Environmental waste treatment and services provider Perma-Fix (NASDAQ:PESI) fell short of the market’s revenue expectations in Q4 CY2024, with sales falling 35.3% year on year to $14.7 million. Its GAAP loss of $0.22 per share was 83.3% below analysts’ consensus estimates.

Is now the time to buy Perma-Fix? Find out by accessing our full research report, it’s free.

Perma-Fix (PESI) Q4 CY2024 Highlights:

- Revenue: $14.7 million vs analyst estimates of $15.8 million (35.3% year-on-year decline, 6.9% miss)

- EPS (GAAP): -$0.22 vs analyst expectations of -$0.12 (83.3% miss)

- Adjusted EBITDA: -$3.01 million vs analyst estimates of -$1.6 million (-20.5% margin, 88.4% miss)

- Operating Margin: -24.4%, down from 0.3% in the same quarter last year

- Market Capitalization: $130.6 million

Mark Duff, President and CEO of the Company, commented, “While our financial performance in the fourth quarter of 2024 was impacted by ongoing yet temporary delays in project starts and waste receipts, we remain confident in the overall outlook and significant opportunities that lie ahead. In the first quarter of 2025, we see improving waste volume receipts and backlog, positioning us to resume revenue growth. Importantly, our waste treatment operations have ramped up in February, with expanded shifts at our Perma-Fix Northwest (PFNW) and Diversified Scientific Services (DSSI) facilities to meet increasing demand, and we are actively preparing for the U.S. Department of Energy’s (DOE) Direct-Feed Low-Activity Waste (DFLAW) program at Hanford, which remains on schedule to begin operations this summer under legally binding milestones.”

Company Overview

Tackling hazardous waste challenges since 1990, Perma-Fix (NASDAQ:PESI) provides environmental waste treatment services.

