With a market cap of $13.3 billion, CF Industries Holdings, Inc. (CF) is a leading global manufacturer and distributor of hydrogen- and nitrogen-based products used primarily for fertilizer, industrial applications, clean energy, and emissions-reduction solutions. Headquartered in Illinois, the company operates an extensive network of ammonia, urea, and UAN production facilities across North America and the United Kingdom, supported by a strong logistics and distribution infrastructure.

CF Industries has struggled to keep pace with the broader market over the past year. CF stock has dipped 1% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14%. Moreover, shares of the company have decreased 2.9% on a YTD basis, compared to SPX's 16.2% return.

However, it’s worth noting that CF has still managed to outperform the Materials Select Sector SPDR Fund's (XLB) 8.3% decline over the past 52 weeks.

On Nov. 5, CF released its third-quarter earnings, and its shares dipped 4.2% in the next trading session due to rising cost factors. On the bright side, its adjusted EPS of $2.19 topped expectations, and revenue rose 21% year-over-year to $1.66 billion, above consensus estimates. The company benefited from favorable nitrogen market conditions, supported by higher pricing and healthy demand across its product portfolio.

For the current fiscal year, ending in December 2025, analysts expect CF's EPS to grow 30% year-over-year to $8.76. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

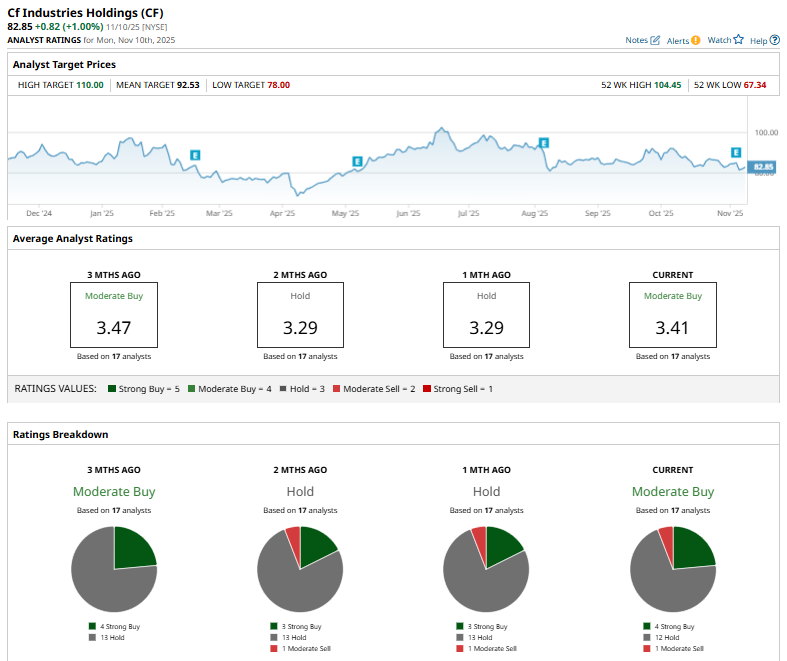

Among the 17 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on four “Strong Buy” ratings, 12 “Holds,” and one “Moderate Sell.”

The overall consensus is a step up from a “Hold” one month ago. Additionally, the current configuration is bullish than a month ago, with three “Strong Buy” ratings on the stock.

On Oct. 10, Barclays plc (BCS) analyst Benjamin Theurer reiterated a “Buy” rating on CF Industries and set a $100 price target.

The mean price target of $92.53 represents a premium of 11.7% from the current market prices. The Street-high price target of $110 implies a modest potential upside of 32.8% from the current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart