PCB manufacturing company TTM Technologies (NASDAQ:TTMI) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 13.8% year on year to $648.7 million. On top of that, next quarter’s revenue guidance ($670 million at the midpoint) was surprisingly good and 4% above what analysts were expecting. Its non-GAAP profit of $0.50 per share was 26.6% above analysts’ consensus estimates.

Is now the time to buy TTM Technologies? Find out by accessing our full research report, it’s free.

TTM Technologies (TTMI) Q1 CY2025 Highlights:

- Revenue: $648.7 million vs analyst estimates of $620 million (13.8% year-on-year growth, 4.6% beat)

- Adjusted EPS: $0.50 vs analyst estimates of $0.40 (26.6% beat)

- Adjusted EBITDA: $99.48 million vs analyst estimates of $83.93 million (15.3% margin, 18.5% beat)

- Revenue Guidance for Q2 CY2025 is $670 million at the midpoint, above analyst estimates of $644.5 million

- Adjusted EPS guidance for Q2 CY2025 is $0.52 at the midpoint, above analyst estimates of $0.48

- Operating Margin: 7.7%, up from 3% in the same quarter last year

- Market Capitalization: $2.08 billion

“We delivered a strong quarter with revenues and non-GAAP EPS above the high end of the guided range. Revenues grew 14% year on year due to demand strength in our Aerospace and Defense, Data Center Computing and Networking end markets, the latter two being driven by generative AI,” said Tom Edman, CEO of TTM.

Company Overview

As one of the world's largest printed circuit board manufacturers with facilities spanning North America and Asia, TTM Technologies (NASDAQ:TTMI) manufactures printed circuit boards (PCBs) and radio frequency (RF) components for aerospace, defense, automotive, and telecommunications industries.

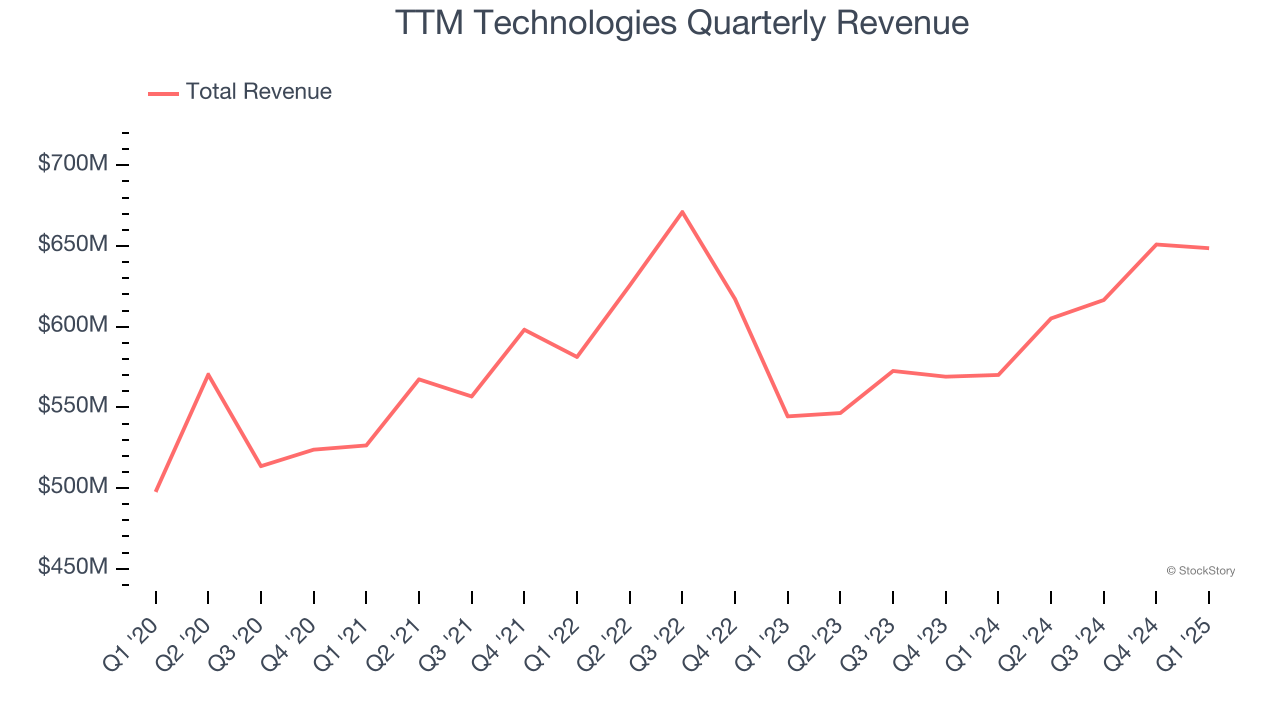

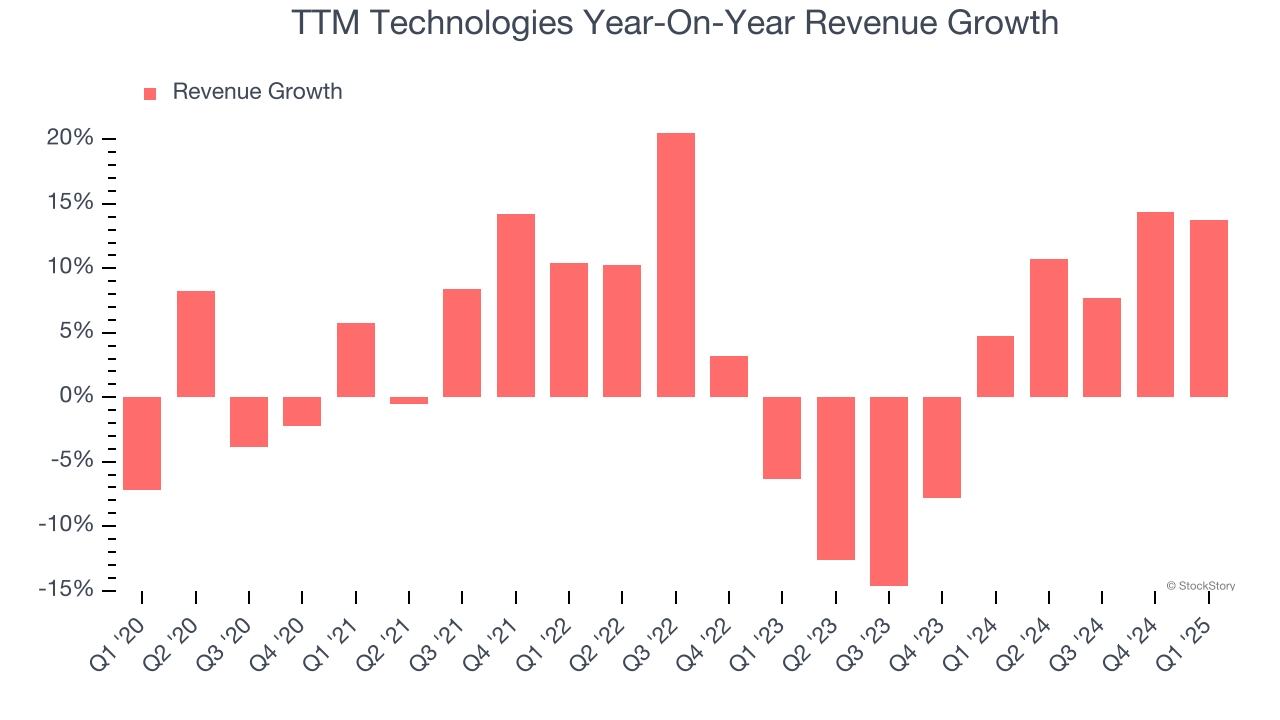

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $2.52 billion in revenue over the past 12 months, TTM Technologies is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

As you can see below, TTM Technologies grew its sales at a tepid 3.8% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. TTM Technologies’s recent performance shows its demand has slowed as its annualized revenue growth of 1.3% over the last two years was below its five-year trend.

This quarter, TTM Technologies reported year-on-year revenue growth of 13.8%, and its $648.7 million of revenue exceeded Wall Street’s estimates by 4.6%. Company management is currently guiding for a 10.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

