SoftBank (SFTBY) sold its entire stake in Nvidia (NVDA) for $5.83 billion. While SoftBank plans to channel the proceeds into new artificial intelligence (AI) ventures, the timing of SoftBank’s exit is interesting. It comes at a time when the market is increasingly questioning whether the billions flowing into AI infrastructure will translate into sustainable returns. Nvidia shares dipped about 3% in morning trading following the news.

AI Spending Frenzy Fuels Investor Caution

The skepticism over spending on AI infrastructure was evident when Microsoft (MSFT) reported its Q1 earnings. MSFT stock came under pressure after the company announced $34.9 billion in capital expenditures for the first quarter, exceeding its previous guidance of $30 billion. The tech giant attributed the higher-than-expected spend to its continued investment in the AI backbone of Azure, as well as first-party AI solutions and ongoing upgrades to its server and networking capacity.

A similar narrative is unfolding across the sector. Meta (META) stock retreated after earnings, as heavy investments in AI clouded near-term profitability. Meanwhile, AI cloud provider CoreWeave (CRWV) also faced investor pushback after forecasting $12 billion to $14 billion in spending for 2025 and plans to more than double that figure in 2026.

Such staggering capital expenditure commitments reflect both the intensity of the AI race and growing fears that valuations across the sector may be running ahead of fundamentals.

The question of whether this reflects a genuine AI revolution or a looming AI bubble remains open. However, for Nvidia, the company is seeing significant demand for its Blackwell GPUs led by massive growth in AI-driven computing needs.

The company’s CEO, Jensen Huang, recently revealed that the company has already secured $500 billion in bookings for its next-generation Blackwell and Rubin chips through 2026, excluding orders from China and Asia. Nvidia has also shipped 6 million Blackwell GPUs in the first four quarters of production, reflecting its dominance in the high-performance computing market.

These figures demonstrate Nvidia’s dominant position within the AI ecosystem and suggest potential growth that could surpass Wall Street’s current forecasts.

Beyond its financial outlook, Nvidia’s expanding network of strategic partnerships continues to strengthen its competitive edge. Despite market concerns about excessive hype in AI, the company’s unmatched leadership in AI hardware positions it well for sustained growth.

Third-Quarter Earnings Could Be a Catalyst for NVDA Stock

Looking ahead, Nvidia’s upcoming third-quarter fiscal 2026 results, scheduled for Nov. 19, will likely provide further details about its growth trajectory. Moreover, analysts remain optimistic heading into the announcement, expecting strong earnings driven by sustained AI-driven demand and continued strength in the data center segment.

Nvidia’s management is projecting an impressive $54 billion in total revenue for the third quarter. That figure represents a sequential increase of over $7 billion, reflecting the company’s stellar growth trajectory, driven by the solid performance of its data center business. In the second quarter, data center revenue surged 56% year-over-year and managed to grow sequentially, despite a $4 billion hit from halted H20 chip shipments to China due to export restrictions.

Driving Nvidia’s growth is its next-gen Blackwell platform, which reached record levels last quarter with a 17% sequential increase. The company also began production shipments of its GB300 chips in the second quarter, marking another key milestone. Nvidia’s full-stack AI solutions, catering to cloud service providers, neocloud operators, large enterprises, and even sovereign customers, are seeing strong adoption across the board. With expanding production capacity and a strong product roadmap, Nvidia is well-positioned to deliver solid growth.

