Clinical research company Fortrea Holdings (NASDAQ:FTRE) beat Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 1.6% year on year to $651.3 million. The company’s full-year revenue guidance of $2.5 billion at the midpoint came in 0.7% above analysts’ estimates. Its non-GAAP profit of $0.02 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Fortrea? Find out by accessing our full research report, it’s free.

Fortrea (FTRE) Q1 CY2025 Highlights:

- CEO Thomas Pike is stepping down

- Revenue: $651.3 million vs analyst estimates of $608 million (1.6% year-on-year decline, 7.1% beat)

- Adjusted EPS: $0.02 vs analyst estimates of -$0.07 (significant beat)

- Adjusted EBITDA: $205.7 million vs analyst estimates of $22.14 million (31.6% margin, significant beat)

- The company reconfirmed its revenue guidance for the full year of $2.5 billion at the midpoint

- EBITDA guidance for the full year is $185 million at the midpoint, above analyst estimates of $172.7 million

- Operating Margin: -79.9%, down from -5.6% in the same quarter last year

- Free Cash Flow was -$127.1 million compared to -$34.9 million in the same quarter last year

- Market Capitalization: $556.8 million

“Fortrea’s first quarter performance represents a solid start to 2025,” said Tom Pike, Chairman and CEO of Fortrea.

Company Overview

Spun off from Labcorp in 2023 to focus exclusively on clinical research services, Fortrea (NASDAQ:FTRE) is a contract research organization that helps pharmaceutical, biotech, and medical device companies develop and bring their products to market through clinical trials and support services.