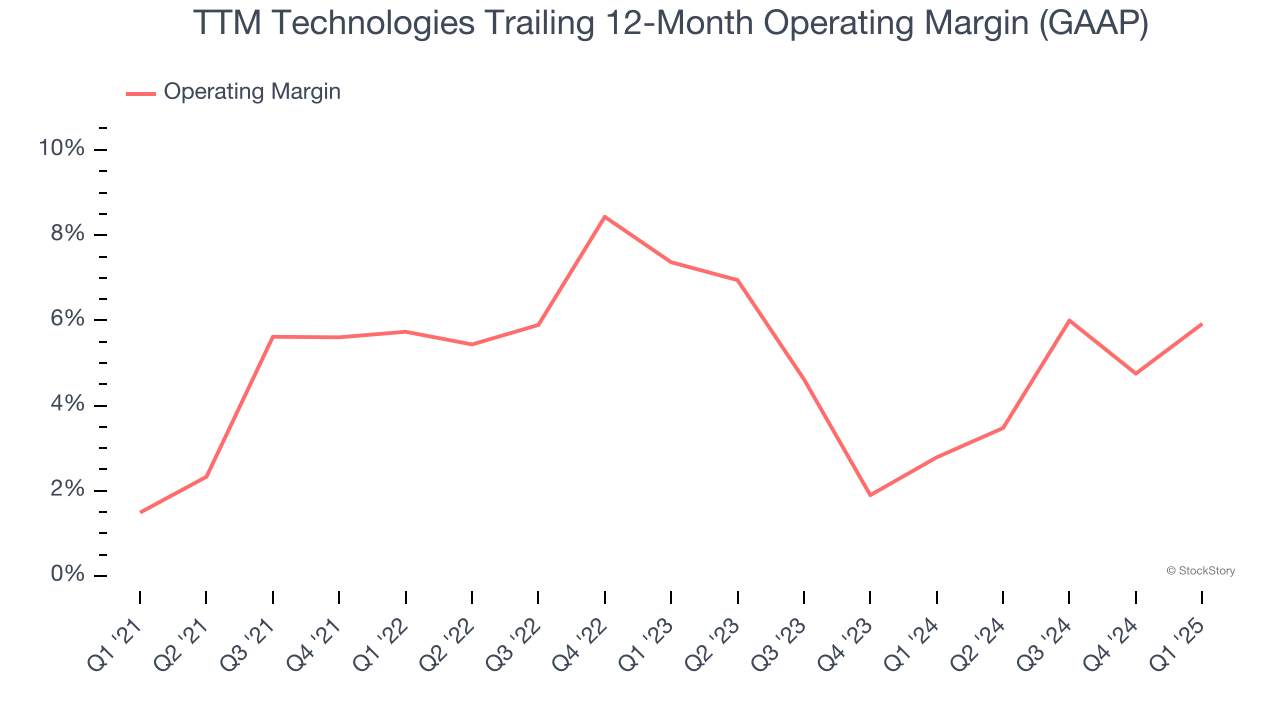

Operating Margin

TTM Technologies was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.8% was weak for a business services business.

On the plus side, TTM Technologies’s operating margin rose by 4.4 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q1, TTM Technologies generated an operating profit margin of 7.7%, up 4.8 percentage points year on year. This increase was a welcome development and shows it was more efficient.

