Healthcare company Surgery Partners (NASDAQ:SGRY) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 8.2% year on year to $776 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $3.38 billion at the midpoint. Its non-GAAP profit of $0.04 per share was $0.01 below analysts’ consensus estimates.

Is now the time to buy Surgery Partners? Find out by accessing our full research report, it’s free.

Surgery Partners (SGRY) Q1 CY2025 Highlights:

- Revenue: $776 million vs analyst estimates of $779.6 million (8.2% year-on-year growth, in line)

- Adjusted EPS: $0.04 vs analyst estimates of $0.05 ($0.01 miss)

- Adjusted EBITDA: $103.9 million vs analyst estimates of $104 million (13.4% margin, in line)

- The company reconfirmed its revenue guidance for the full year of $3.38 billion at the midpoint

- EBITDA guidance for the full year is $560 million at the midpoint, in line with analyst expectations

- Operating Margin: 8%, down from 10.6% in the same quarter last year

- Free Cash Flow was -$16.7 million, down from $19.7 million in the same quarter last year

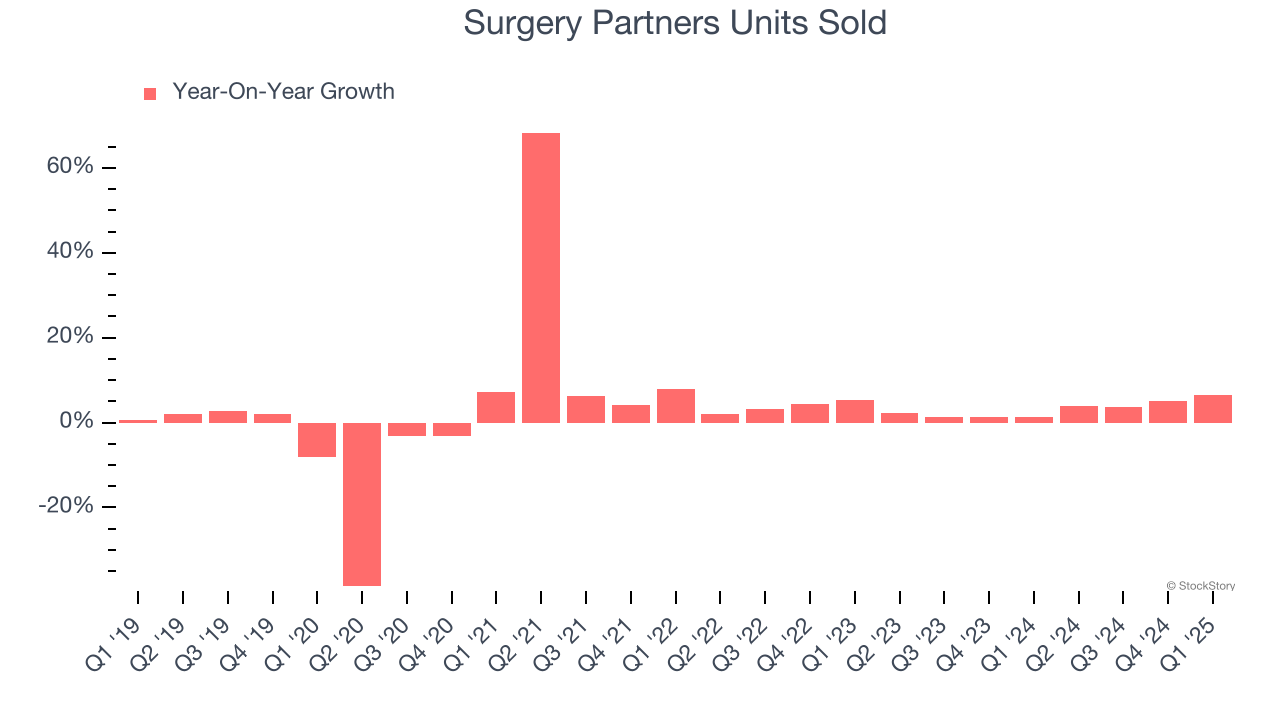

- Sales Volumes rose 6.5% year on year (1.3% in the same quarter last year)

- Market Capitalization: $2.82 billion

Eric Evans, Chief Executive Officer, stated, “I am pleased with our strong start to 2025, as the Company continues to deliver growth that is consistent with Surgery Partners’ long-term growth algorithm. Our continued focus on maximizing portfolio performance, advancing a robust M&A pipeline and driving greater operating efficiencies, combined with a bullish outlook on surgical trends and the regulatory landscape, have us positioned to continue delivering industry leading earnings growth in 2025 and beyond.”

