Cybersecurity AI platform provider SentinelOne (NYSE:S) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 22.9% year on year to $258.9 million. On the other hand, next quarter’s revenue guidance of $271 million was less impressive, coming in 0.8% below analysts’ estimates. Its non-GAAP profit of $0.07 per share was 31.5% above analysts’ consensus estimates.

Is now the time to buy SentinelOne? Find out by accessing our full research report, it’s free for active Edge members.

SentinelOne (S) Q3 CY2025 Highlights:

- Revenue: $258.9 million vs analyst estimates of $256.1 million (22.9% year-on-year growth, 1.1% beat)

- Adjusted EPS: $0.07 vs analyst estimates of $0.05 (31.5% beat)

- Adjusted Operating Income: $17.67 million vs analyst estimates of $10.2 million (6.8% margin, 73.2% beat)

- Revenue Guidance for Q4 CY2025 is $271 million at the midpoint, below analyst estimates of $273.2 million

- Operating Margin: -28.3%, up from -42.3% in the same quarter last year

- Free Cash Flow was $15.9 million, up from -$7.15 million in the previous quarter

- Customers: 1,572 customers paying more than $100,000 annually

- Annual Recurring Revenue: $1.06 billion vs analyst estimates of $1.05 billion (22.8% year-on-year growth, in line)

- Market Capitalization: $5.68 billion

“We continue to demonstrate a strong combination of top-tier growth and margin improvement. Our third-quarter performance underscores the growing demand for our AI-native security platform that combines data, intelligence, and defense,” said Tomer Weingarten, CEO of SentinelOne.

Company Overview

Built on the principle of "fighting machine with machine," SentinelOne (NYSE:S) provides an AI-powered cybersecurity platform that autonomously prevents, detects, and responds to threats across endpoints, cloud workloads, and identity systems.

