Coffeehouse chain Starbucks (NASDAQ:SBUX) missed Wall Street’s revenue expectations in Q1 CY2025 as sales rose 2.3% year on year to $8.76 billion. Its GAAP profit of $0.34 per share was 29.2% below analysts’ consensus estimates.

Is now the time to buy Starbucks? Find out by accessing our full research report, it’s free.

Starbucks (SBUX) Q1 CY2025 Highlights:

- Revenue: $8.76 billion vs analyst estimates of $8.82 billion (2.3% year-on-year growth, 0.6% miss)

- EPS (GAAP): $0.34 vs analyst expectations of $0.48 (29.2% miss)

- Adjusted EBITDA: $1.02 billion vs analyst estimates of $1.23 billion (11.6% margin, 17.2% miss)

- Operating Margin: 6.9%, down from 12.8% in the same quarter last year

- Free Cash Flow was -$297.2 million compared to -$153.1 million in the same quarter last year

- Locations: 40,789 at quarter end, up from 38,951 in the same quarter last year

- Same-Store Sales fell 1% year on year (-4% in the same quarter last year)

- Market Capitalization: $95.3 billion

“My optimism has turned into confidence that our 'Back to Starbucks' plan is the right strategy to turn the business around and to unlock opportunities ahead,” commented Brian Niccol, chairman and CEO.

Company Overview

Started by three friends in Seattle’s historic Pike Place Market, Starbucks (NASDAQ:SBUX) is a globally-renowned coffeehouse chain that offers a wide selection of high-quality coffee, beverages, and food items.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $36.35 billion in revenue over the past 12 months, Starbucks is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. Its scale also gives it negotiating leverage with suppliers, enabling it to source its ingredients at a lower cost. However, its scale is a double-edged sword because there are only a finite of number places to build restaurants, making it harder to find incremental growth. For Starbucks to boost its sales, it likely needs to adjust its prices, launch new chains, or lean into foreign markets.