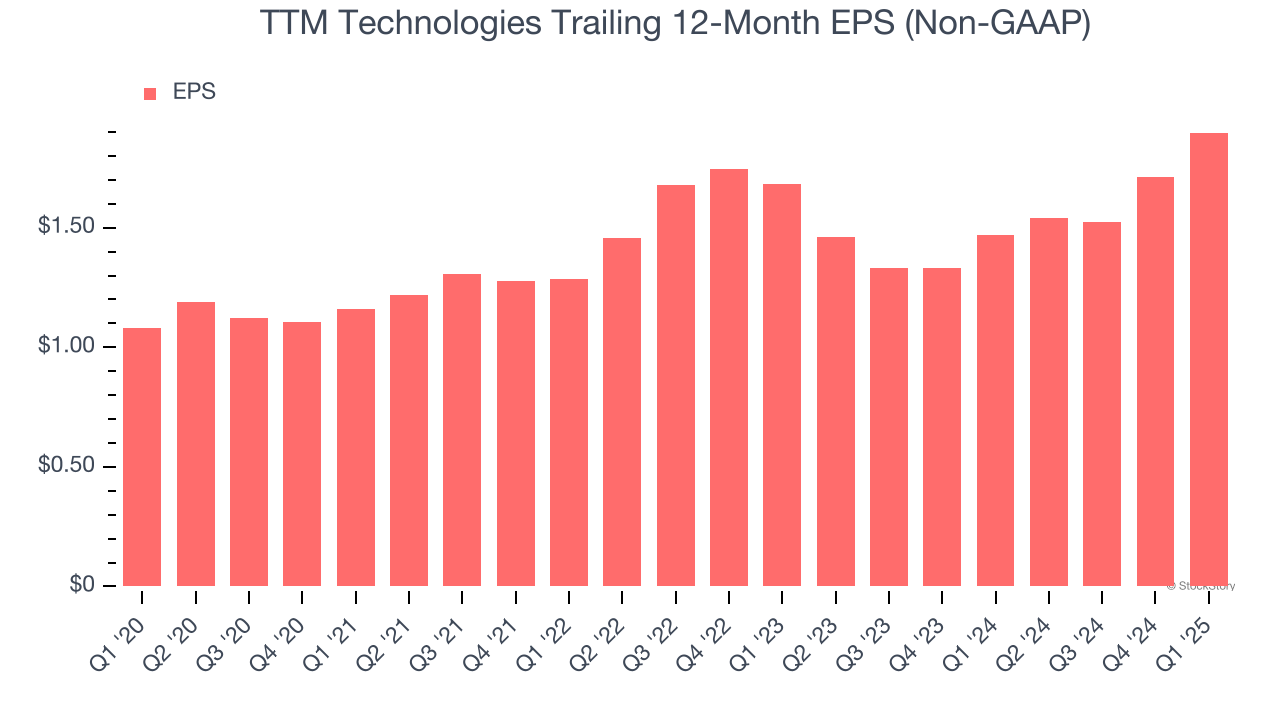

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

TTM Technologies’s EPS grew at a remarkable 11.9% compounded annual growth rate over the last five years, higher than its 3.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

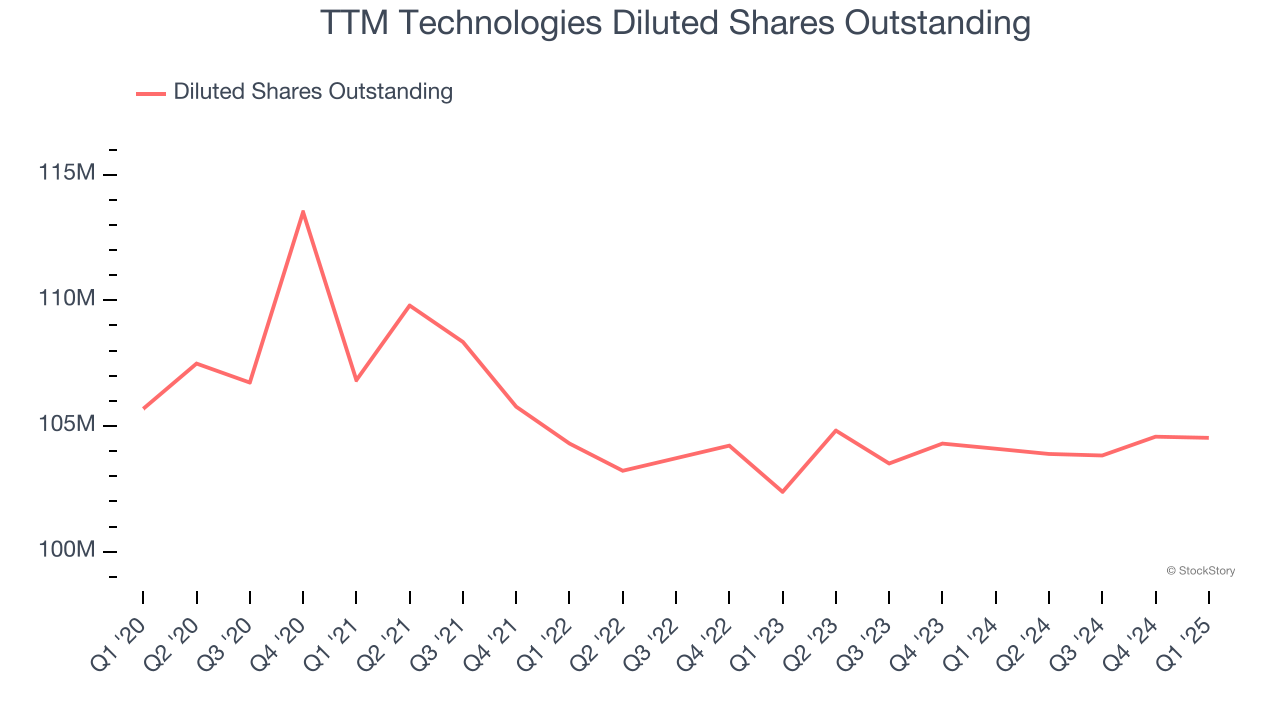

Diving into TTM Technologies’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, TTM Technologies’s operating margin expanded by 4.4 percentage points over the last five years. On top of that, its share count shrank by 1.1%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q1, TTM Technologies reported EPS at $0.50, up from $0.31 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects TTM Technologies’s full-year EPS of $1.90 to grow 9.5%.

Key Takeaways from TTM Technologies’s Q1 Results

We were impressed by how significantly TTM Technologies blew past analysts’ EPS expectations this quarter. We were also excited its EPS guidance for next quarter outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 16.2% to $23.30 immediately after reporting.

TTM Technologies put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.