Amazon's (AMZN) status as a leading global e-commerce and cloud giant is well-known. However, this company has also been a prominent investor in other companies, putting some of its capital to work in companies Amazon sees as the future of certain industries, typically partnering with such firms on various joint ventures to spur its own growth over time.

Amazon has a large investment in EV maker Rivian (RIVN), for example, which provides Amazon with many of its electric delivery vans. Other investments in chipmakers and other consumer products companies (which drive sales in its key cloud and e-commerce segments) have also allowed the company to benefit from its massive network effects over time.

But one recent sale this past quarter, which came to light via the company's 13-F filing, has some investors taken aback. Amazon has liquidated its holdings of IonQ (IONQ), as well as its position in Advanced Micro Devices (AMD).

Let's dive into this decision, focusing in on IonQ and what to make of this move.

I Thought Quantum Computing Was the Next Big Thing?

IonQ is a leading quantum computing company, focusing on putting forward next-generation quantum computing infrastructure that can power a wave of new machine learning and AI computing applications. Quantum computing stocks have benefited from the fact that this technology is so inherently difficult to understand, with some recent breakthroughs startling the market and suggesting that this powerful potential technology could become dominant once widespread.

Indeed, how quantum computing and AI (and other technologies, for that matter) will intersect will be an interesting phenomenon to watch. For now, investors in both the capital markets and institutional investors like Amazon appear to be taking a step back, with the recent parabolic surges in such stocks stoking some profit-taking among key investors in this space.

I won't doubt the idea that Amazon eventually steps into this space in some way in the future and will look to retain a foothold in what could be a revolutionary technology moving forward. For now, this divestiture of its small investment in IonQ (at least on a relative basis) may send some shockwaves through the industry as market participants try to parse out what this move really means.

Would This Investment Have Moved the Needle for Amazon?

Fundamentally, Amazon's investment in IonQ of around 854,000 shares (amounting to a little more than $45 million at the time of writing) was a bet that I'd put on the smaller end of the spectrum for Amazon. The company has invested billions in other partnerships, so this move does appear to be one that was made with some inkling of future potential partnership deal hopes. Maybe IonQ didn't want to play ball, or there's more to the story. That's for others to speculate about.

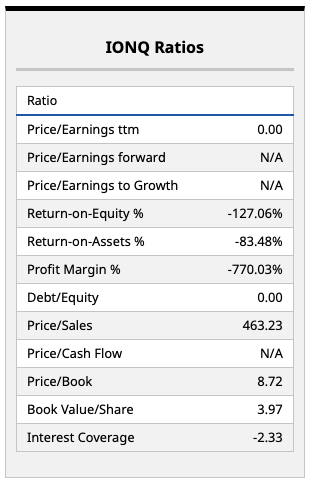

But on the fundamentals front, when we look at IonQ independently of Amazon, investors can see why some may have some trepidation around where this stock is trading. As an early-stage quantum computing company with no meaningful revenues, the company's valuation metrics are all over the place. Indeed, it's difficult to find any company trading at a $20 billion market capitalization with a -127% return on equity and a profit margin of -770%.

Now, as I mentioned, these metrics are largely meaningless. Most investors will ignore any discussion around fundamentals for IonQ, as there really aren't any. For this company and its future prospects, investors will spend much more time and energy parsing earnings calls and interviews from IonQ's brass to find clues about its timeline to commercialization and future growth prospects once the company's technology has been commercialized.

Depending on who one listens to in this space, IonQ could be months or years away from producing meaningful revenue. At this point in the market cycle, investors seem keen to gain exposure to this stock before it turns the corner on these key metrics.

What Do Wall Street Analysts Think about IONQ Stock?

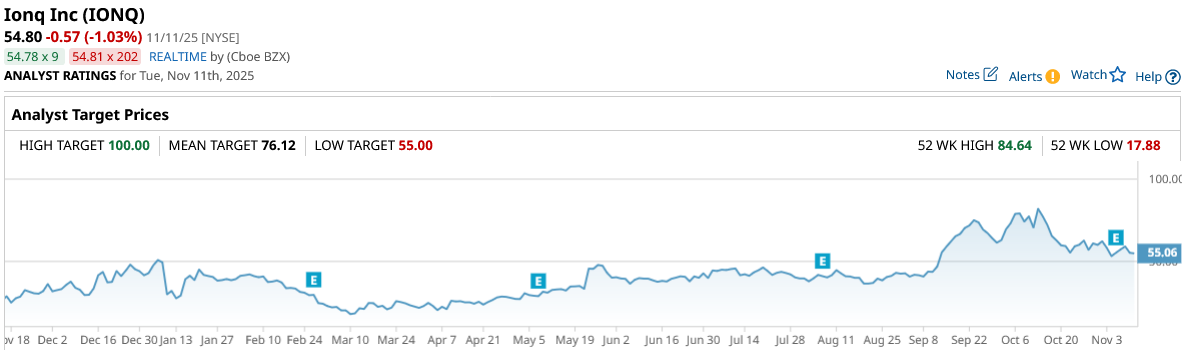

Currently, the consensus price target for IonQ sits at around $74 per share, implying impressive upside for IONQ stock of around 33% from current levels.

This price target implies plenty of profitable growth down the line, with many market participants expecting much higher revenue and EPS growth than what analysts have plugged into their models. While IonQ is likely a ways away from producing meaningful revenue and earnings, this is one of those long-shot bets investors appear to be willing to make right now. And analysts are playing ball.

Personally, I'm skeptical of this entire space. But on the other side of the coin, I can understand the incredible investor demand for what could be a revolutionary technology.

It will be interesting to see if Wall Street analysts are correct in their bullish views on IonQ a year from now. I'm going to happily watch the price action from the sidelines.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Alphabet Generates Strong FCF and If It Continues GOOGL Stock is 40% Undervalued

- Is Owens & Minor’s New Focus Enough to Lift Its Shares From the Bottom 100?

- SPY’s 50-Day Moving Average Streak is Going Strong. The Rest of the Market is Sending Up Flares.

- This ‘Strong Buy’ Tech Stock Just Inked a Deal with AWS. Should You Buy It Now?