Waste Management

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

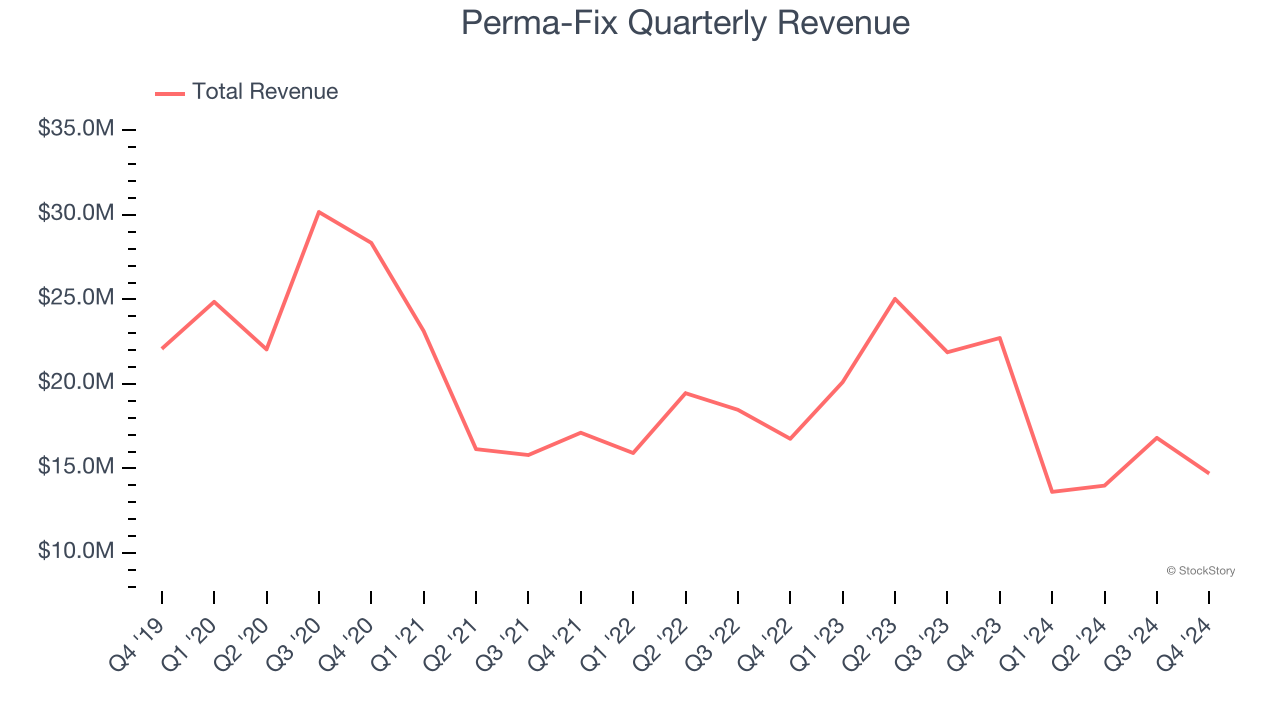

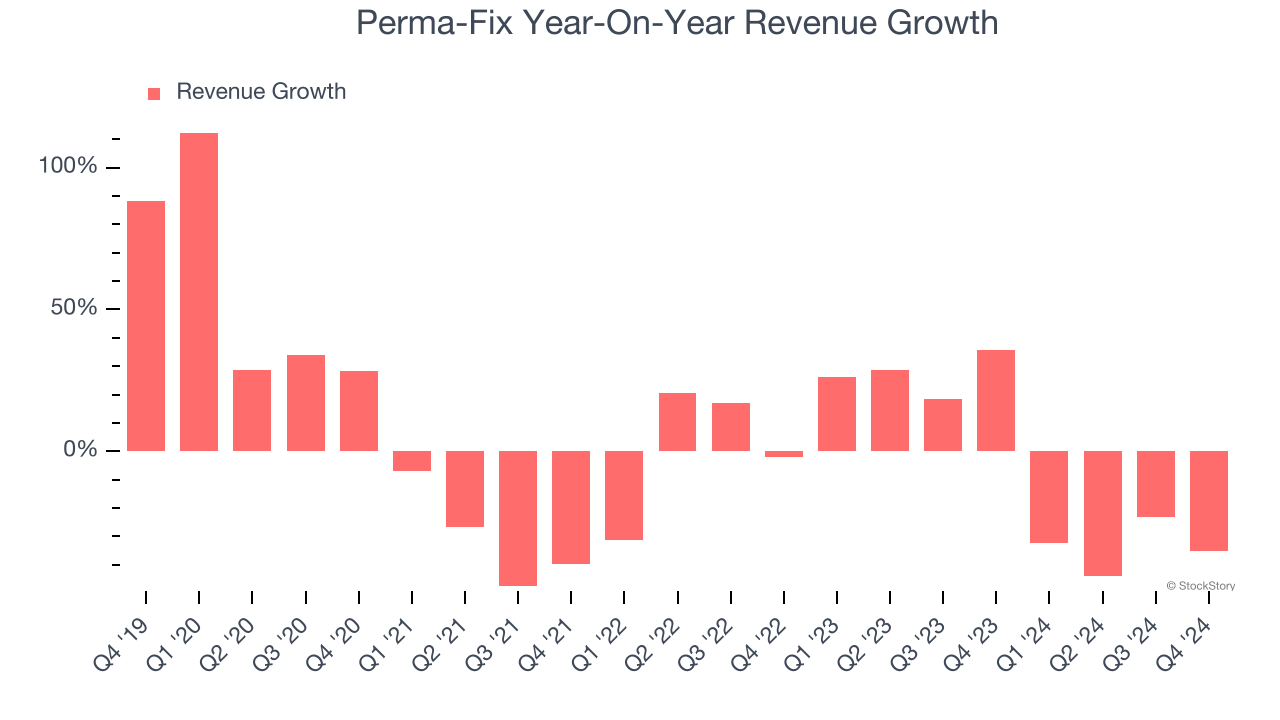

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Perma-Fix’s demand was weak and its revenue declined by 4.3% per year. This wasn’t a great result and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Perma-Fix’s recent history shows its demand remained suppressed as its revenue has declined by 8.5% annually over the last two years.

This quarter, Perma-Fix missed Wall Street’s estimates and reported a rather uninspiring 35.3% year-on-year revenue decline, generating $14.7 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 35.5% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will spur better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

