SAN ANTONIO, Nov. 12, 2025 (GLOBE NEWSWIRE) -- U.S. Global Investors, Inc. (NASDAQ: GROW) (the "Company"), a registered investment advisory firm1 with longstanding experience in global markets and specialized sectors, today reported net income of $1.5 million for the quarter ended September 30, 2025. This marks a return to profitability from the previous quarter and a 378% increase over the September 2024 quarter. The positive change in net income was largely driven by investment income, which was $2.3 million at quarter-end, a nearly 300% increase from the previous quarter and a 148% increase from the year-ago period. Total operating revenues were $2.3 million in the first quarter of fiscal 2026, up 15% from the June quarter and 4% higher than the same quarter last year.

As of September 30, 2025, average assets under management (AUM) were $1.4 billion, a slight increase from $1.3 billion in the previous quarter but below the $1.5 billion recorded in the same three-month period a year earlier.

The Company’s shareholder yield as of September 30, 2025, was 8.32%, approximately double the yield on the five-year and 10-year Treasury bonds on the same trading day. 2

Record Gold Prices Have Attracted Fund Flows

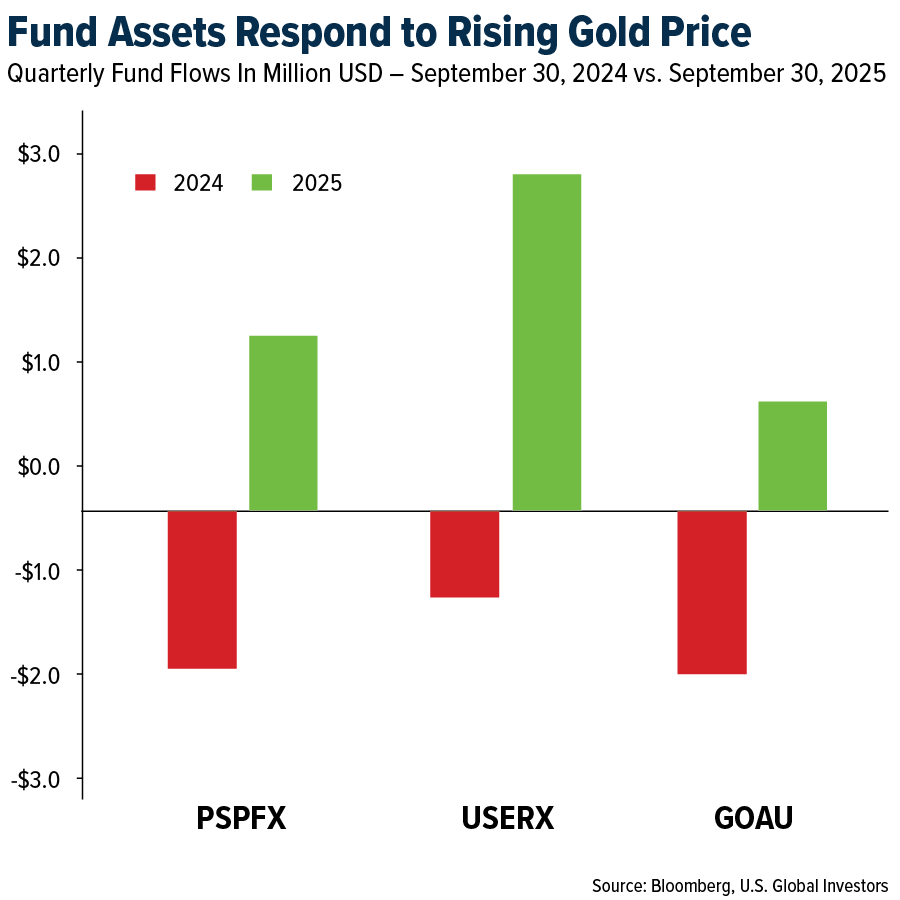

2025 has been a historic year for gold, with prices surging 47% year-to-date through the end of September due to a number of ongoing economic and geopolitical issues. Besides physical bullion, investors also sought increased exposure to the gold and precious metal mining industry. According to LSEG Lipper data, the third quarter saw inflows of $5.4 billion go into gold mining funds, the most for a single quarter since December 2009.3

The Company’s gold mining and natural resource funds likewise benefited from investors’ shift into hard assets. In the quarter ended September 30, 2025, fund flows into the Global Natural Resources Fund (PSPFX), Gold and Precious Metals Fund (USERX) and U.S. Global GO GOLD and Precious Metal Miners ETF (GOAU) were all positive, compared to the September quarter in 2024, when fund flows were negative.