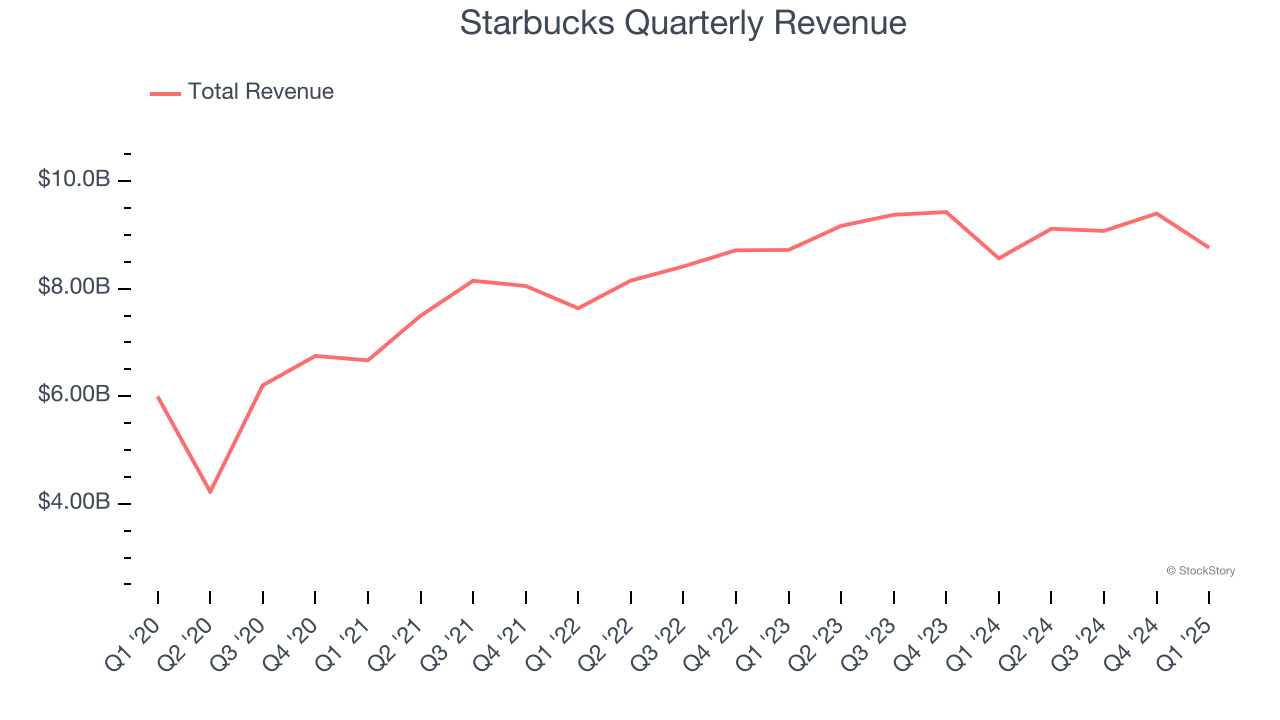

As you can see below, Starbucks grew its sales at a mediocre 6% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, Starbucks’s revenue grew by 2.3% year on year to $8.76 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.8% over the next 12 months, similar to its six-year rate. This projection doesn't excite us and indicates its newer menu offerings will not lead to better top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Restaurant Performance

Number of Restaurants

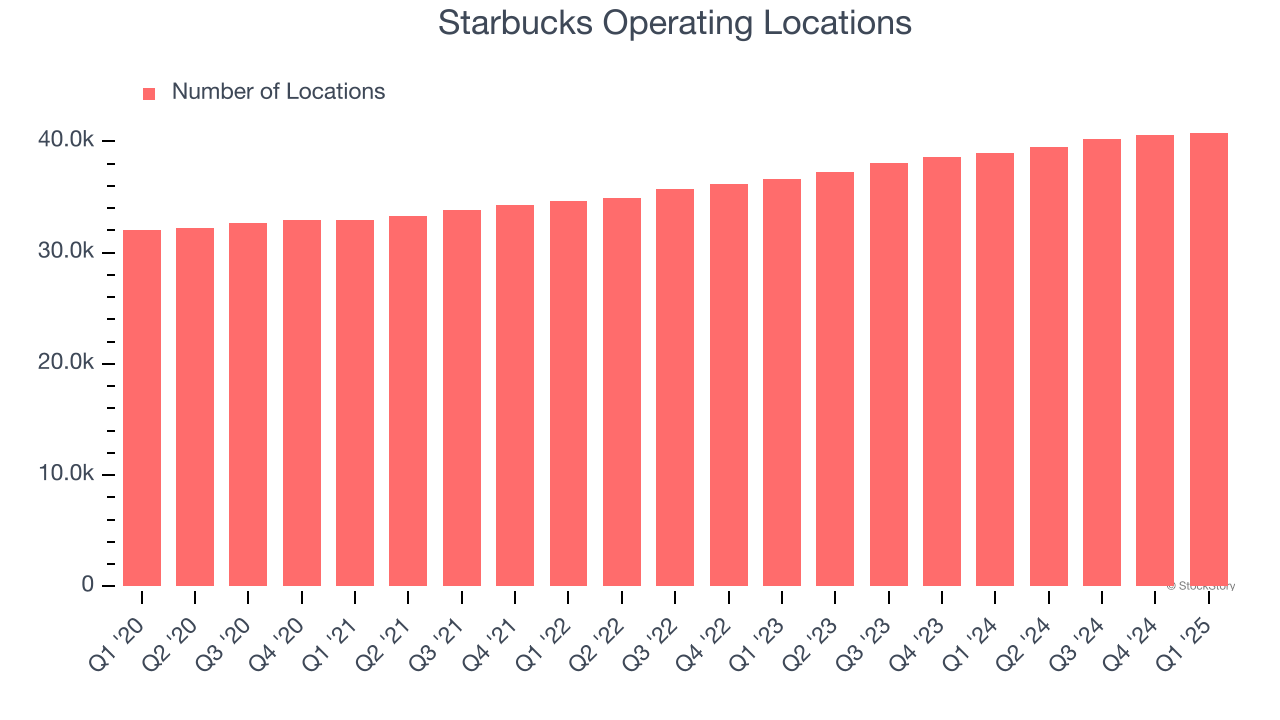

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

Starbucks operated 40,789 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years, averaging 6% annual growth, much faster than the broader restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