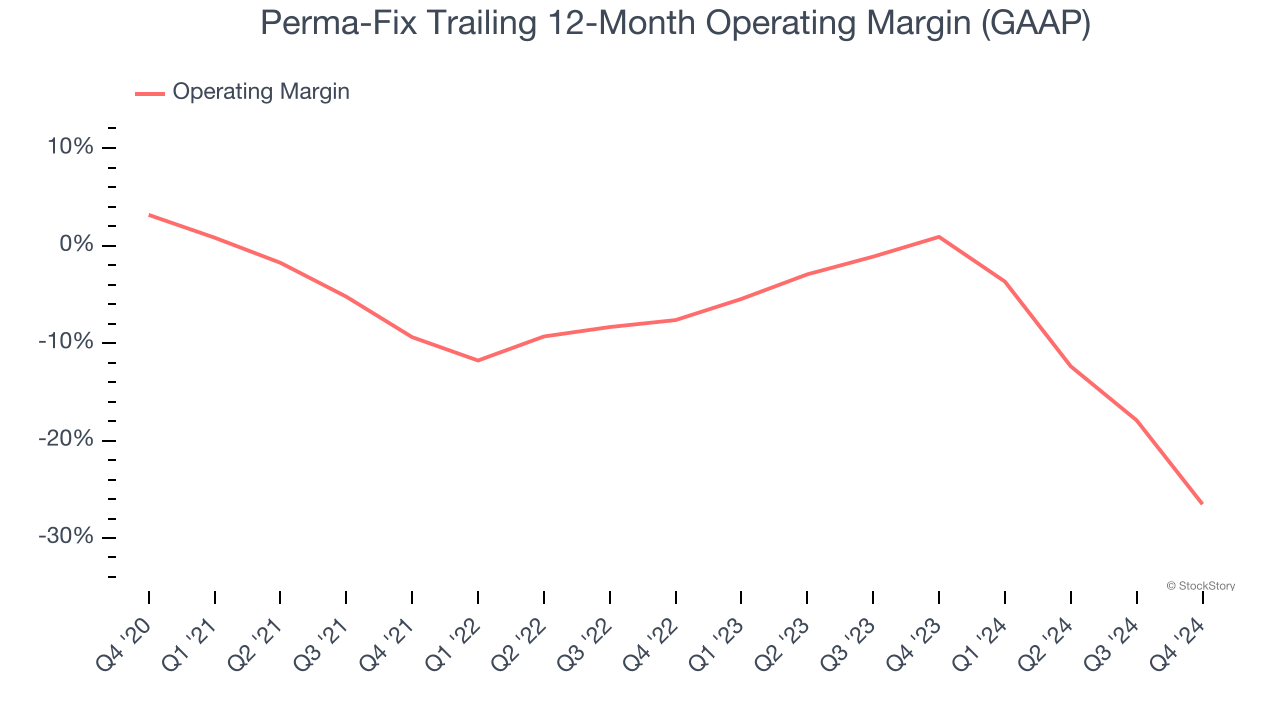

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Perma-Fix’s high expenses have contributed to an average operating margin of negative 6% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Perma-Fix’s operating margin decreased by 29.7 percentage points over the last five years. Perma-Fix’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Perma-Fix generated a negative 24.4% operating margin. The company's consistent lack of profits raise a flag.