Company Overview

With more than 180 locations across 33 states serving as alternatives to traditional hospital settings, Surgery Partners (NASDAQ:SGRY) operates a national network of outpatient surgical facilities including ambulatory surgery centers and short-stay surgical hospitals.

Sales Growth

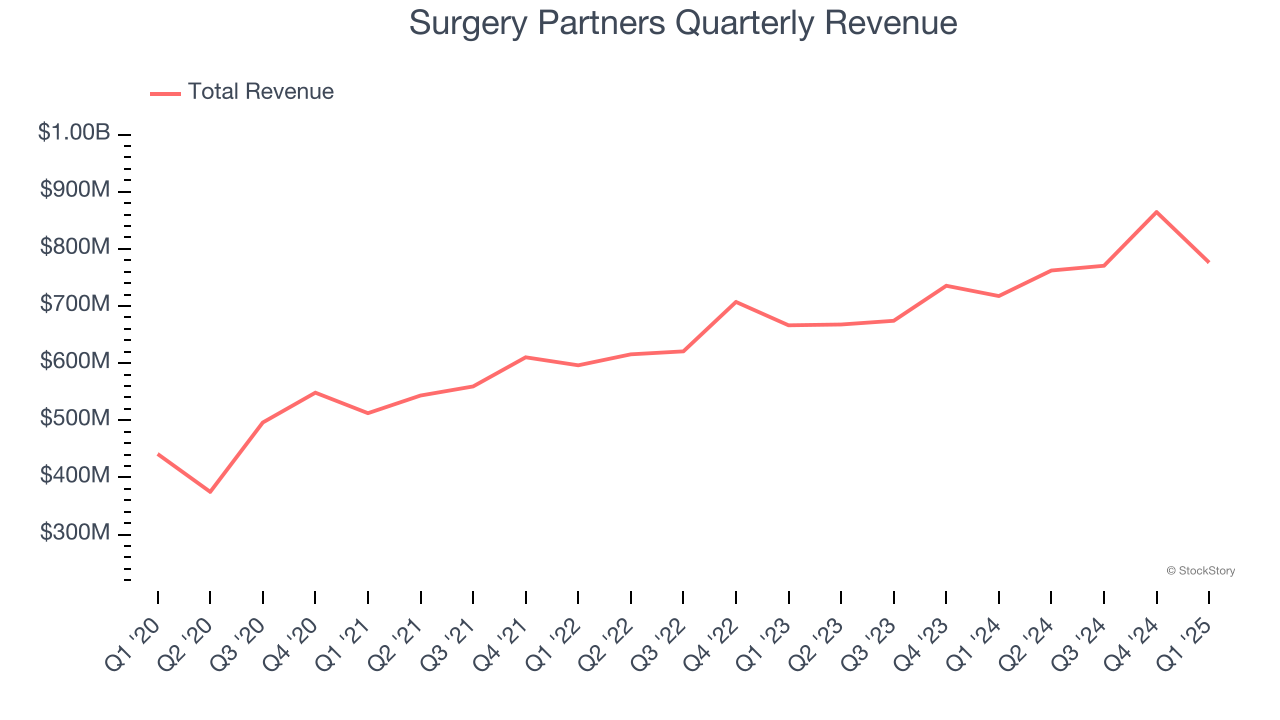

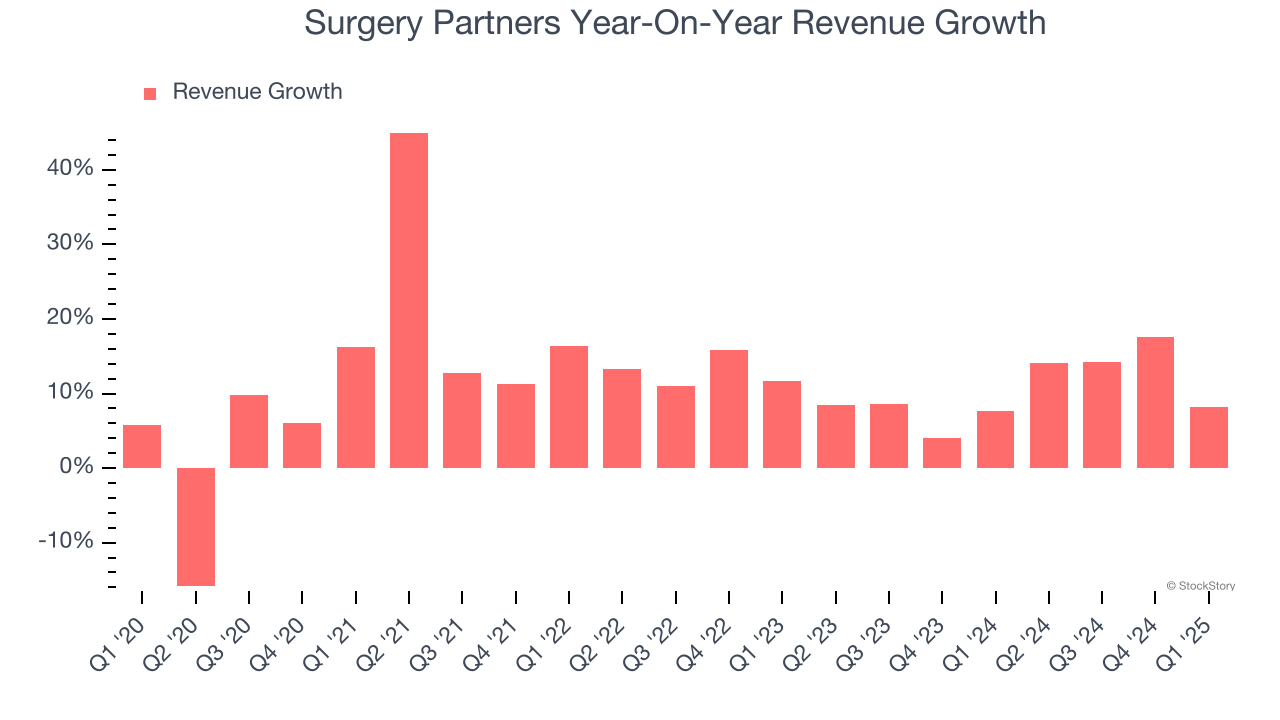

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Surgery Partners’s 11.3% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Surgery Partners’s annualized revenue growth of 10.3% over the last two years is below its five-year trend, but we still think the results were respectable.

Surgery Partners also reports its number of units sold. Over the last two years, Surgery Partners’s units sold averaged 3.2% year-on-year growth. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Surgery Partners grew its revenue by 8.2% year on year, and its $776 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.1% over the next 12 months, similar to its two-year rate. Still, this projection is healthy and implies the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