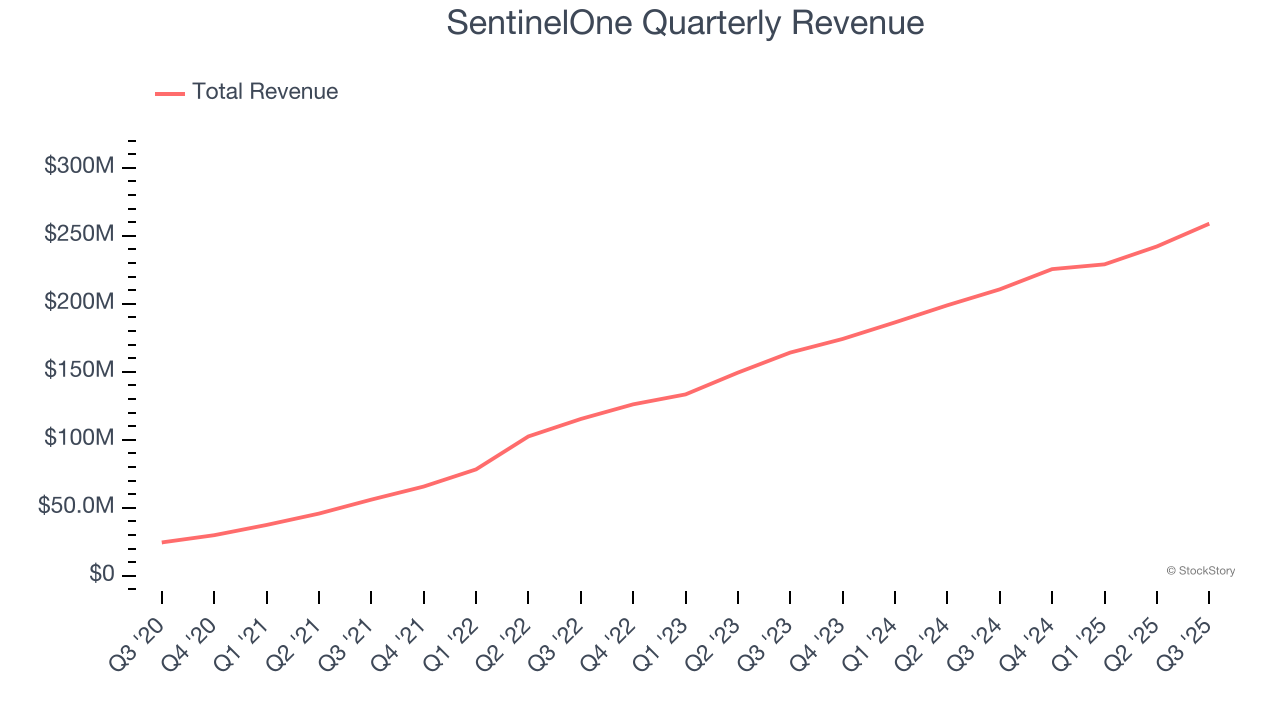

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, SentinelOne’s 64.9% annualized revenue growth over the last five years was incredible. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. SentinelOne’s annualized revenue growth of 29.1% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, SentinelOne reported robust year-on-year revenue growth of 22.9%, and its $258.9 million of revenue topped Wall Street estimates by 1.1%. Company management is currently guiding for a 20.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 20.6% over the next 12 months, a deceleration versus the last two years. Still, this projection is healthy and indicates the market is forecasting success for its products and services.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

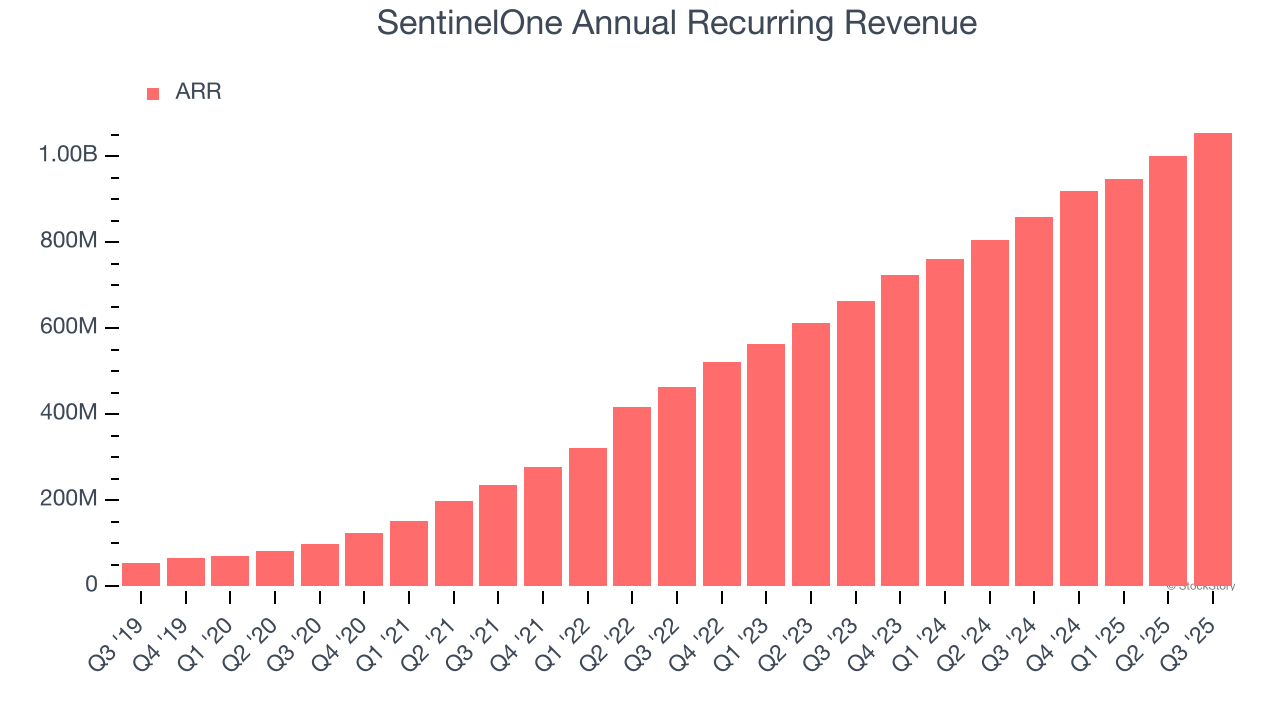

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

SentinelOne’s ARR punched in at $1.06 billion in Q3, and over the last four quarters, its growth was fantastic as it averaged 24.6% year-on-year increases. This performance aligned with its total sales growth and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes SentinelOne a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