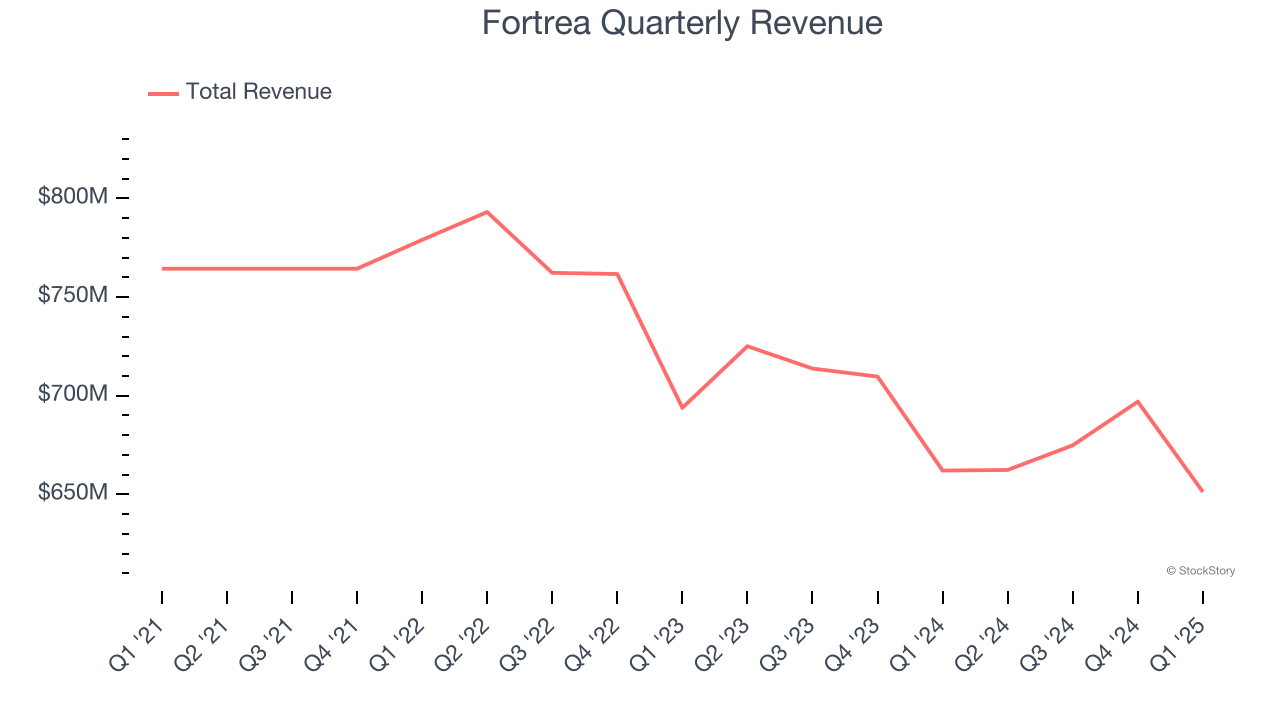

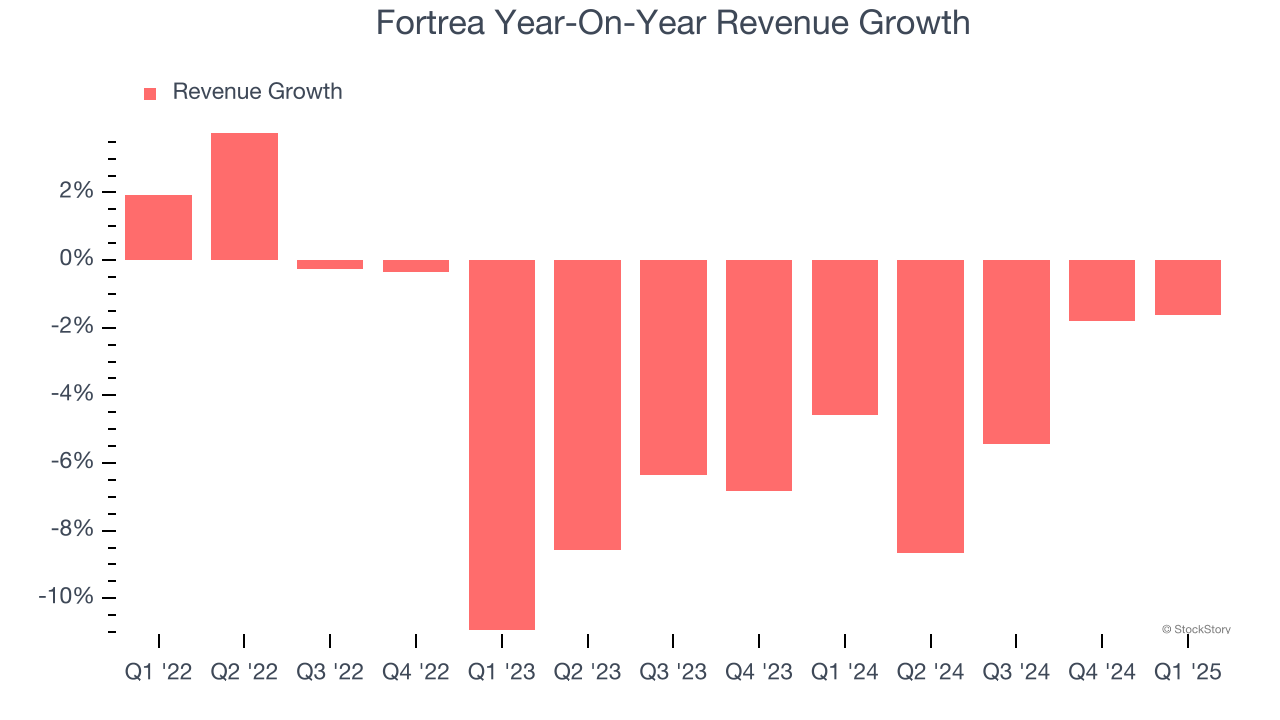

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last three years, Fortrea’s demand was weak and its revenue declined by 4.4% per year. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within healthcare, a stretched historical view may miss new innovations or demand cycles. Fortrea’s recent performance shows its demand remained suppressed as its revenue has declined by 5.6% annually over the last two years.

This quarter, Fortrea’s revenue fell by 1.6% year on year to $651.3 million but beat Wall Street’s estimates by 7.1%.

Looking ahead, sell-side analysts expect revenue to decline by 7.3% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