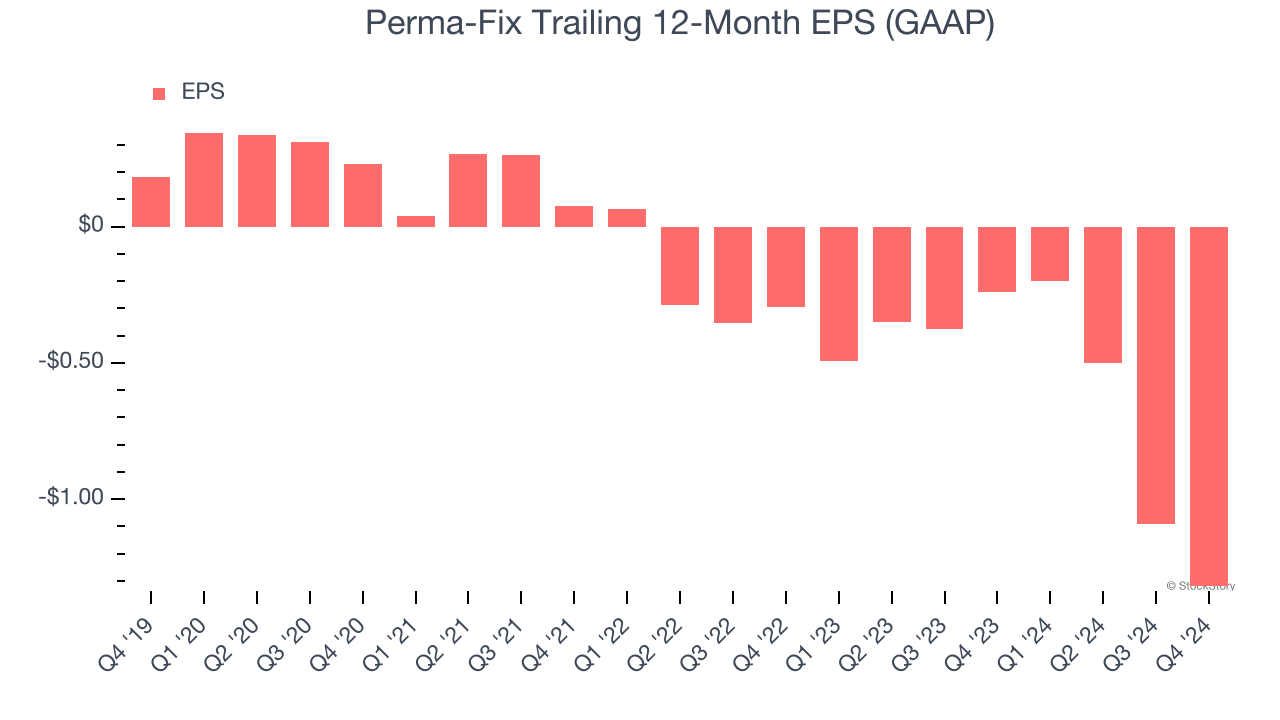

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Perma-Fix, its EPS declined by 56.2% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

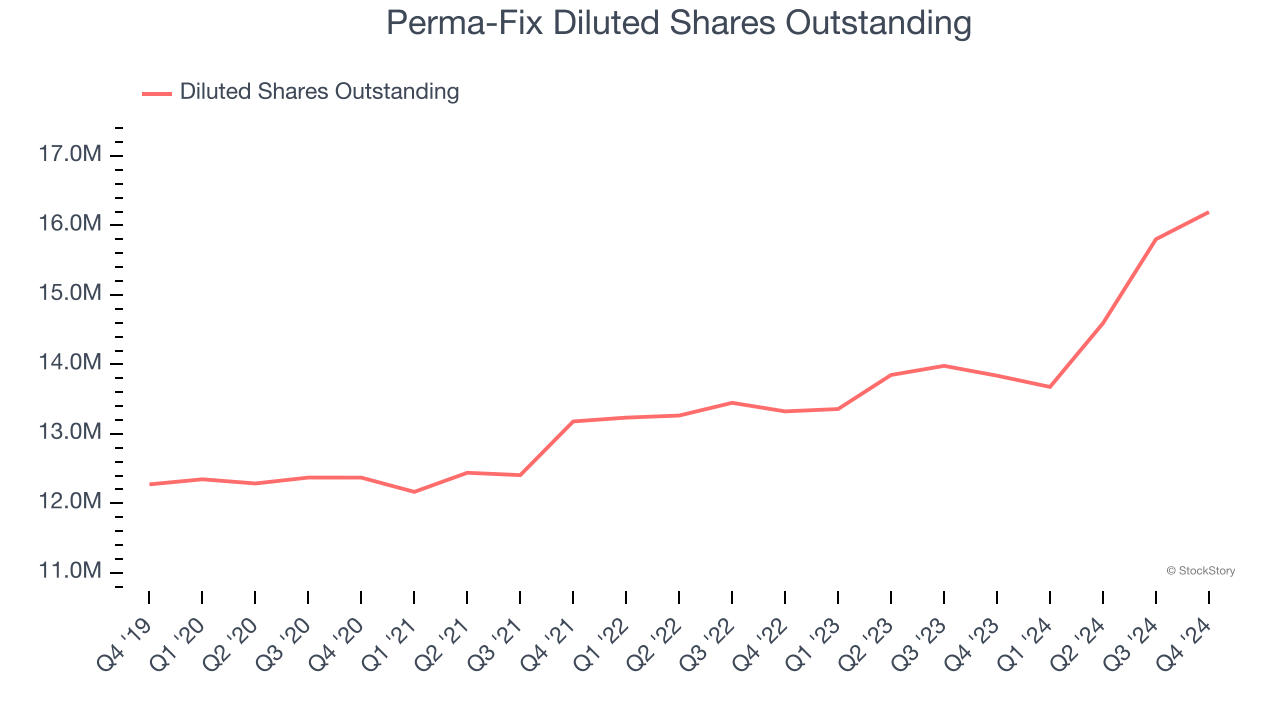

We can take a deeper look into Perma-Fix’s earnings to better understand the drivers of its performance. As we mentioned earlier, Perma-Fix’s operating margin declined by 29.7 percentage points over the last five years. Its share count also grew by 31.9%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Perma-Fix, its two-year annual EPS declines of 112% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Perma-Fix reported EPS at negative $0.22, down from $0.01 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Perma-Fix’s full-year EPS of negative $1.32 will reach break even.

Key Takeaways from Perma-Fix’s Q4 Results

We struggled to find many positives in these results. Its revenue missed significantly and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.4% to $7 immediately following the results.

Perma-Fix’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.