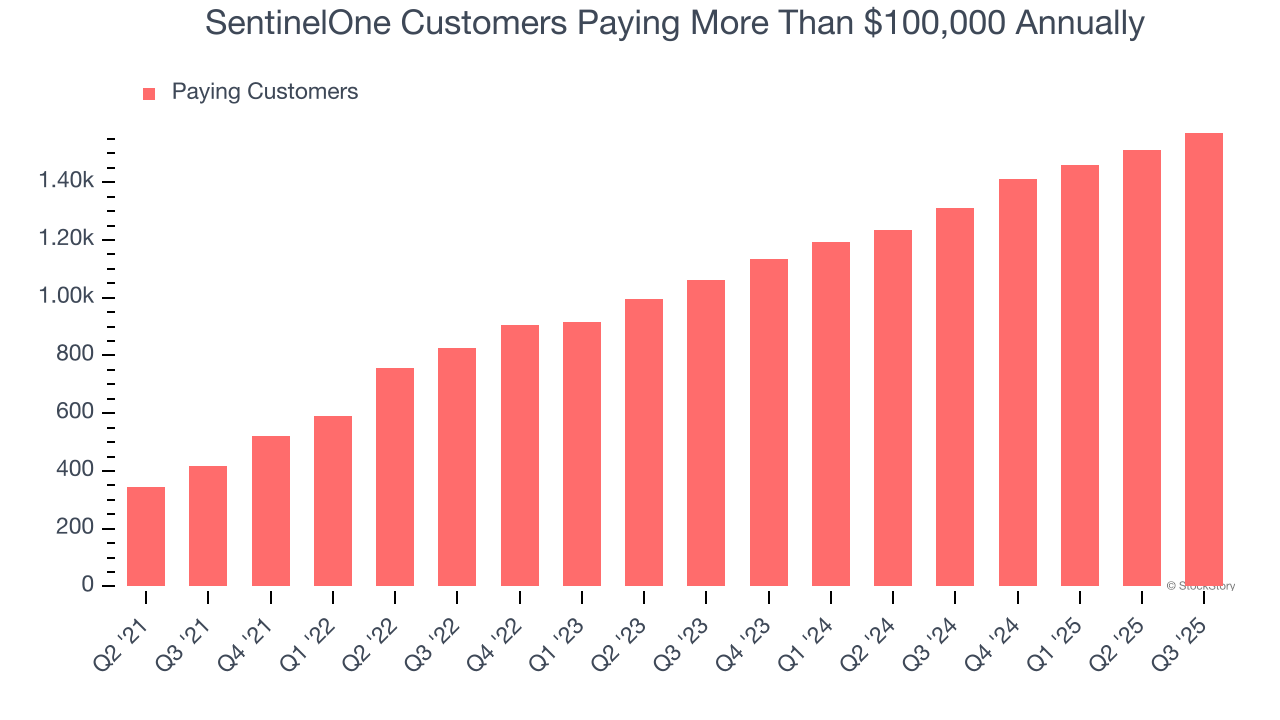

Enterprise Customer Base

This quarter, SentinelOne reported 1,572 enterprise customers paying more than $100,000 annually, an increase of 59 from the previous quarter. That’s in line with the number of contract wins in the last quarter but quite a bit below what we’ve observed over the previous year, suggesting that the slowdown we observed in the last quarter could continue. It also implies that SentinelOne will likely need to upsell its existing large customers or move down market to maintain its top-line growth.

Key Takeaways from SentinelOne’s Q3 Results

It was good to see SentinelOne narrowly top analysts’ revenue expectations this quarter. On the other hand, its revenue guidance for next quarter slightly missed. Overall, this was a softer quarter. The stock traded down 8.3% to $15.69 immediately after reporting.

SentinelOne may have had a tough quarter, but does that actually create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.