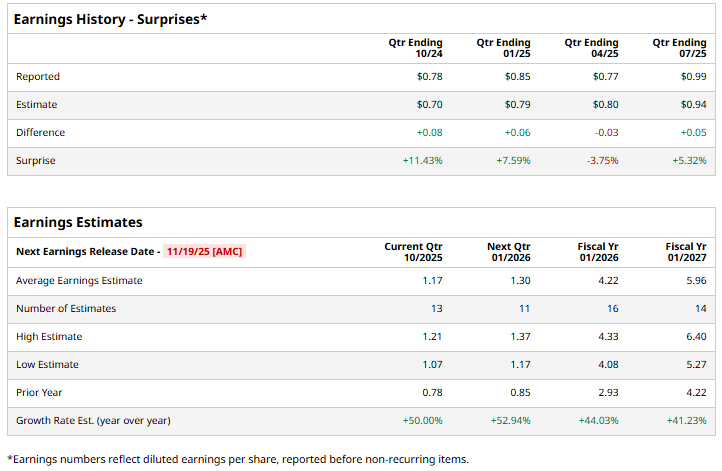

The company’s accelerating revenue growth is expected to translate into solid earnings performance. Analysts project Nvidia will report earnings of $1.17 per share, representing a 50% year-over-year increase. Notably, NVDA has beaten Wall Street’s EPS estimates in three of the past four quarters, including a 5.3% beat in its most recent report.

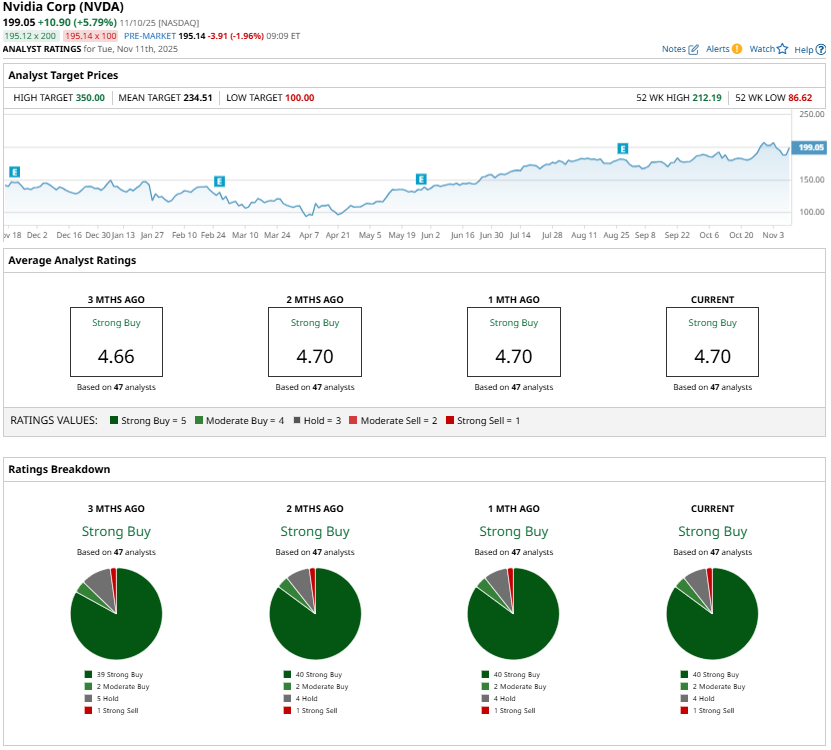

Wall Street’s Take: Nvidia Stock Still a ‘Strong Buy’

Nvidia stock currently trades at a forward price-earnings ratio of about 44.6x. While this valuation might appear high at first glance, it’s supported by strong growth forecasts. Analysts expect Nvidia’s earnings to soar 44% in fiscal 2026 and rise another 41% in fiscal 2027. With the global appetite for AI computing power showing no signs of slowing, the company’s earnings momentum will likely accelerate, further propelling its stock.

Wall Street remains optimistic about Nvidia’s prospects. The stock carries a “Strong Buy” consensus rating. Moreover, the highest price target of $350 implies about 82% upside from current levels.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Alphabet Generates Strong FCF and If It Continues GOOGL Stock is 40% Undervalued

- Is Owens & Minor’s New Focus Enough to Lift Its Shares From the Bottom 100?

- SPY’s 50-Day Moving Average Streak is Going Strong. The Rest of the Market is Sending Up Flares.

- This ‘Strong Buy’ Tech Stock Just Inked a Deal with AWS. Should You Buy It Now?