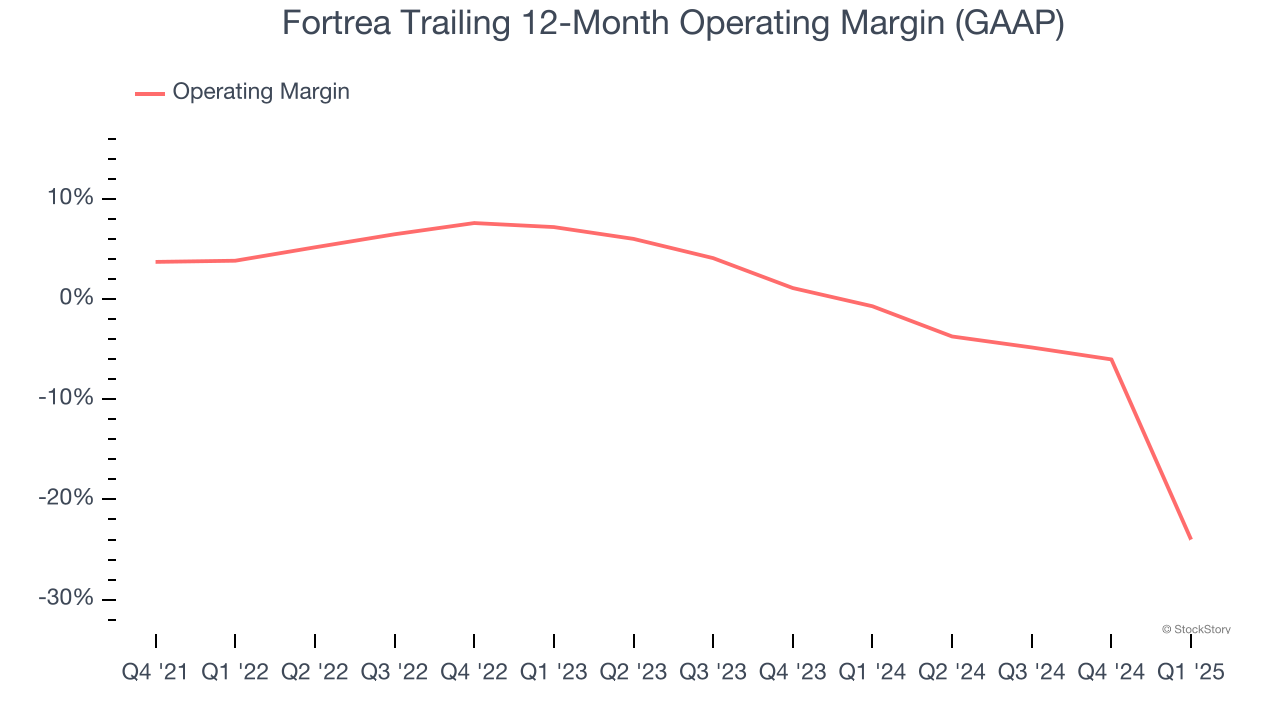

Operating Margin

Fortrea’s high expenses have contributed to an average operating margin of negative 2.4% over the last four years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Fortrea’s operating margin decreased by 27.9 percentage points over the last four years. This performance was caused by more recent speed bumps as the company’s margin fell by 31.2 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Fortrea generated a negative 79.9% operating margin. The company's consistent lack of profits raise a flag.

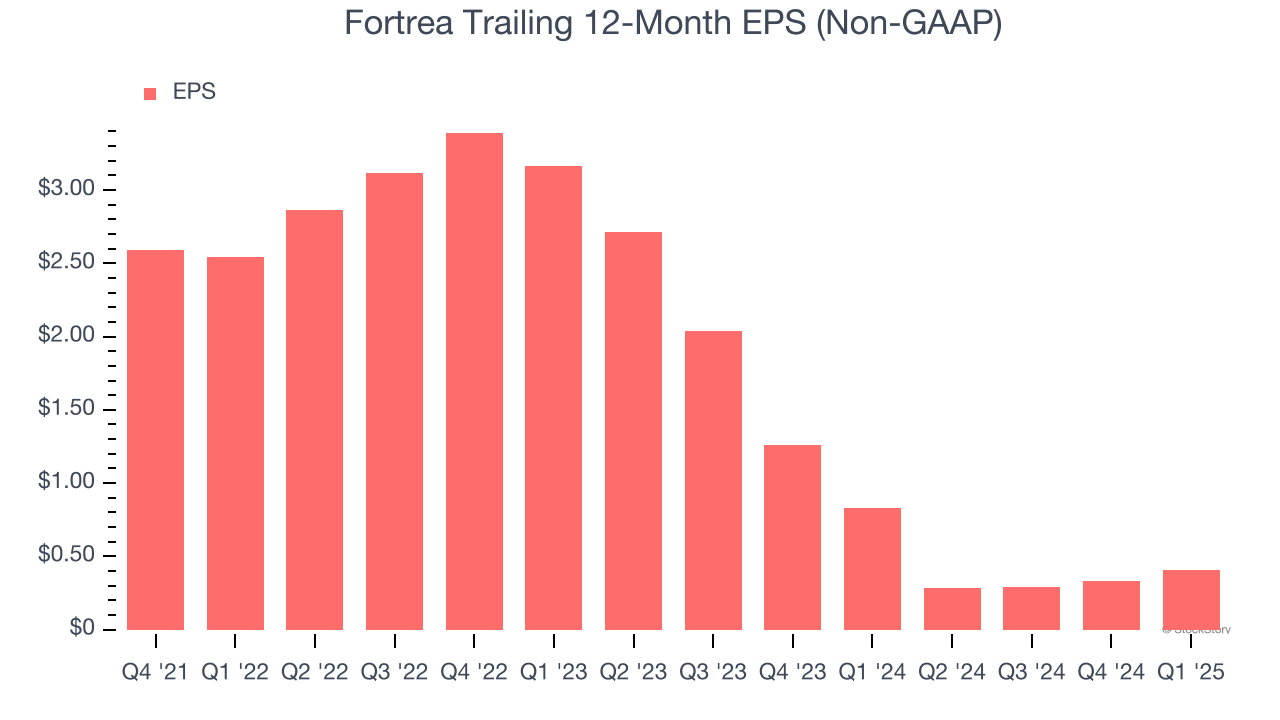

Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Fortrea, its EPS declined by 45.7% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

In Q1, Fortrea reported EPS at $0.02, up from negative $0.05 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Fortrea’s full-year EPS of $0.41 to grow 27.3%.

Key Takeaways from Fortrea’s Q1 Results

We were impressed by how significantly Fortrea blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. Still, news of the CEO stepping down dominated, and shares traded down 2.4% to $6.01 immediately after reporting.

Is Fortrea an attractive investment opportunity at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.