“I’m thrilled to see fund flows into our gold mining and natural resources funds turn positive in the first quarter of fiscal 2026, a welcome reversal from a year earlier,” commented Frank Holmes, the Company’s CEO and Chief Investment Officer. “Despite this growth, there’s plenty of recent analysis that shows that investors remain deeply underinvested in the gold and gold mining industries, which have long been seen by many as hedges against bad government policies, currency devaluation, inflation and other risks. For years, I have recommended investors maintain a 10% weighting in gold, with 5% in physical bullion and the other 5% in high-quality gold mining companies.”

Company’s Offerings Well-Positioned

Looking ahead, Mr. Holmes discussed why he believes the Company’s investment offerings are well-positioned for today’s economy and geopolitical background:

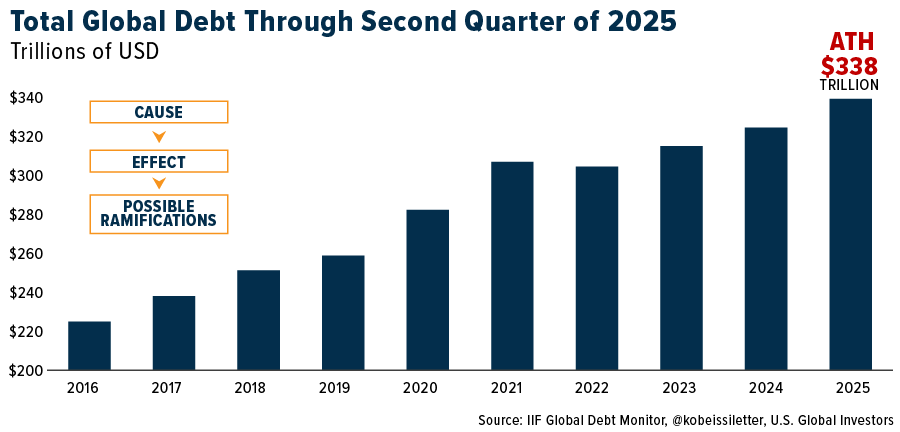

“Bank of America named its top 10 investment themes of 2025 in a note to investors dated September 25, and we were pleased, though not surprised, to see gold miners rank as the year’s number one theme. Global debt stood at a new record high of $338 trillion at the end of the second quarter,4 which is more than three times the value of total world output. We believe that when debt outpaces economic activity, it’s a tailwind for gold and gold mining stocks.

“We’re proud to offer three ways for investors to gain exposure to the gold mining industry: USERX, which invests primarily in senior, large-cap precious metal mining stocks; the World Precious Minerals Fund (UNWPX), which provides increased exposure to junior and intermediate mining companies; and GOAU, which invests in companies that produce gold and precious metals either through active (mining) or passive (owning royalties or production streams) means.

“Other themes in BofA’s report that caught our eye were global defense technology and artificial intelligence (AI),” Mr. Holmes continued. “These high-tech sectors are adequately represented in our WAR ETF, the U.S. Global Technology and Aerospace & Defense ETF.”

Shareholder Value Initiatives

The Company’s Board of Directors (the “Board”) approved payment of a $0.0075 per share per month dividend beginning in October 2025 and continuing through December 2025. The remaining payment dates will be November 24 and December 29 for record dates of November 10 and December 15.

The Company maintains a share repurchase program, authorized by the Board, allowing for the annual purchase of up to $5 million of its outstanding common shares on the open market, as market and business conditions permit. The program has been in place since December 2012 and has been renewed each calendar year by the Board. During the three-month period ended September 30, 2025, the Company repurchased 159,074 shares at a cost of approximately $400,000.

Strong Liquidity Position

As of September 30, 2025, the Company reported net working capital of approximately $37.2 million. With $24.6 million in cash and cash equivalents, the Company has adequate liquidity to meet its current obligations.

Tune In to the Earnings Webcast

The Company has scheduled a webcast for 7:30 a.m. Central time on Thursday, November 13, where Mr. Holmes will be joined by CFO Lisa Callicotte and Director of Marketing Holly Schoenfeldt to discuss financial results. To register for the webcast, click here, or visit www.usfunds.com for more information.