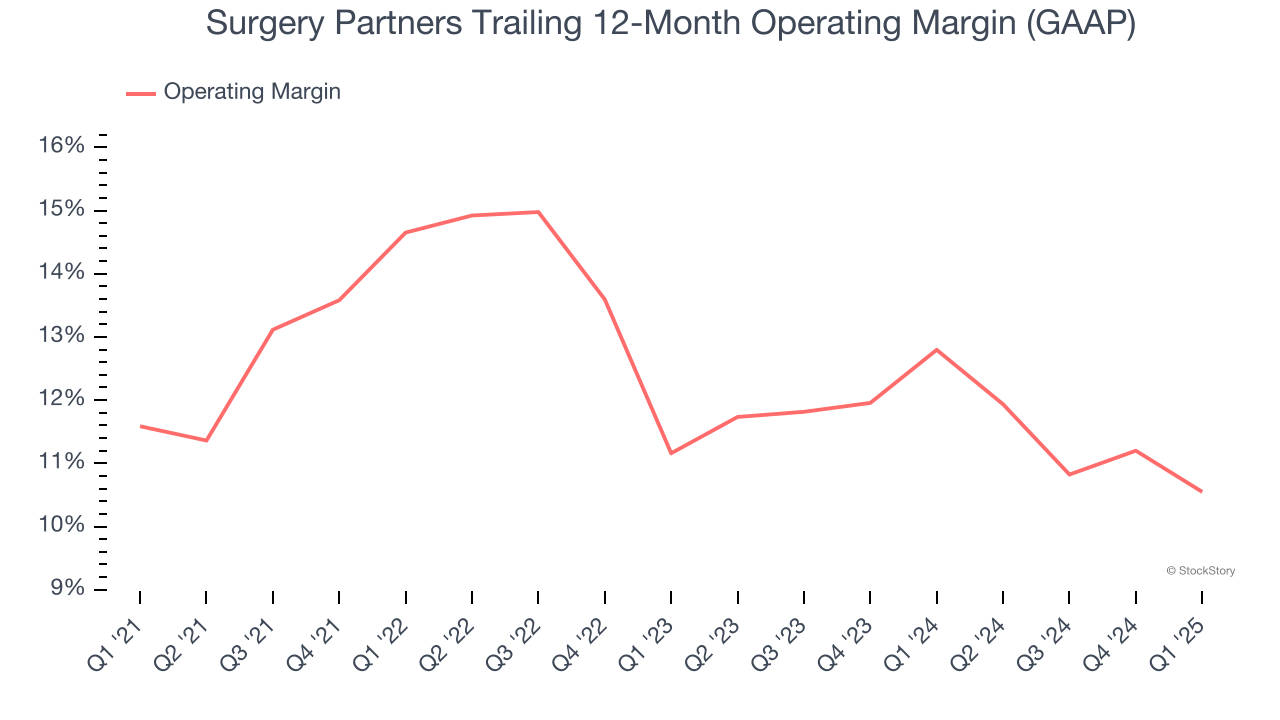

Surgery Partners has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 12.1%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, Surgery Partners’s operating margin decreased by 1 percentage points over the last five years. A silver lining is that on a two-year basis, its margin has stabilized. Still, shareholders will want to see Surgery Partners become more profitable in the future.

This quarter, Surgery Partners generated an operating profit margin of 8%, down 2.6 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

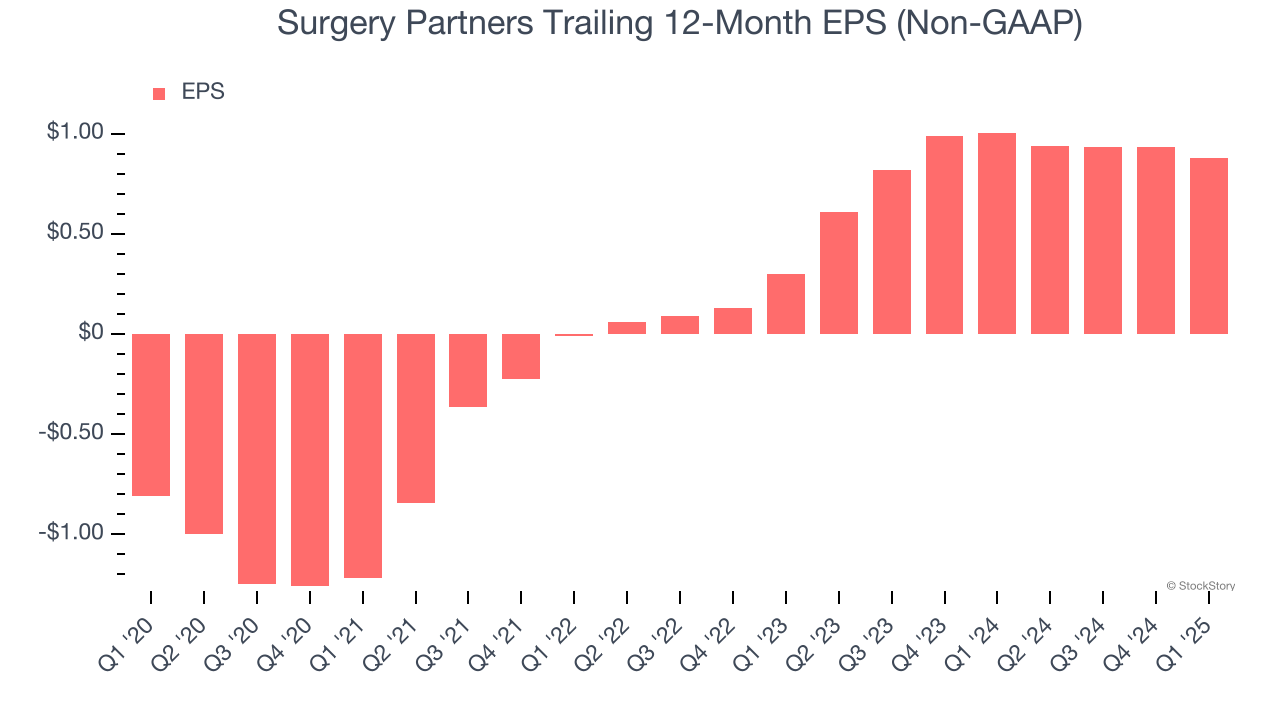

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Surgery Partners’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q1, Surgery Partners reported EPS at $0.04, down from $0.10 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Surgery Partners’s full-year EPS of $0.88 to grow 24.6%.

Key Takeaways from Surgery Partners’s Q1 Results

We were impressed by how significantly Surgery Partners beat analysts’ sales volume expectations this quarter. On the other hand, its EPS missed significantly and its revenue was just in line with Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 5.1% to $21 immediately following the results.

Should you buy the stock or not? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.