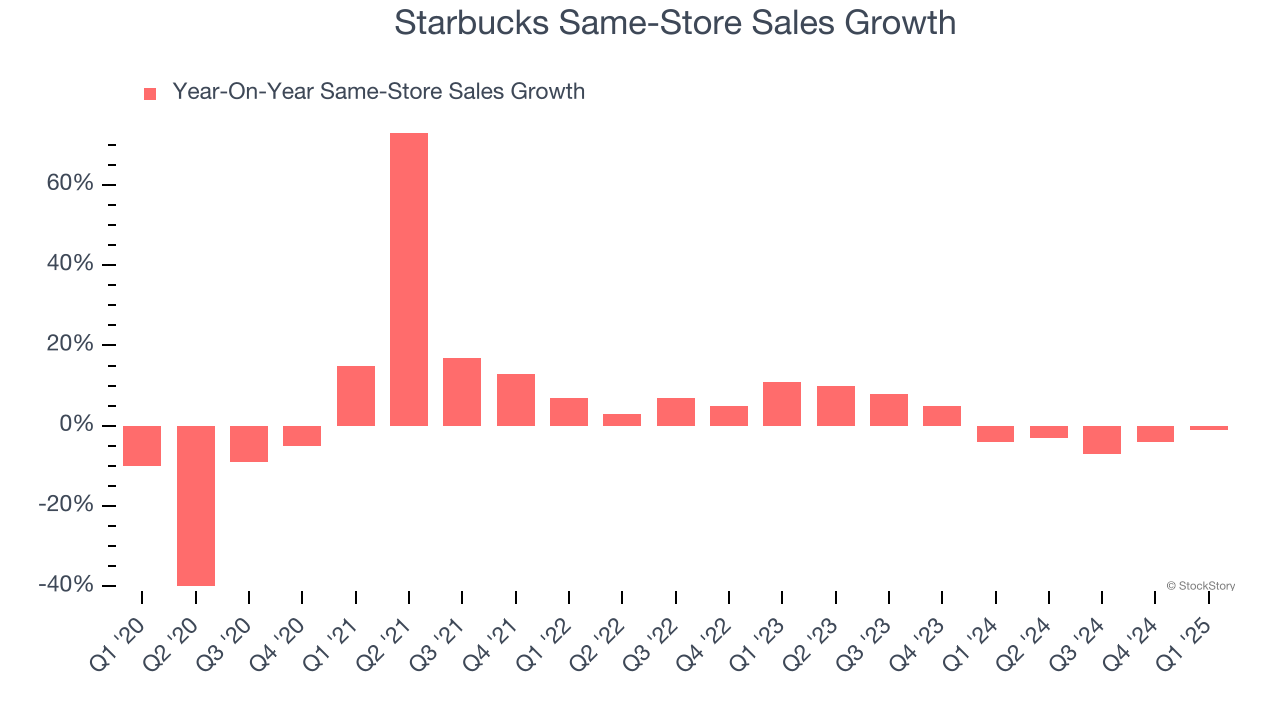

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing restaurants and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Starbucks’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat. Starbucks should consider improving its foot traffic and efficiency before expanding its restaurant base.

In the latest quarter, Starbucks’s same-store sales fell by 1% year on year. This decline was a reversal from its historical levels.

Key Takeaways from Starbucks’s Q1 Results

We struggled to find many positives in these results as its revenue, EPS, and EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 1.2% to $83.88 immediately after reporting.

Starbucks’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.