Selected Financial Data (unaudited): (dollars in thousands, except per share data)

| Three months ended | ||||||

| 9/30/2025 | 9/30/2024 | |||||

| Operating Revenues | $ | 2,251 | $ | 2,157 | ||

| Operating Expenses | 2,766 | 2,716 | ||||

| Operating Income (Loss) | (515 | ) | (559 | ) | ||

| Total Other Income (Loss) | 2,359 | 995 | ||||

| Income (Loss) Before Income Taxes | 1,844 | 436 | ||||

| Income Tax Expense (Benefit) | 337 | 121 | ||||

| Net Income (Loss) | $ | 1,507 | $ | 315 | ||

| Net Income (Loss) Per Share (Basic and Diluted) | $ | 0.12 | $ | 0.02 | ||

| Avg. Common Shares Outstanding (Basic) | 12,971,512 | 13,714,517 | ||||

| Avg. Common Shares Outstanding (Diluted) | 12,974,543 | 13,714,517 | ||||

| Avg. Assets Under Management (Billions) | $ | 1.4 | $ | 1.5 | ||

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 50 years when it began as an investment club. Today, U.S. Global Investors, Inc. (www.usfunds.com) is a registered investment adviser that focuses on niche markets around the world. Headquartered in San Antonio, Texas, the Company provides investment management and other services to U.S. Global Investors Funds and U.S. Global ETFs.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors may include certain “forward-looking statements,” including statements relating to revenues, expenses and expectations regarding market conditions. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “opportunity,” “seeks,” “anticipates” or other comparable words. Such statements involve certain risks and uncertainties and should be read with corporate filings and other important information on the Company’s website, www.usfunds.com, or the Securities and Exchange Commission’s website at www.sec.gov.

These filings, such as the Company’s annual report and Form 10-Q, should be read in conjunction with the other cautionary statements that are included in this release. Future events could differ materially from those anticipated in such statements and there can be no assurance that such statements will prove accurate and actual results may vary. The Company undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

Please carefully consider a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus for WAR and GOAU by clicking here and here. Read it carefully before investing.

Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser. GOAU and WAR are distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to GOAU and WAR. Foreside Fund Services, LLC and Quasar Distributors, LLC are affiliated.

Investing involves risk including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the fund. Brokerage commissions will reduce returns. Because the fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The fund is non-diversified, meaning it may concentrate more of its assets in a smaller number of issuers than a diversified fund. The fund invests in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The fund may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. Because the Global Resources Fund concentrates its investments in specific industries, the fund may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

WAR is actively-managed and there is no guarantee the investment objective will be met. The fund is new and has a limited operating history to evaluate. The Fund is non-diversified, meaning it may concentrate its assets in fewer individual holdings than a diversified fund.

WAR’s concentration in the securities of a particular industry namely Aerospace and Defense, Cybersecurity and Semi-conductor industries as well as geographic concentration may cause it to be more susceptible to greater fluctuations in share price and volatility due to adverse events that affect the Fund’s investments.

Aerospace and Defense companies are subject to numerous risks, including fierce competition, adverse political, economic and governmental developments, substantial research and development costs. Aerospace and defense companies rely heavily on the U.S. Government, political support and demand for their products and services.

Companies in the cybersecurity field face intense competition, both domestically and internationally, which may have an adverse effect on profit margins. The products of cybersecurity companies may face obsolescence due to rapid technological development. Companies in the cybersecurity field are heavily dependent on patent and intellectual property rights.

Competitive pressures may have a significant effect on the financial condition of semiconductor companies and may become increasingly subject to aggressive pricing, which hampers profitability. Semiconductor companies typically face high capital costs and can be highly cyclical, which may cause the operating results to vary significantly. The stock prices of companies in the semiconductor sector have been and likely will continue to be extremely volatile.

Investments in the securities of non-U.S. issuers may subject the Fund to more volatility and less liquidity due to currency fluctuations, political instability, economic and geographic events. Emerging markets may pose additional risks and be more volatile due to less information, limited government oversight and lack of uniform standards.

Past performance is not indicative of future results, and there is no assurance that any cryptocurrency will maintain its value or achieve its objectives.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

_____________________________

1 Registration does not imply a certain level of skill or training.

2 The Company calculates shareholder yield by adding the percentage of change in shares outstanding, the dividend yield, and any debt reduction for the 12 months ending September 30, 2025.

3 Murugaboopathy, Patturaja. “Funds Investing in Gold Miners Bask in Record Prices.” Reuters, 7 Oct. 2025, https://www.reuters.com/world/asia-pacific/funds-investing-gold-miners-bask-record-prices-2025-10-07

4 Sevgili, Canan. “Global Debt Hits Record of Nearly $338 Trillion, Says IIF.” Reuters, 25 Sept. 2025, https://www.reuters.com/world/china/global-debt-hits-record-nearly-338-trillion-says-iif-2025-09-25

Contact:

Holly Schoenfeldt

Director of Marketing

210.308.1268

hschoenfeldt@usfunds.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/ed0e32c0-b3b1-423c-be66-235c0b51e3dc

https://www.globenewswire.com/NewsRoom/AttachmentNg/3292389d-6adc-43b6-a261-9af1217c28b5