as the face of crypto, Coinbase (NASDAQ:COIN) is a blockchain infrastructure company updating the financial system with its trading, staking, stablecoin, and other payment solutions.

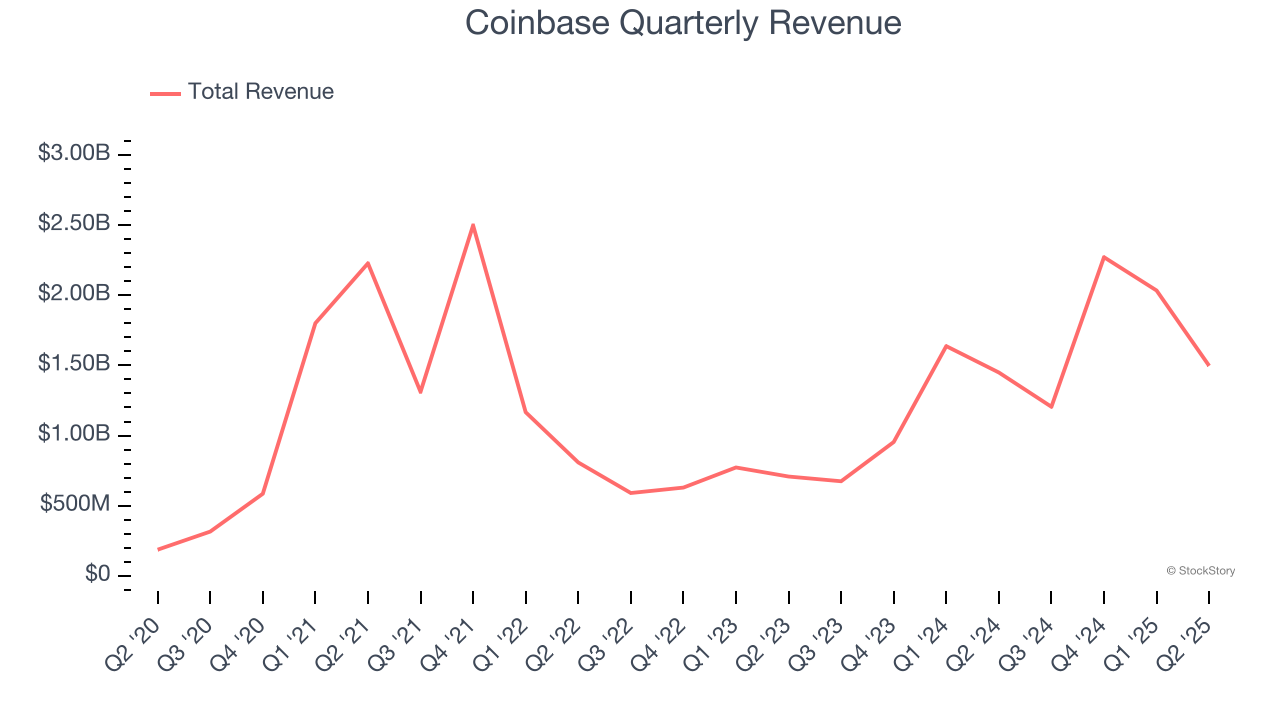

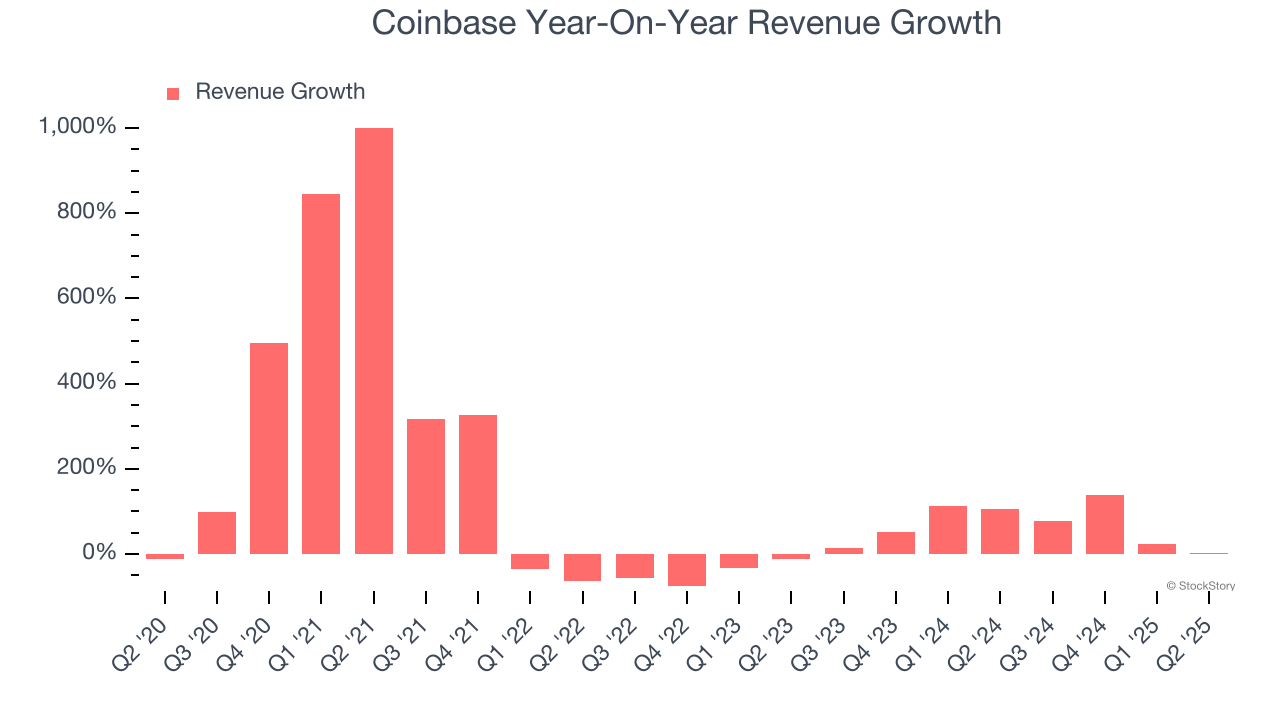

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Coinbase’s sales grew at an incredible 61.7% compounded annual growth rate over the last five years. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within consumer internet, a half-decade historical view may miss new innovations or demand cycles. Coinbase’s annualized revenue growth of 61.1% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Coinbase’s revenue grew by 3.3% year on year to $1.5 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.6% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

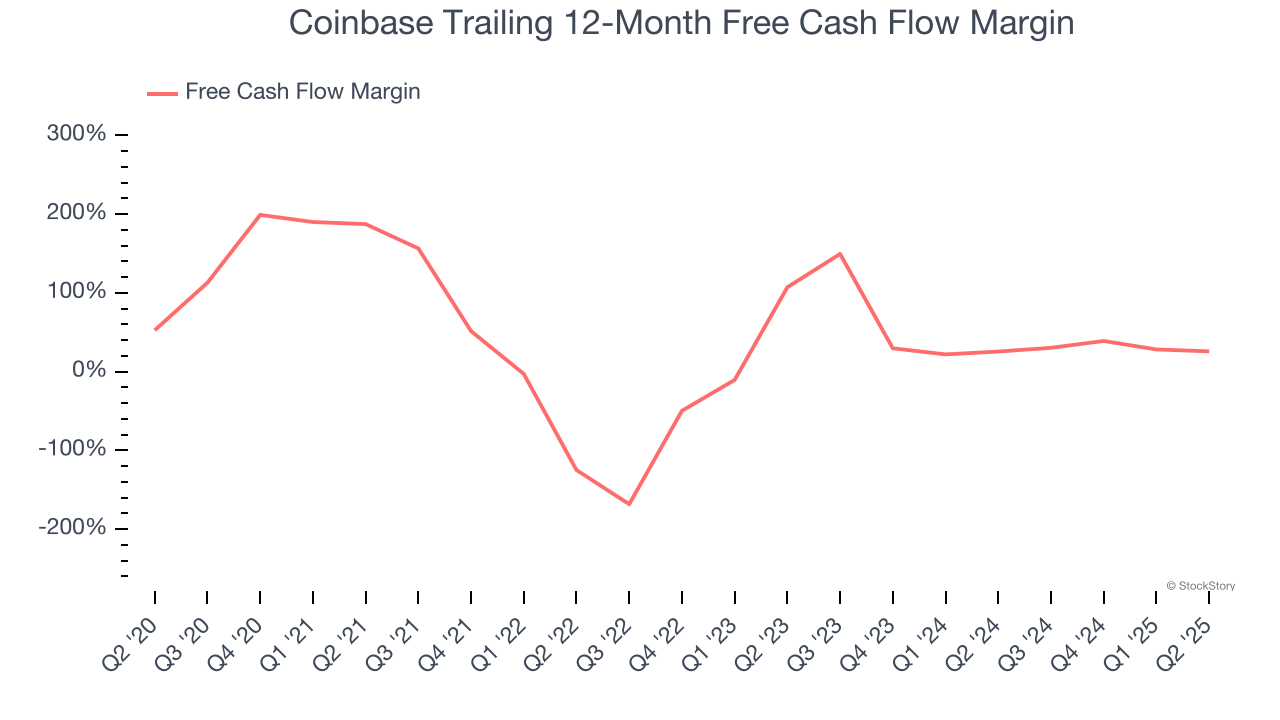

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Coinbase has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging 25.7% over the last two years.

Taking a step back, we can see that Coinbase’s margin dropped meaningfully over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity.

Coinbase’s free cash flow clocked in at $328.5 million in Q2, equivalent to a 21.9% margin. The company’s cash profitability regressed as it was 11.5 percentage points lower than in the same quarter last year, which isn’t ideal considering its longer-term trend.

Key Takeaways from Coinbase’s Q2 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Looking ahead, Q3 guidance for subscription and services revenue also came in below expectations. Overall, this quarter could have been better. The stock traded down 7.6% to $349 immediately after reporting.

Coinbase didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.